At least three buyers of Saudi Arabian oil requested between 30% and 50% more supplies than they had originally planned in April after the world’s biggest exporter slashed its prices, according to people familiar with the matter. The so-called nominations show how the price war that’s broken out between the world’s biggest crude producers is having an immediate impact on global oil flows. Taking additional Saudi crude would mean the buyers make significantly fewer purchases in the spot market, potentially devastating markets in which companies traditionally sell their crude via tenders and spot transactions, including West African and some Russian crude streams.

Two of the three buyers, both with refineries in Northeast Asia, plan to refine some of the additional purchases while diverting the rest to storage, said the people, who asked not to be identified due to company policy. Saudi Aramco said it wasn’t able to immediately comment on the matter.

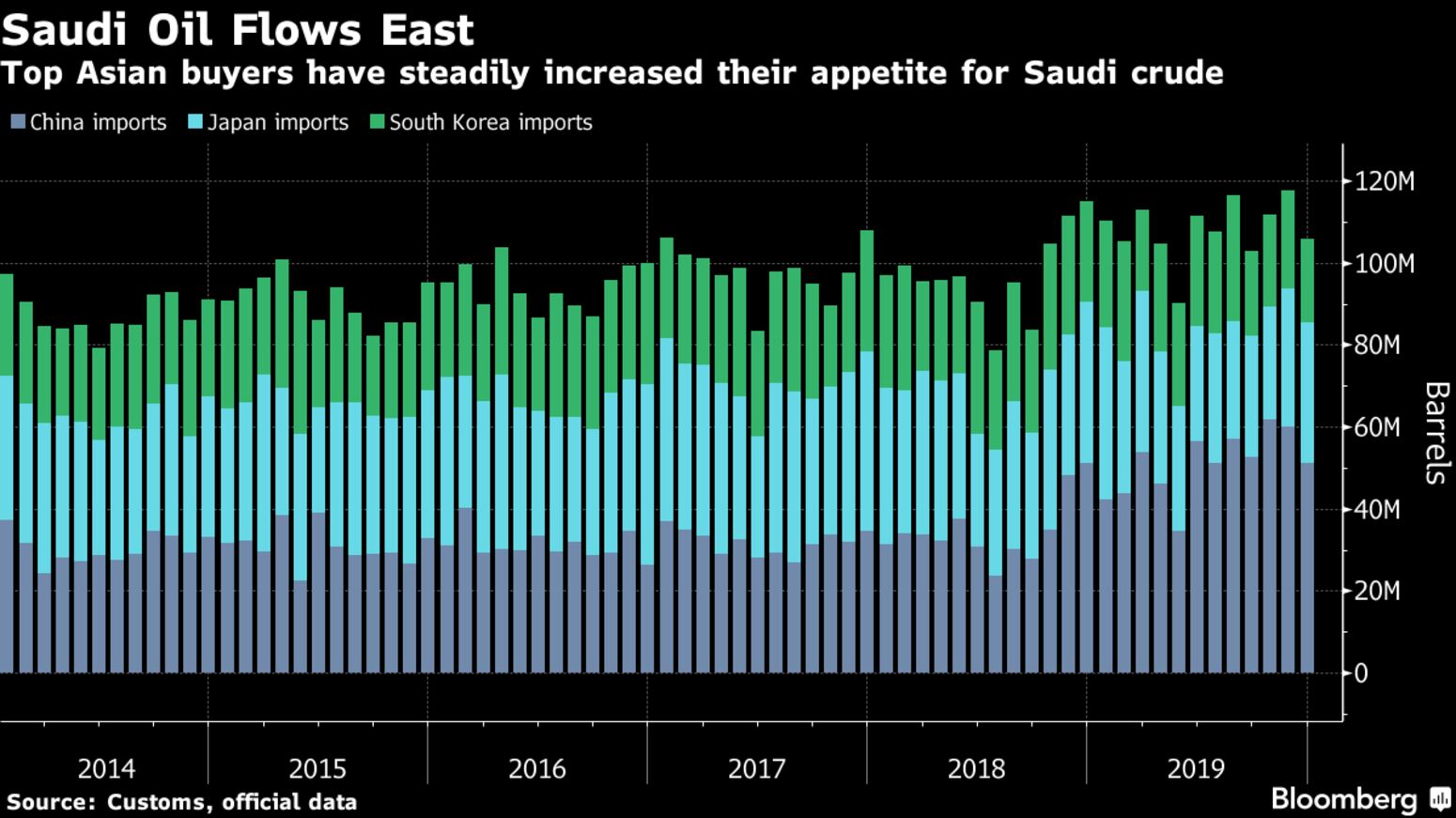

Asia takes roughly two-thirds of Saudi oil exports, according to the U.S. Energy Information Administration. Monday was the deadline for buyers in the region to tell state producer Saudi Aramco how much oil they want next month as part of their long-term supply contracts with the kingdom. In this nomination process, they can typically ask to take up to 10% more or less crude than stipulated by their contracts should market circumstances alter their needs.