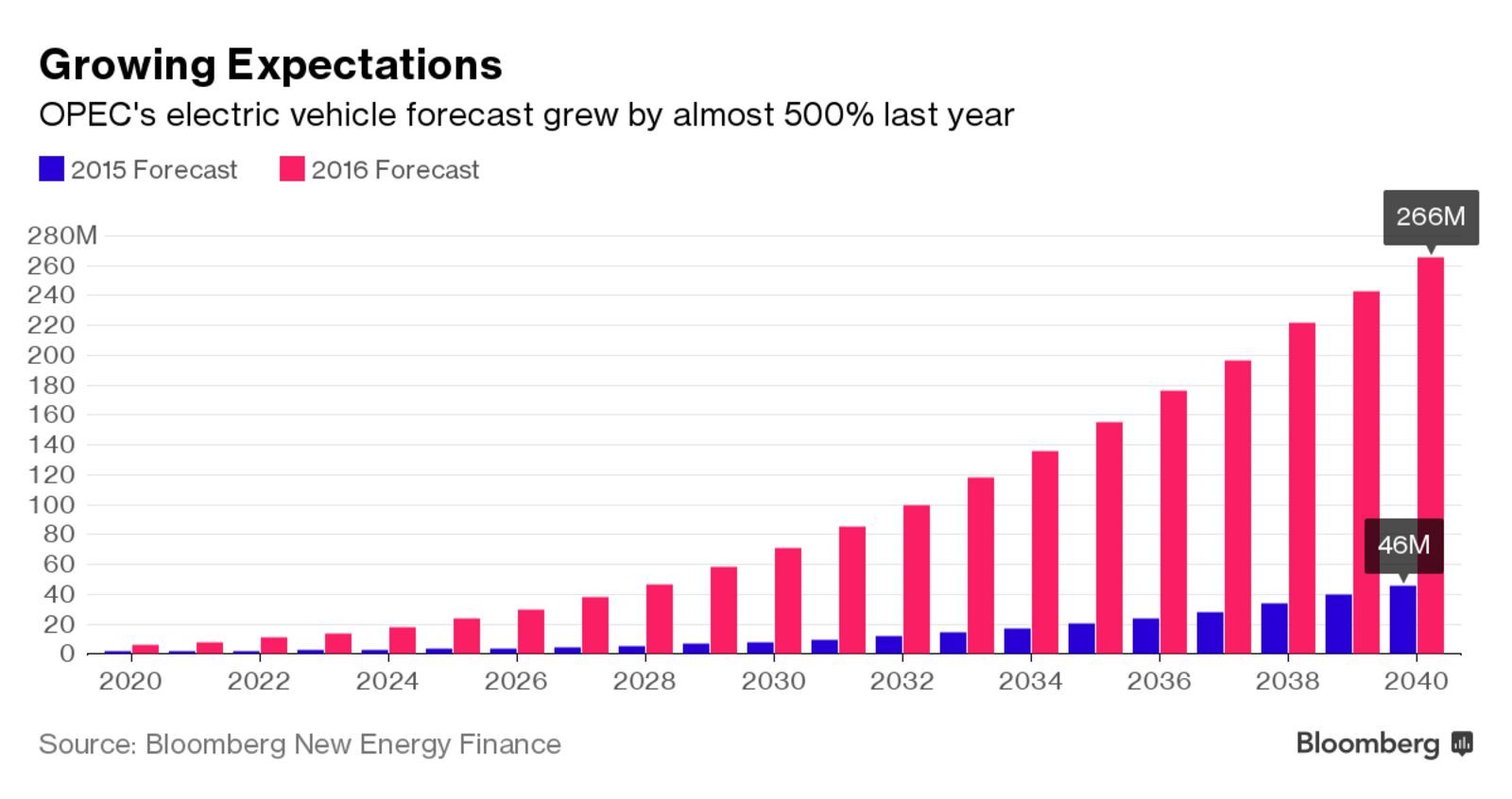

The world’s biggest oil producers are starting to take electric vehicles seriously as a long-term threat. OPEC quintupled its forecast for sales of plug-in EVs, and oil producers from Exxon Mobil Corp. to BP Plc also revised up their outlooks in the past year, according to a study by Bloomberg New Energy Finance released on Friday. The London-based researcher expects those cars to reduce oil demand 8 million barrels by 2040, more than the current combined production of Iran and Iraq. Growing popularity of EVs increases the risk that oil demand will stagnate in the decades ahead, raising questions about the more than $700 billion a year that’s flowing into fossil-fuel industries. While the oil producers’ outlook isn’t nearly as aggressive as BNEF’s, the numbers indicate an acceleration in the number of EVs likely to be in the global fleet.

To see BNEF’s report comparing long-term EV adoption forecasts, click here.

“The number of EVs on the road will have major implications for automakers, oil companies, electric utilities and others,” Colin McKerracher, head of advanced-transport analysis at BNEF in London, wrote in a note to clients. “There is significant disagreement on how fast adoption will be, and views are changing quickly.”