Oil in New York is heading for an extra dose of unpredictability over the next two days as the current contract nears expiration, adding extra volatility to a market that’s grappling with a glut and vaporating demand. The contract expiry is when white-collar financial derivatives trading intersects with the blue-collar world of pipelines and storage tanks. West Texas Intermediate futures for May are set to expire at the end of trading Tuesday, but a market structure is known as contango — indicating near term oversupply — has helped lead to a wide gap with the June contract.

While May futures declined almost 19% to $14.88 a barrel as of 8:34 a.m. London time, June crude is down around 5.6% to $23.62. Volumes are also larger for June as investors position for the change of contracts.

The tens of billions of dollars traded every day in WTI futures are almost always settled financially, but any contract that hasn’t been closed out after expiry has to be liquidated with a physical delivery of oil if the parties can’t come to some kind of over-the-counter agreement. Those deliveries go to the storage hub of Cushing, Oklahoma, which is connected by pipeline to Canada, the U.S. Midwest, West Texas and the Gulf Coast.

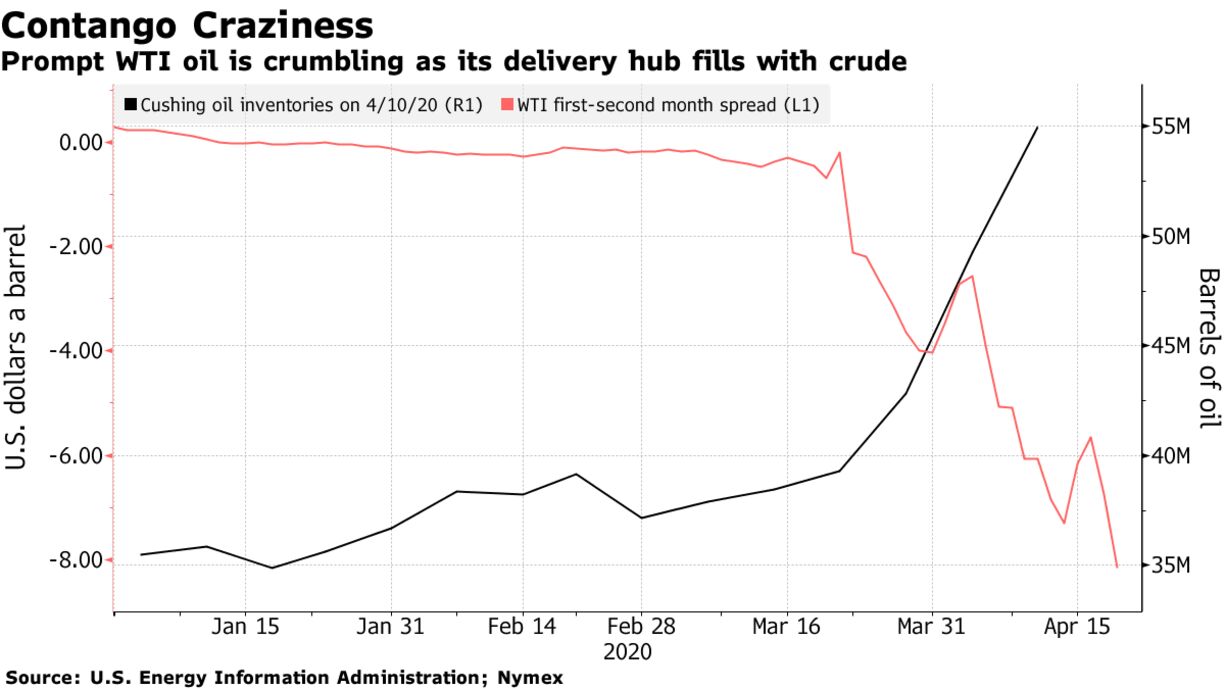

The problem is that Cushing is rapidly filling as fuel consumption collapses due to lockdowns to stem the coronavirus pandemic. Crude stockpiles ballooned by almost 16 million barrels in the three weeks through April 10 to 55 million barrels. The hub had working storage capacity of 76 million as of Sept. 30, according to the Energy Information Administration.

That’s bad news if you’re long May futures, because if you don’t close out your position by the end of trading Tuesday, you have just a few days to let the seller know how you’re going to accept delivery, which is due from May 1-31. At the rate Cushing is filling, finding space is going to be difficult, especially for financial traders who rarely deal with the physical world.

That’s one of the reasons why the May future is trading nearly $9 a barrel lower than WTI for June, more than the record $8.49 spread between the first- and second-month contracts set in December 2008. The wide gap is also being driven by the large flows of exchange-traded funds into the June contract. The U.S. Oil Fund accounted for about 25% of outstanding June crude as of last week.