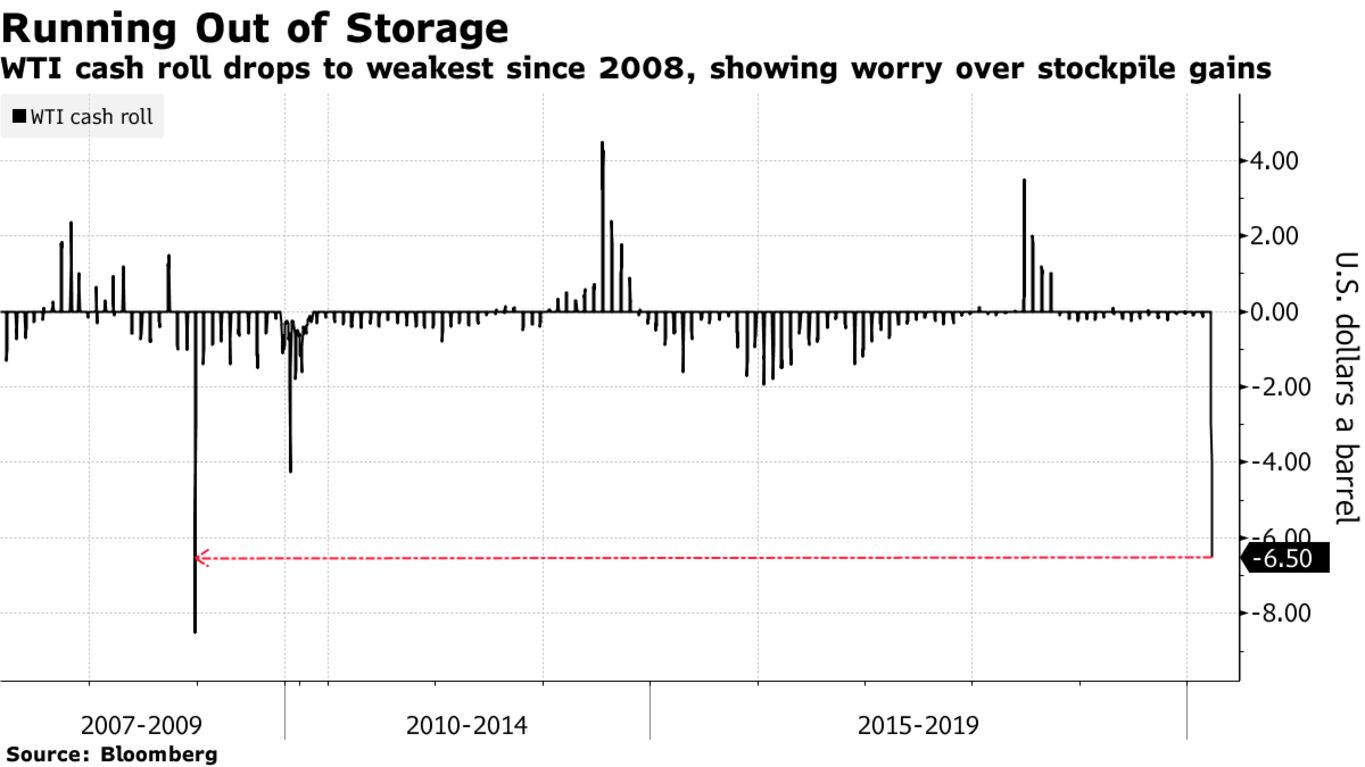

The U.S. oil market is displaying worries that stockpiles are going to run out of storage space, with futures being whipsawed as a growing glut counters economic stimulus measures. While crude in New York rose for a third day as the U.S. made progress on an economic aid package, the so-called WTI cash roll traded down at the lowest level since December 2008 on expectations that inventories at the delivery point for U.S. futures would balloon in coming weeks and months. Gauges of the physical market for actual barrels of crude are also pointing to weakness.

The WTI cash roll, which traded down to –$6.50 a barrel Wednesday, allows traders to push long positions forward to later months or cover short positions in the three days following the expiration of the prompt New York Mercantile Exchange futures contract. “Investors are still grappling with the magnitude of decreased demand,” said Nick Holmes, portfolio manager at Tortoise. “Combine that with more supply hitting the market, it creates severe dislocations across oil markets. There’s a lot of uncertainty about how long demand will be depressed and at what levels.”