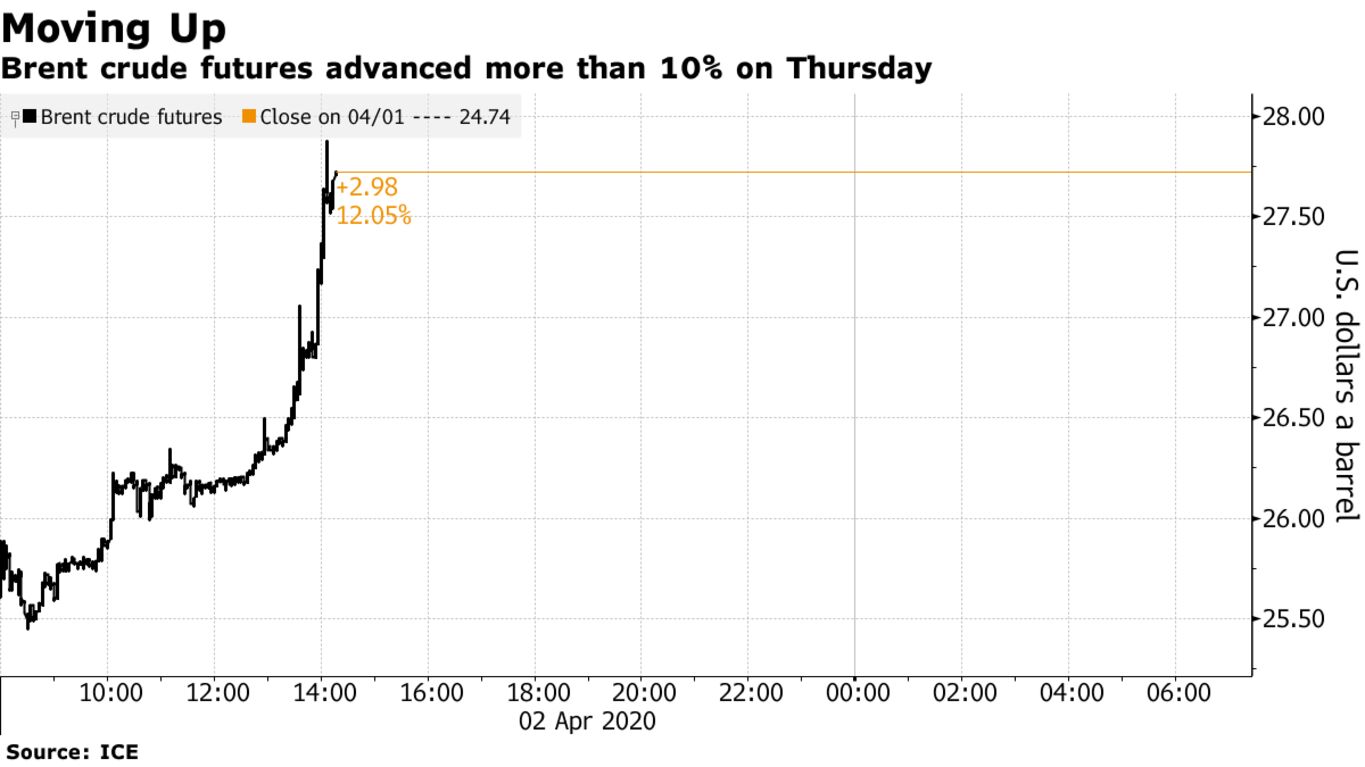

Oil surged more than 12% as China planned to start buying up cheap crude for its strategic reserves, adding to tentative signs of growing risk appetite across financial markets that’s propelling prices higher. Futures extended gains as Beijing instructed government agencies to start filling state stockpiles after oil plunged 66% over the first three months of the year. China’s move comes as the physical crude market shows deepening signs of strain as supply explodes and demand collapses due to the coronavirus.

Dated Brent, the benchmark for two-thirds of the world’s physical supply, was assessed at $15.135 on Wednesday, the lowest since at least 1999. Crude has slipped below $10 in some areas including Canada and shale regions in the U.S., while some grades have posted negative prices.

China’s purchases are likely to help soak up some excess oil as the market faces an unprecedented collapse in consumption. Top trader Vitol SA said demand will be destroyed by as much as 30 million barrels a day in April. In addition to state-owned reserves, Beijing may use commercial space for storage, while also encouraging companies to fill their own tanks, according to people with knowledge of the matter. The initial target is to hold government stockpiles equivalent to 90 days of net imports, which could eventually be expanded to as much as 180 days when including commercial reserves.