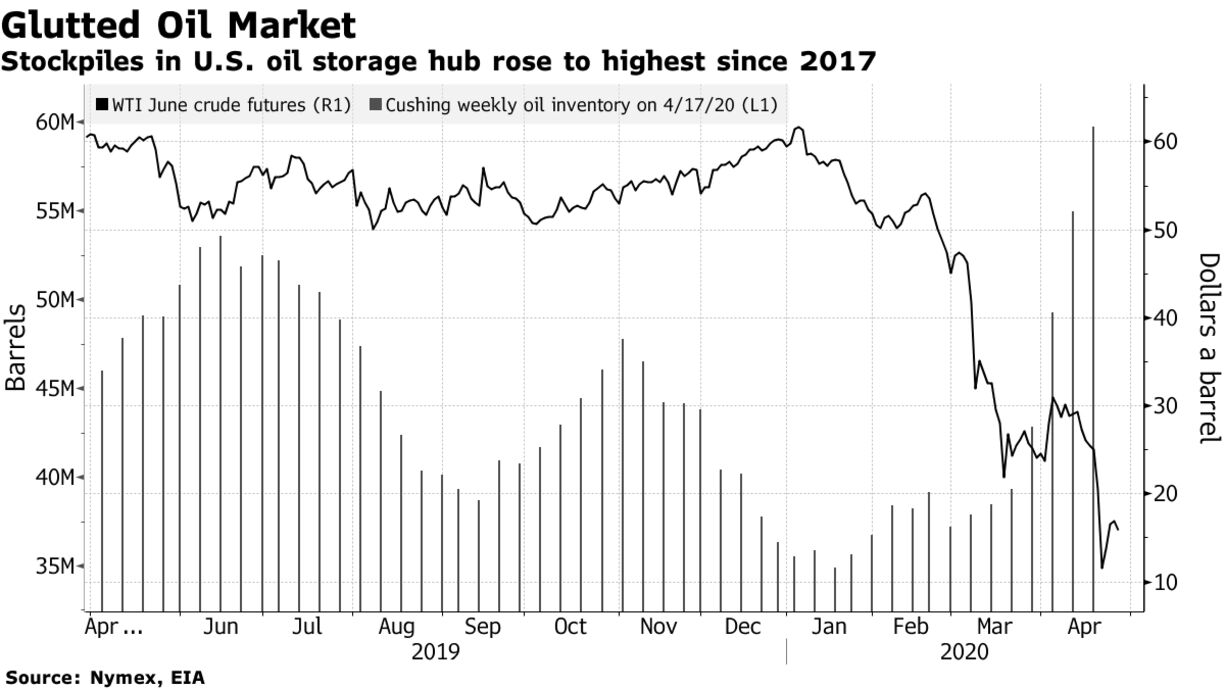

Oil dropped back below $15 a barrel as swelling global crude stockpiles made it more difficult for leading producers to balance the market by curbing output. Futures in New York slid 16%, snapping a four-day gain. While U.S. drilling is sliding and Saudi Arabia has started reducing output ahead of the start date for OPEC+ supply cuts, an immense glut of oil means storage tanks are close to capacity around the world. South Korea became the fourth Asian nation to run out of commercial storage space on Monday.

On a global level the swelling glut is set to test storage capacity limits in as little as three weeks, according to Goldman Sachs Group Inc., with traders, refiners and infrastructure providers seeking novel ways to hoard crude, including on tiny barges around Europe’s petroleum-trading hub and in pipelines. The hub of Cushing, Oklahoma, the delivery point for American crude futures, is filling fast and putting added pressure on the U.S. benchmark.

“While bringing forward cuts by a handful of producers is helpful, it will have little impact on the oil balance in the short term,” said ING analysts including Warren Patterson.

There were tentative signs at the weekend that the coronavirus outbreak might be loosening its grip, with the death tolls slowing by the most in more than a month in Spain, Italy and France. Reported fatalities in the U.K. and New York were the lowest since the end of March.