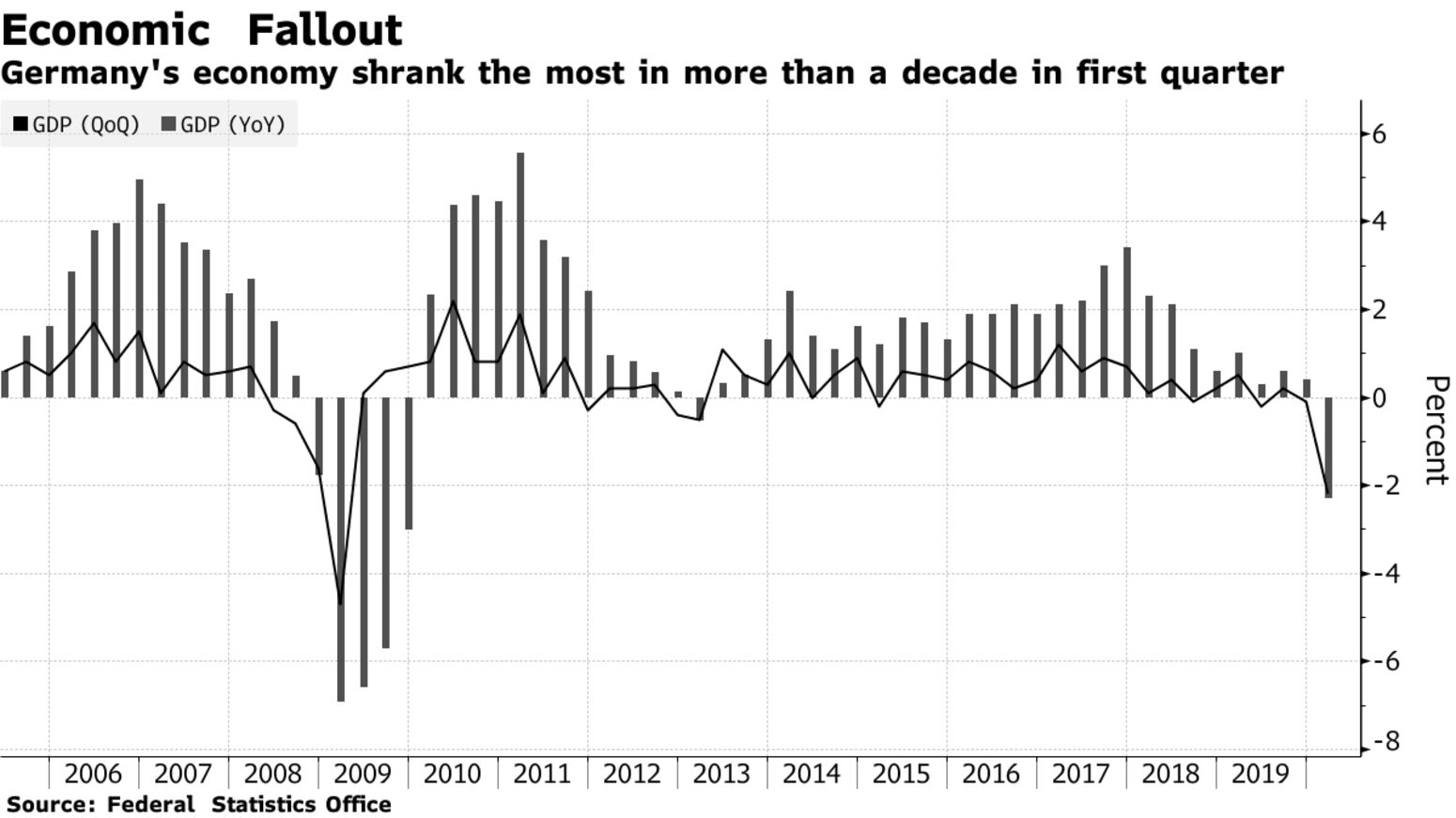

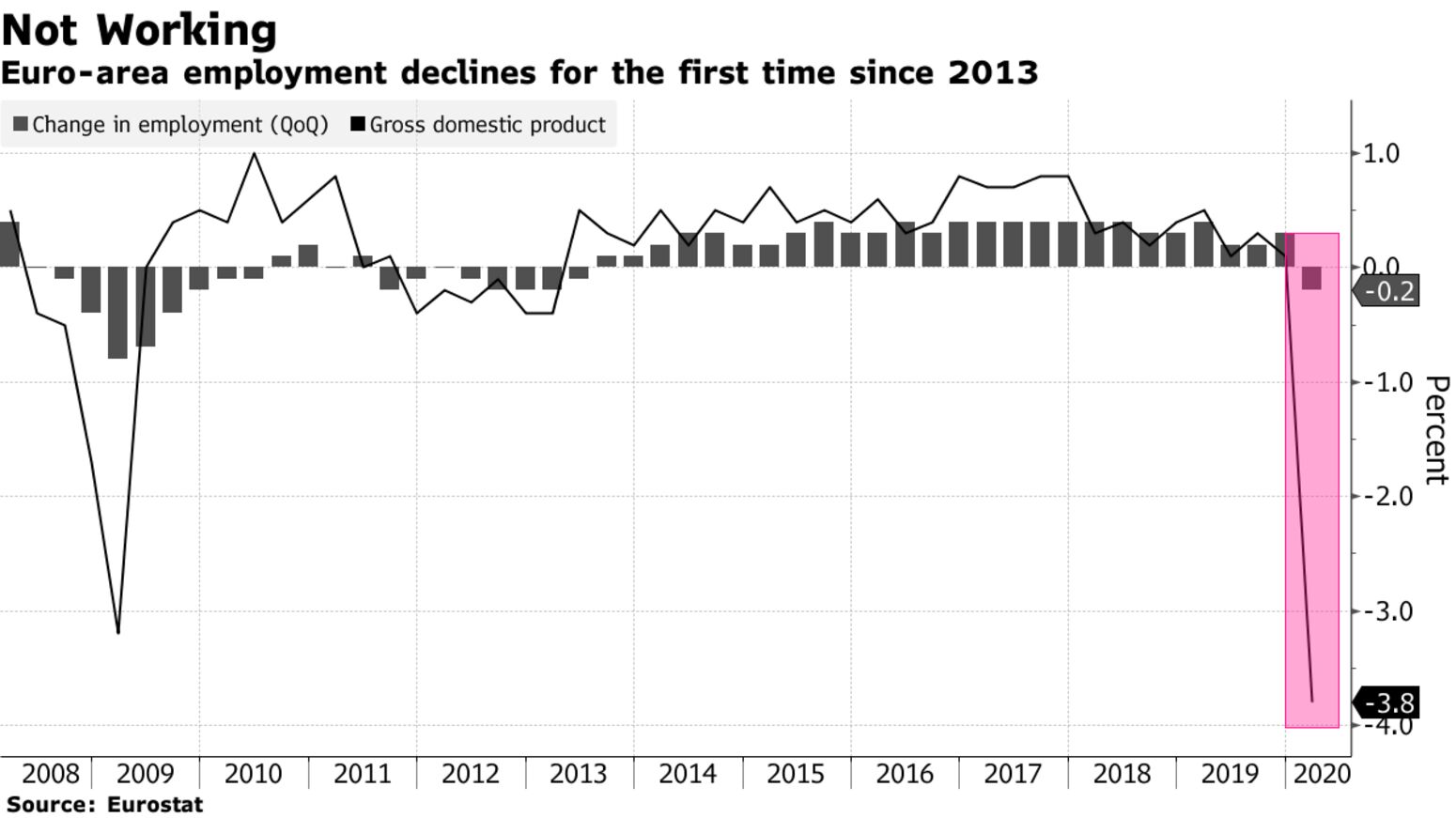

The German economy shrank 2.2% in the first quarter, the most in more than a decade, offering an early flavor of the damage from the coronavirus outbreak. Less than two weeks of official lockdown caused slumps in consumer spending and capital investment. Government spending and construction provided some stabilization. A 3.8% slump in the euro-area economy led to a decline in employment, the first since 2013.

A revision to Germany’s fourth-quarter performance means Europe’s largest economy is already in a recession. With restrictions to contain the pandemic only slowly being lifted, the economy is set to suffer much more in the three months through June. The euro and German bunds barely reacted to the data. The single currency is trading little changed from the previous day.

The German government has already mobilized some 1.2 trillion euros ($1.3 trillion) to support German businesses, and is working on additional tools to kickstart the economy. More than 370,000 people lost their jobs in April alone, and a program where the state compensates large parts of wages lost when businesses cut workers’ hours has received applications for more than 10 million staff.

Finance Minister Olaf Scholz on Thursday promised a stimulus program in early June that will focus on investing in a “modern and climate friendly future.” The Italian government passed a stimulus package worth 55 billion euros this week to try to prop up the economy, after a previous 25 billion-euro plan in March was deemed insufficient. The decline in industrial sales and orders in the country exceeded 25% in March. Even though the situation is dire, Germany isn’t faring as poorly as much of the rest of the euro area. France, Italy and Spain have all registered first-quarter contractions of around 5%. The Dutch economy shrank 1.7%.