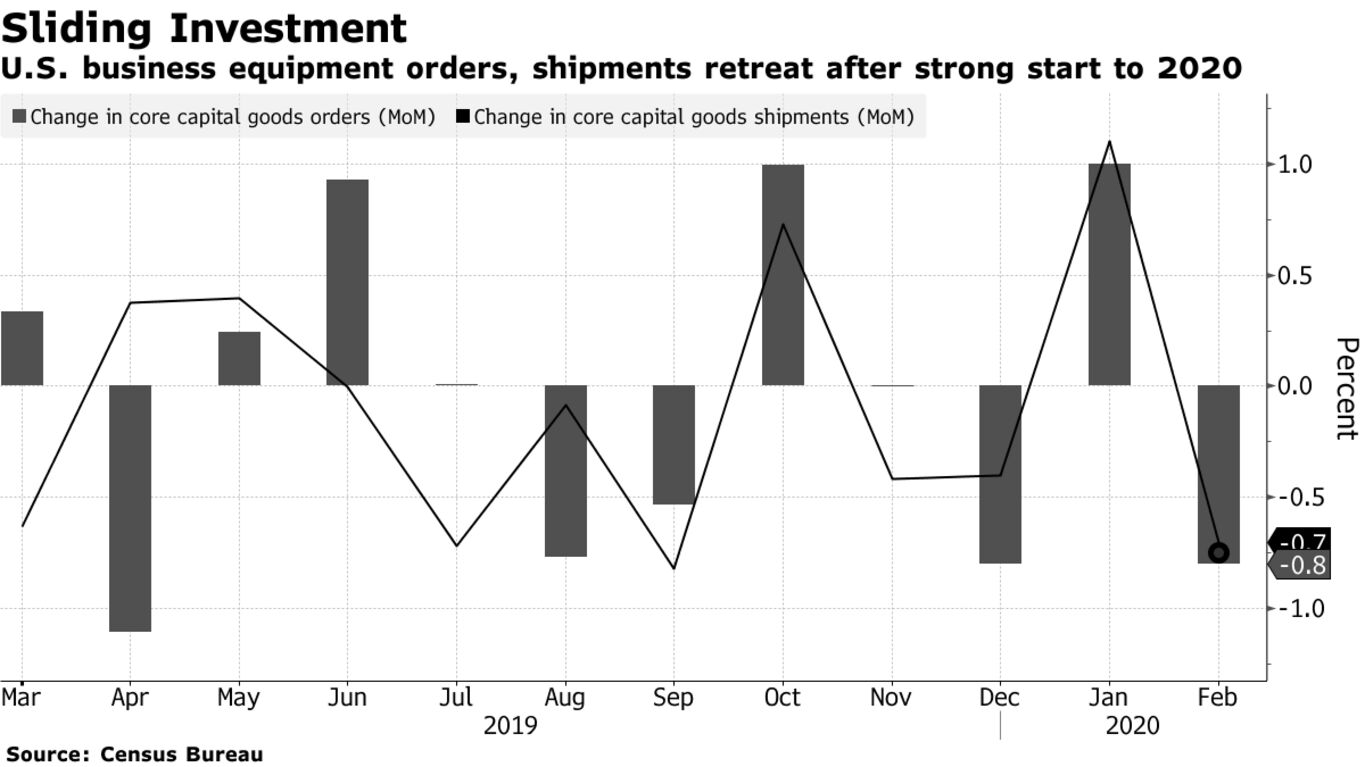

U.S. factories received fewer orders for business equipment than forecast in February, just before the coronavirus-related demand shock that will likely lead a massive pullback in corporate investment. Core capital goods orders, which exclude aircraft and military hardware, fell 0.8% after a revised 1% advance in January, Commerce Department data showed Wednesday. The median forecast in a Bloomberg survey of economist had called for a 0.4% decline. The broader measure of bookings for all durables, or goods meant to last at least three years, increased 1.2%, reflecting a pickup in motor vehicle and electrical equipment orders.

Shipments of business equipment, a figure used in gross domestic product calculations, decreased 0.7% after rising in January by the most in a year. While the U.S.-China trade deal was seen helping stabilize capital spending after the biggest quarterly slide in equipment outlays since 2015, the Boeing Co.’s 737 Max production halt was projected to weigh on manufacturing. The pandemic represents a new and immense challenge for domestic producers. As global economies stop to contain the spread, business investment is likely to be dialed back sharply in the second quarter.

Boeing plans to restart production of the 737 Max by May, Reuters News reported Tuesday. The aircraft maker also asked suppliers to be ready to ship parts in April, Reuters said.