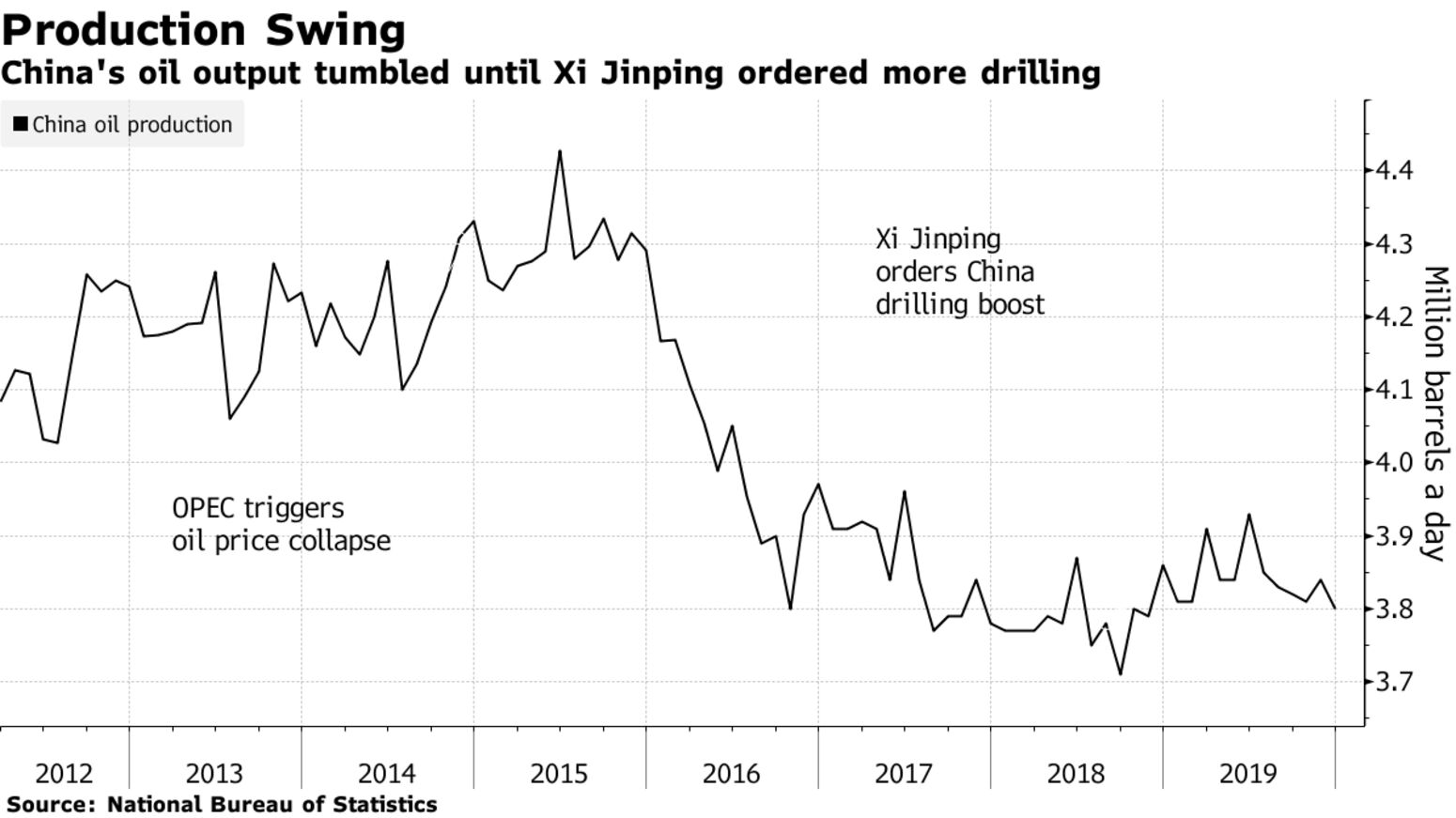

Oil’s historic price crash is presenting an uncomfortable dilemma to China’s energy majors: follow market signals to cut drilling, or heed President Xi Jinping’s orders to boost output. While China’s main influence on global oil is as the world’s largest importer, it also produces 3.8 million barrels a day, more crude than all but two of OPEC’s individual members. The last time crude slumped this low, in 2016, China’s response was to cut spending at old and expensive fields, and output slumped.

That may not be an option this time, after trade tensions with the U.S. prompted Xi in 2018 to order an increase in domestic exploration and production to safeguard the country’s energy security. The longer the price collapse lasts, the more the government’s push for energy sufficiency will be tested, with state-owned firms like PetroChina Co., Sinopec Corp. and Cnooc Ltd. caught in the middle.

“The Chinese government still wants to produce more to enhance its self-sufficiency rate,” said Dennis Ip, an analyst at Daiwa Capital Markets Hong Kong Ltd. “Lower oil prices are definitely going to hurt the cash flow for those Big Three oil majors. Whether they execute 100% of their capital plan this year, or try to defer, really depends on how long this lasts.” Crude prices have tumbled by nearly half since the beginning of the year as the coronavirus outbreak saps demand and Saudi Arabia and Russia unleash supply in what appears to be the start of a price war. U.S. drillers like Occidental Petroleum Corp. and Diamondback Energy Inc. have already announced plans to slash spending amid the rout.