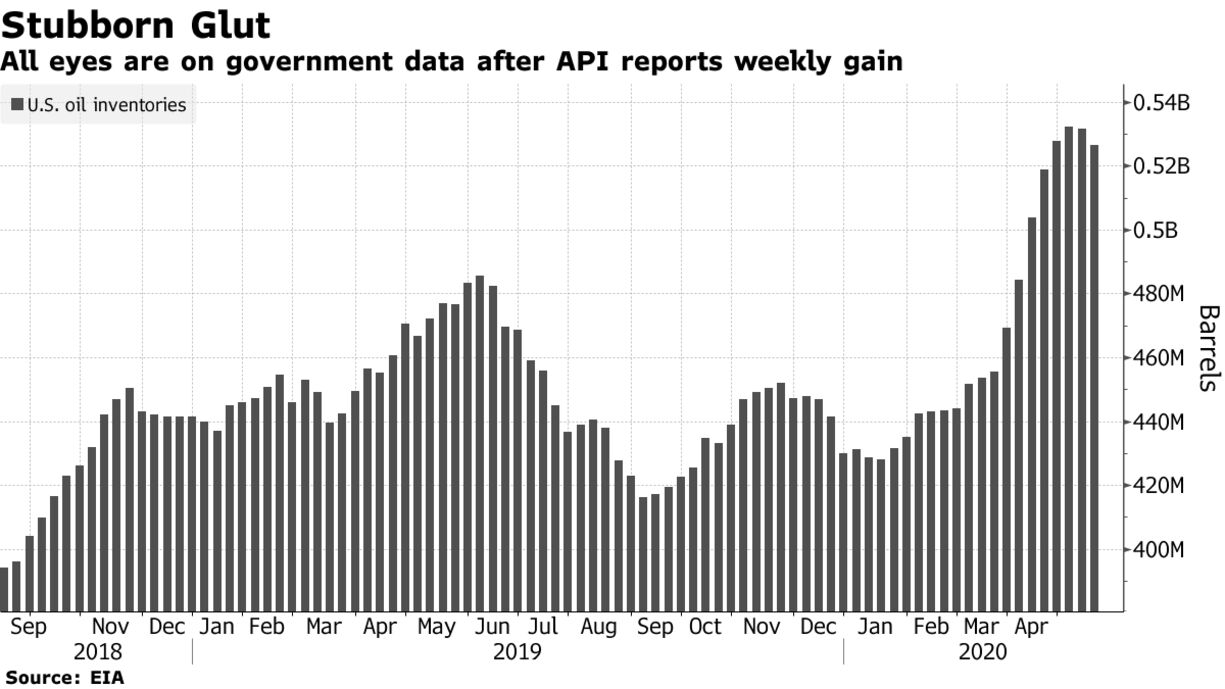

Oil extended declines after a industry report showed U.S. crude inventories swelled for the first time in three weeks. Futures fell 1.4% in New York, following Wednesday’s 4.5% decrease. The American Petroleum Institute reported that stockpiles expanded by 8.73 million barrels last week, according to people familiar with the data, raising questions about the strength of the market’s return to balance. Meanwhile, Chinese lawmakers approved a Hong Kong security legislation, setting the stage for increased tensions with America.

Oil’s rally started to falter Wednesday as Russia indicated it wants to stick with OPEC+ plans to ease output cuts from July. Russian President Vladimir Putin and Saudi Arabian Crown Prince Mohammed bin Salman reiterated their cooperation on the deal ahead of a June 9-10 meeting. While OPEC+ nations have shown high compliance with the current deal, investors are weighing if that will continue.

The API data “was not a pretty read,” said Tamas Varga, analyst at PVM Oil Associates Ltd. If confirmed by official government data later on Thursday, “the recovery from yesterday’s slump will take more than just a day.”

Oil in New York is still up about 70% this month, the most since at least the early 1980s. Demand is starting to recover as many countries ease virus lockdowns. The physical market has been showing some signs of strength, with refiners across Asia buying distressed cargoes. The top U.S. infectious disease expert said there is a chance that a coronavirus vaccine will be available by the end of the year, boosting sentiments.