Oil dropped below $58 a barrel as investors weighed an increase in U.S. drilling rigs against OPEC’s promise to extend output cuts through the end of next year. Futures fell as much as 1.2 percent in New York after adding 1.7 percent Friday. OPEC and its allies including Russia last week agreed to keep supply cuts in place and beefed up the extension with the inclusion of Nigeria and Libya. Executives from three of the biggest independent U.S. drillers said that while they won’t increase activity just because prices rise, they’ll still grow.

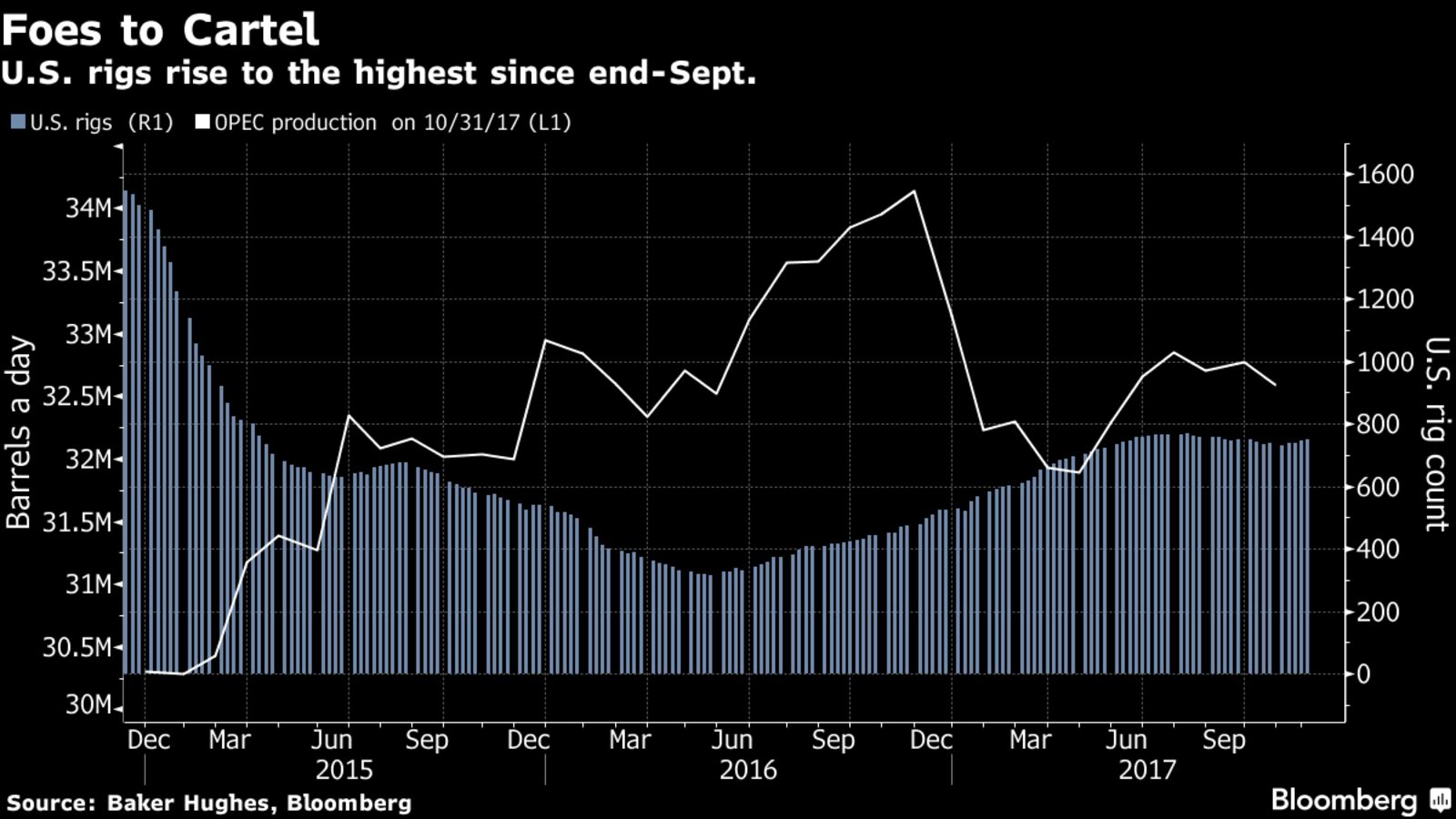

Oil has advanced for the past three months amid optimism that output cuts by Organization of Petroleum Exporting Countries and its partners are helping to balance the market. Yet U.S. rivals have been expanding their operations, with drillers adding two oil rigs to reach 749 last week, the highest level since late September, according to Baker Hughes. “The OPEC deal will mostly work for non-OPEC,” said Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt. “Even if OPEC delivers the cuts promised, and prices stay high long enough, the main result will be that U.S. shale adds on close to 1 million barrels a day of additional production.”

West Texas Intermediate for January delivery dropped 57 cents to $57.79 a barrel on the New York Mercantile Exchange at 10:35 a.m. London time, after gaining 96 cents on Friday. Total volume traded was about 21 percent below the 100-day average. Brent for February settlement dropped 51 cents to $63.22 a barrel on the London-based ICE Futures Europe exchange. Prices added $1.10, or 1.8 percent, to close at $63.73 on Friday. The global benchmark crude was at a premium of $5.43 to February WTI.