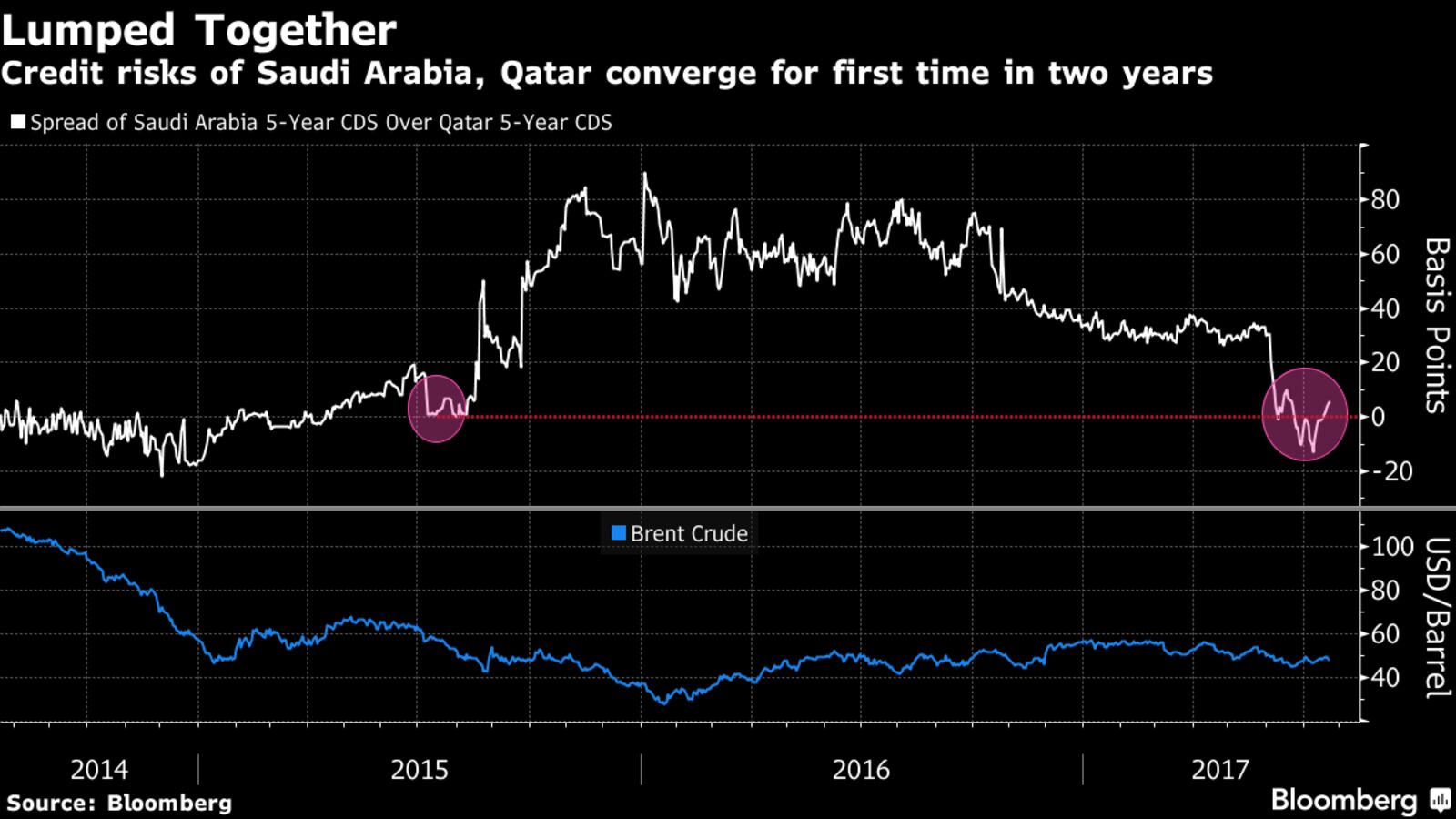

Investors aren’t taking sides in the biggest political crisis in the Gulf in decades because their focus has already returned to oil. Seven weeks after Saudi Arabia led a coalition of Arab states in cutting ties with Qatar over allegations that it supports terrorism, holders of both countries’ stocks and bonds are paying almost identical risk premiums. Their five-year credit default swaps converged for the first time in two years, stocks are valued at about 13.7 times’ projected earnings over the next 12 months, and their international bonds were almost level on Monday.

The Gulf dispute remains in stalemate after Qatar denied the charges and rejected the Saudi bloc’s demands, which include rolling back ties with Iran and shutting the Al Jazeera news channel. Meanwhile, the feud is taking a back seat to oil for investors, said analysts including Saad Siddiqui at JPMorgan Chase & Co. The price of crude is languishing under $50 a barrel, far below the level many Gulf producers need to balance their budgets.