The fallout from sub-zero oil prices is accelerating the slump in U.S. crude exploration to a pace never seen before. Drilling in onshore American fields fell the most in 14 years this week, according to data released just days after benchmark New York-traded crude futures sank to minus $40.32 a barrel in a heretofore unheard of crash.

As the financial wreckage piles up from cratering fuel demand and Covid-19 lockdowns around the world, drillers have idled 45% of U.S. oil rigs since mid March — the worst-ever six-week decline. The wholesale devastation of a sector that as recently as last year couldn’t find workers or equipment fast enough to meet demand promises to worsen as explorers cancel more contracts and abandon projects to wait out the rout.

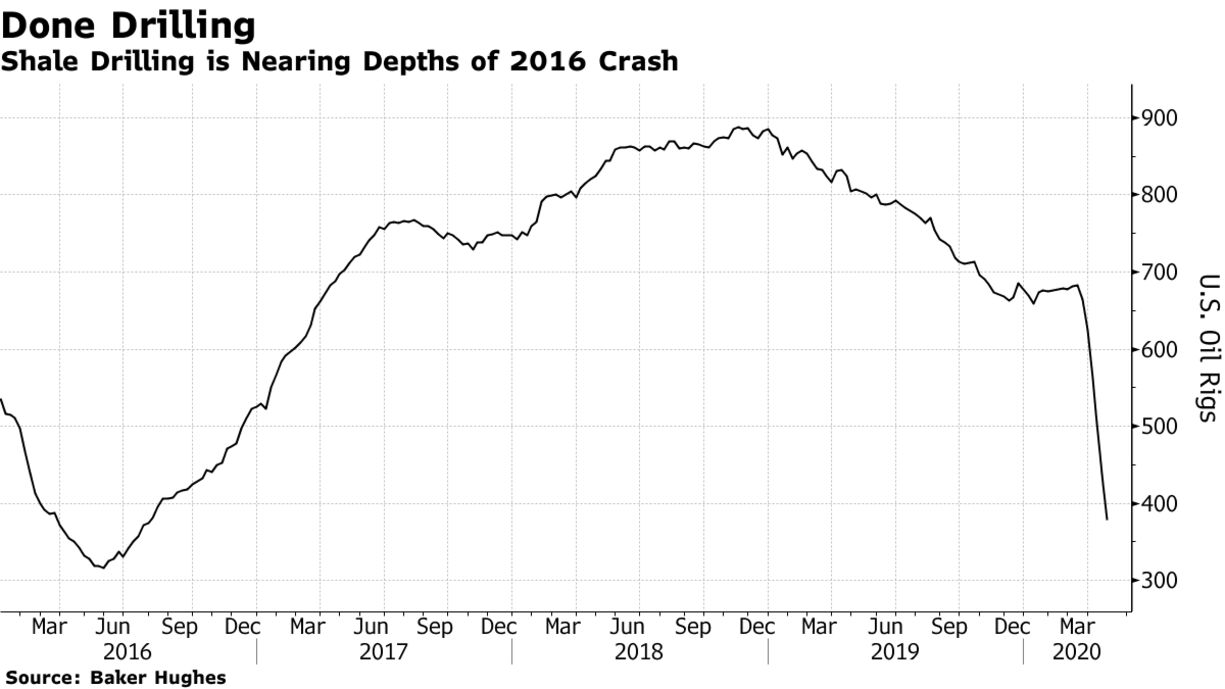

Drillers idled 60 rigs this week, shrinking the active nationwide fleet to 378 machines, according to data from Baker Hughes Co. on Friday. On a percentage basis, this week’s decline was the worst since February 2006.

The Permian Basin of West Texas and New Mexico accounted for 62% of this week’s shutdowns, an ominous signal for the industry because that region has for many years been one of the only areas where production still turned a profit. Exploration also declined in shale formations in South Texas, North Dakota, Wyoming, Colorado and Oklahoma. Benchmark U.S. crude futures were trading around $17 a barrel when the Baker Hughes tally was released. As recently as the second week of January, they were above $65.