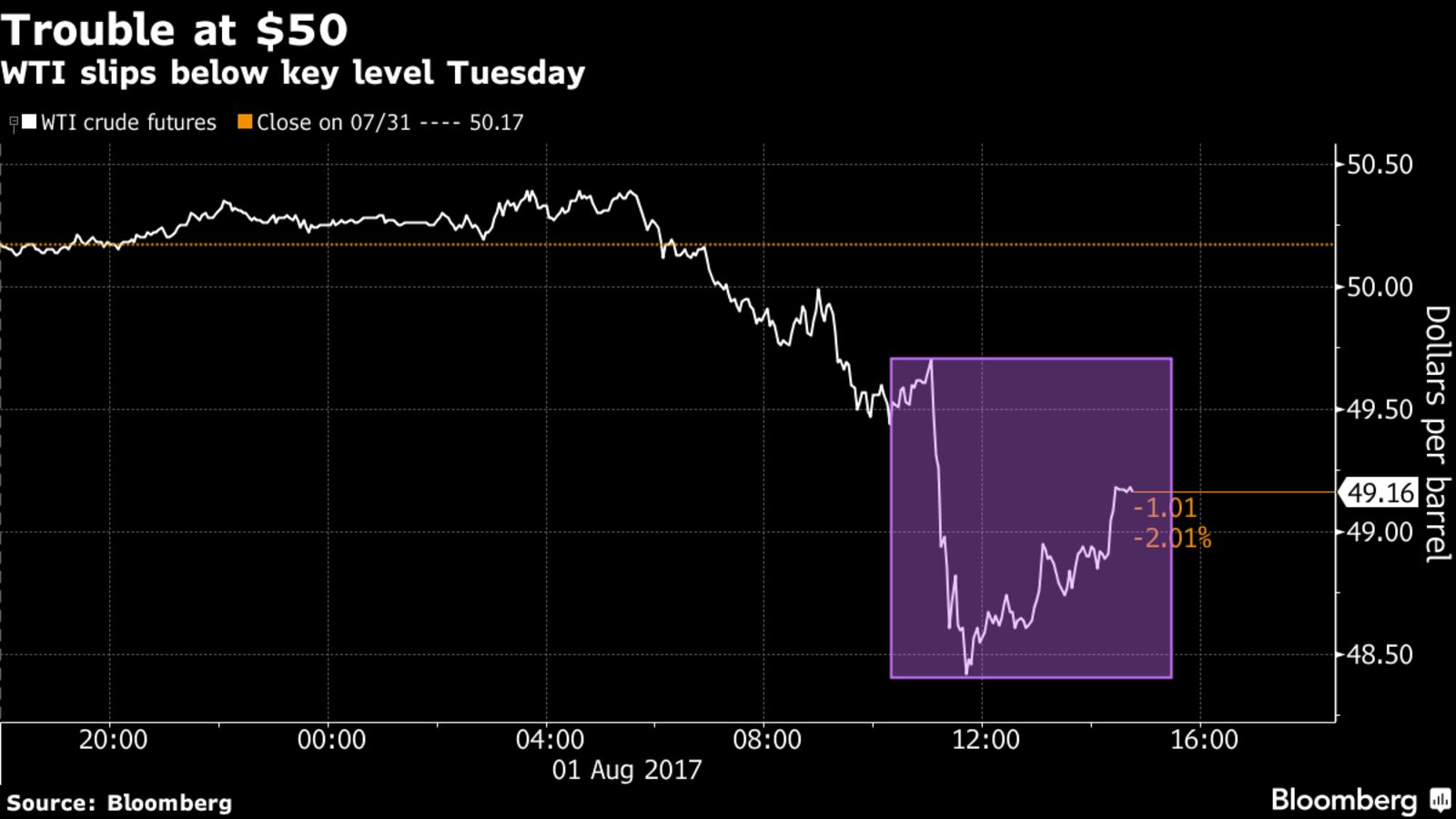

Oil extended its slide below $50 a barrel after an industry report was said to show U.S. crude inventories unexpectedly jumped. Crude stockpiles climbed by 1.78 million barrels last week in an American Petroleum Institute report released Tuesday, according to people familiar with the data. That would be the first crude build since the end of June when compared with Energy Information Administration data. Yet, a Bloomberg survey showed nationwide crude inventories probably fell last week. The EIA will release its inventory data Wednesday. “Any build in inventories at this point is negative for the market because this is the time of year when inventories drop naturally anyway,” James Williams, an economist at London, Arkansas-based energy-research firm WTRG Economics, said by telephone.

Oil settled above $50 for the first time since May on Monday. While the Organization of Petroleum Exporting Countries and its allies work to rebalance the market and trim global inventories, doubts remain that supplies will increase from elsewhere, with the U.S. oil rig count at the highest level since April 2015. West Texas Intermediate for September delivery was at $48.68 a barrel at 4:50 p.m. on the New York Mercantile Exchange in aftermarket trading. Prices closed at $49.16 a barrel Tuesday. Total volume traded was about 41 percent above the 100-day average.