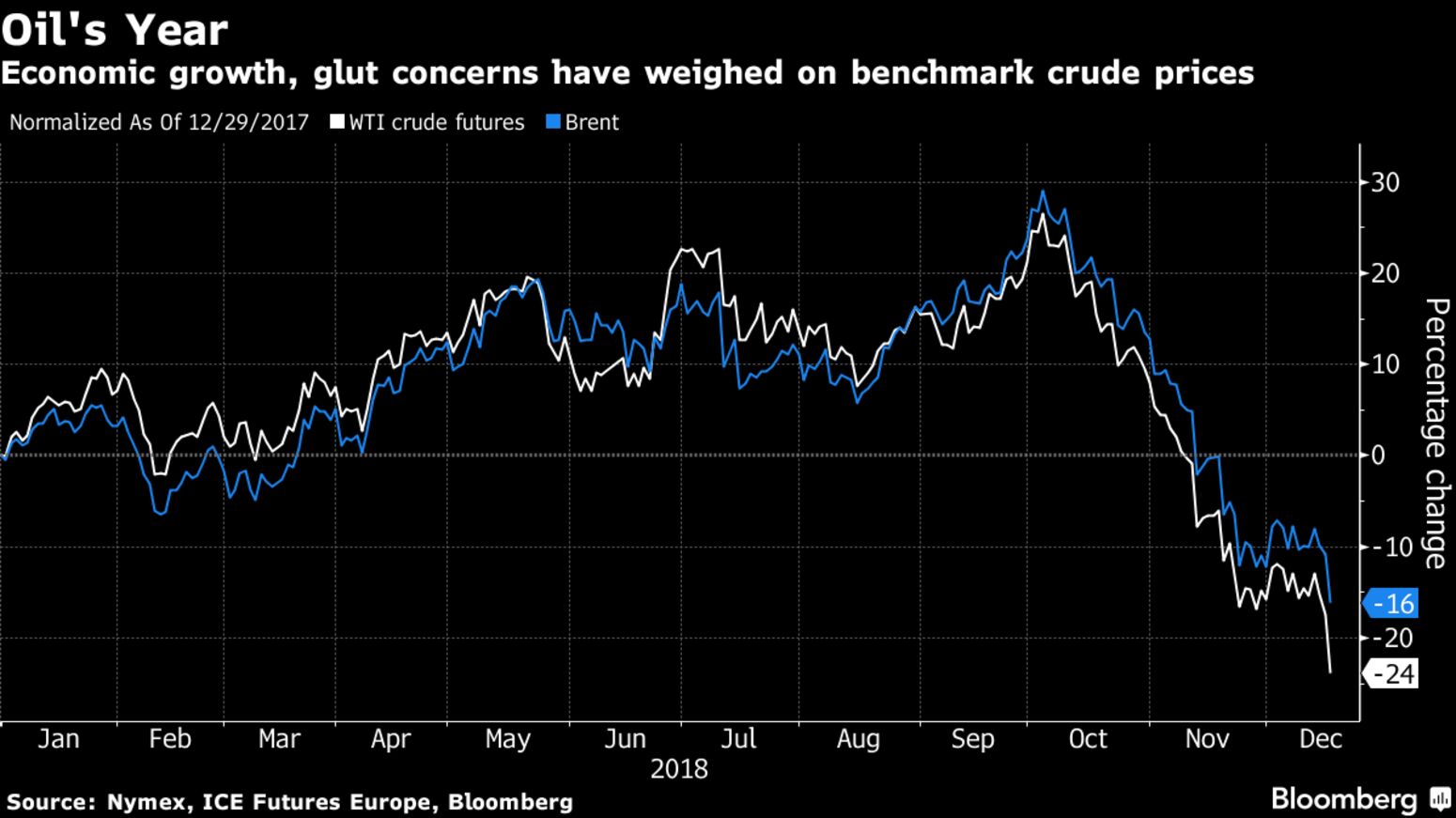

Economic jitters and surging supplies from the U.S. to Russia hammered oil again, with crude suffering its biggest decline in more than three weeks. Futures slid 7.3 percent in New York on Tuesday, putting prices on track for their worst quarterly loss since the start of the last oil market crash in late 2014. Anxieties over growth swirled as Chinese President Xi Jinping appeared to push back against U.S. President Donald Trump in a Beijing speech and American investors braced for an interest-rate hike. Another late-afternoon fizzle for U.S. equities added to the dour outlook.

“Sentiment is negative, it’s low-volume trading and we’re not getting any good news,” said Ashley Petersen, lead oil analyst at Stratas Advisors in New York. A U.S. government report Monday forecast surging shale-oil production, adding to worries about a glut. In Moscow, Russian Energy Minister Alexander Novak said production is rising, although the country is preparing to implement output curbs to conform with an OPEC+ accord.

Crude’s mired in a bear market amid growing skepticism that cuts by the Organization of Petroleum Exporting Countries and its allies will be deep enough to prevent a surplus in 2019. The group’s efforts to balance the market have been undermined by the relentless growth in U.S. shale, which veteran crude trader Andy Hall said is making it harder to predict global supplies. West Texas Intermediate for January delivery fell $3.64 to $46.24 a barrel on the New York Mercantile Exchange, the lowest since Aug. 30, 2017. Total volume traded Tuesday was about 23 percent above the 100-day average.

In Midland, Texas, the heart of the Permian shale basin that’s driven the U.S. boom, prices briefly broke below $40 a barrel, as buyers factored in pipeline shortages that have pushed up transportation costs. Drillers “will likely see harsher cuts to capital plans if WTI remains below $50,” Houston investment bank Tudor Pickering Holt & Co. warned in a note to clients. Brent for February settlement lost $3.35 to $56.26 on London’s ICE Futures Europe exchange. The global benchmark crude traded at a $9.66 premium to WTI for the same month.