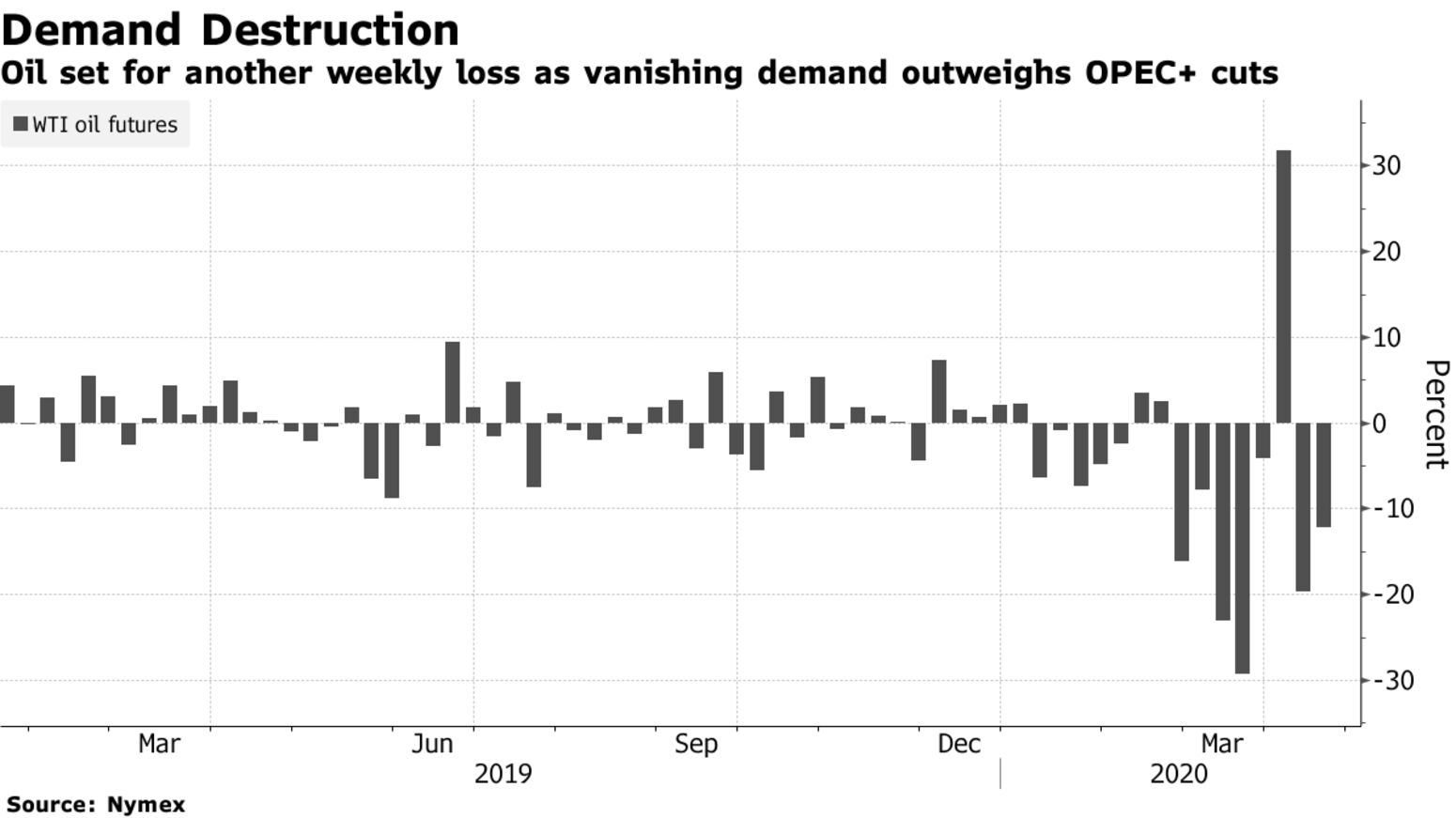

Oil fell below $19 a barrel in New York after a wave of gloomy demand forecasts and a cratering physical market outweighed an unprecedented deal to cut output. China’s economy suffered a historic slump in the first quarter with the coronavirus outbreak threatening countries around the world. OPEC expects demand of its crude will fall to the lowest in three decades, and the International Energy Agency predicted that oil use would slump by a record this year and potentially make 2020 the worst in the market’s history.

U.S. oil futures have come under huge pressure as concerns grow that stockpiles at the key storage hub of Cushing, Oklahoma will fill to capacity. That has increasingly disconnected it with Brent futures in London. Dated Brent was assessed at $18.86 on Thursday, according to S&P Global Platts, far below futures prices, and real cargoes are trading at even steeper discounts to that.

A record deal by OPEC and its partners to cut production by 9.7 million barrels a day is falling short of reviving the market. In a joint statement on Thursday, Saudi Arabia and Russia said they will “continue to closely monitor the oil market and are prepared to take further measures jointly with OPEC+ and other producers if these are deemed necessary.” Saudi Aramco said Friday that it will cut supply to 8.5 million barrels a day from May 1.

“We’re seeing record cuts, but still not enough to bring the market even close to balance,” said Warren Patterson, head of commodities strategy at ING Bank NV. “Even OPEC’s own numbers showed that. It’s a continuation of the story.”

The coronavirus pushed China’s economy into its first contraction in decades in the first quarter, with the spread of the disease around the world now leaving the nation reliant on fragile domestic demand to spur a recovery. GDP fell 6.8% from a year ago, the worst performance since at least 1992. OPEC estimates that just under 20 million barrels a day will be needed on average from the group during the second quarter, according to its monthly report. The cartel hasn’t pumped this little since early 1989.