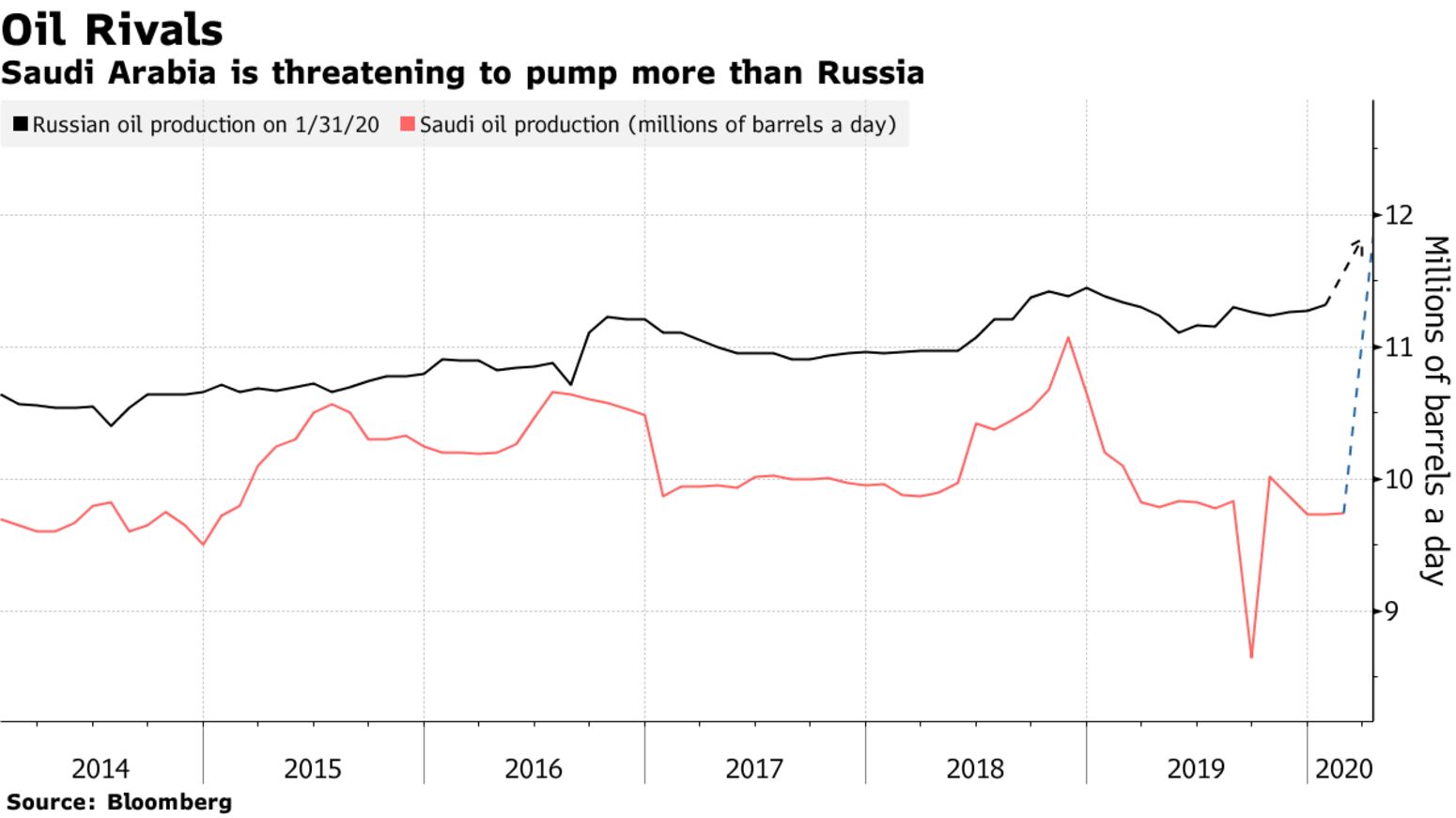

Oil’s rebound from its biggest crash in a generation halted after Saudi Arabia said it would boost its production capacity, and the United Arab Emirates joined them in raising supplies. Brent crude fell 3.4% in London after being up almost 7% earlier. Saudi Aramco said Wednesday it was making maximum efforts to boost its oil production capacity to 13 million barrels a day from 12 million after pledging to supply a record 12.3 million barrels a day next month in a massive increase. Abu Dhabi National Oil Co. will boost oil supply to over 4 million barrels a day, it said in a statement.

In the U.S., President Donald Trump pitched a payroll tax holiday and relief for the travel and hospitality sectors to combat the virus’s impact, while some Republican senators suggested a bailout for the shale industry.

The Trump administration’s willingness to revive the economy comes after the disintegration of OPEC+ and subsequent plunge in oil prices threatened the U.S. shale industry and spurred an indiscriminate sell-off in markets already reeling from the coronavirus. However, investor hopes were tempered when the president didn’t appear at a White House briefing Tuesday after promising a day earlier he’d hold a news conference to announce a major stimulus.

“I view the string of announcements from Saudi Arabia as upping the ante in the poker game that the kingdom is playing with Russia,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA. “The Saudi end-goal, in our view, is to demonstrate that a cooperative solution seeking price stability is the best outcome rather the pursuit of market share.”