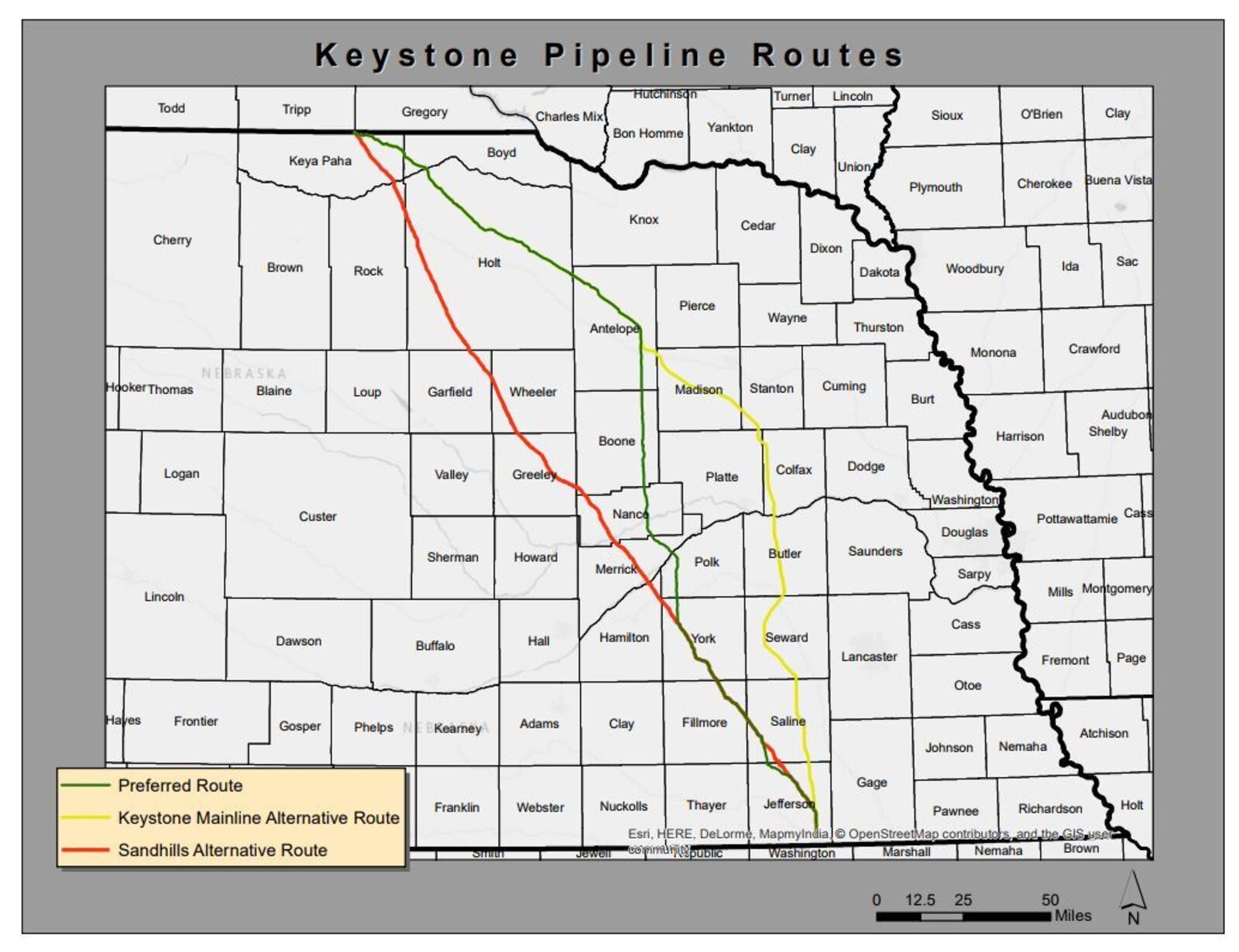

Nebraska’s approval of an alternative route could throw more uncertainty into the mix for the long-delayed Keystone XL oil pipeline. The Public Service Commission approved TransCanada Corp.’s project on a three-to-two vote, removing one of the last hurdles to the Calgary-based company’s construction of the $8 billion, 1,179-mile (1,897-kilometer) conduit, which has been on its drawing boards since 2008. The decision, though, wasn’t wrinkle-free: The panel mandated an alternative route that was immediately targeted by the project’s opponents as lacking adequate vetting. TransCanada is now “assessing how the decision would impact the cost and schedule of the project,” Russ Girling, TransCanada’s chief executive officer, said in a statement. The company’s shares rose 1.3 percent to C$63.35 at 12:24 p.m. in New York trading.

The uncertainty expressed by Girling was quickly reflected in analyst notes. “While today’s Keystone XL pipeline approval is an important milestone, it does not provide certainty that the project will ultimately be built and begin operating,” said Gavin MacFarlane, a vice president at Moody’s Investors Service. “Pipeline construction would negatively affect TransCanada’s business risk profile through increased project execution risk, and would likely put pressure on financial metrics.” Jane Kleeb, president of the environmental advocacy group Bold Alliance, said green-lighting the alternative may have helped the commission reach a “middle ground solution.” But it opens new questions that she said her group would likely explore in federal court.