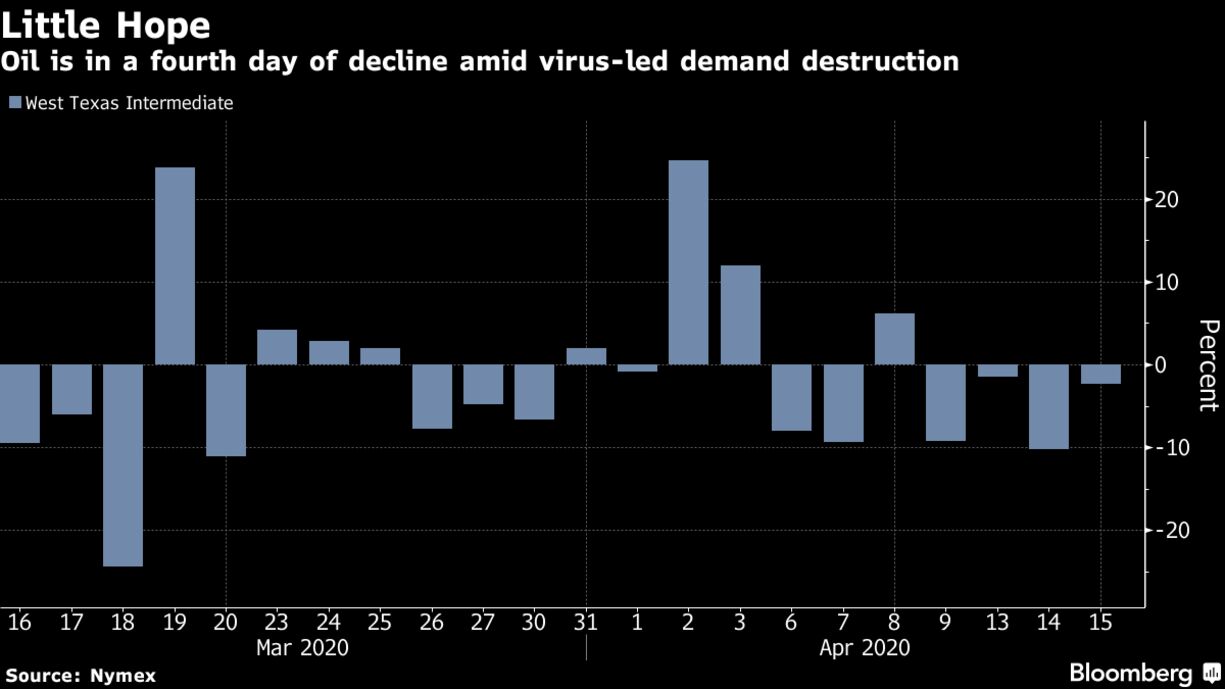

Oil fell below $20 a barrel after the International Energy Agency said demand would slump by a record this year despite a historic production cut deal. Futures fell as much as 4.5% in New York to the lowest since 2002. Oil demand will drop by over 9 million barrels a day this year, wiping out a decade of consumption growth, the IEA said, exhausting storage by mid-year. While Saudi Arabia and other Gulf producers have pledged to cut supply starting next month, they continue to flood the market in April.

Stockpiles are rising everywhere and weakening key physical market gauges. New York oil futures moved deeper into contango, signaling an expanding glut, while swap prices indicate North Sea cargoes are trading at bumper discounts.

Oil has lost about two-thirds of its value this year as countries extend their coronavirus lockdowns, death tolls mount around the world, and unemployment explodes in America. The International Monetary Fund estimated the global economy will shrink 3% this year, a signal that energy demand may remain weak, while the IEA is warning that the worst may be yet to come.

“We may see further downward pressure on prices in coming days and weeks,” IEA Executive Director Fatih Birol said.