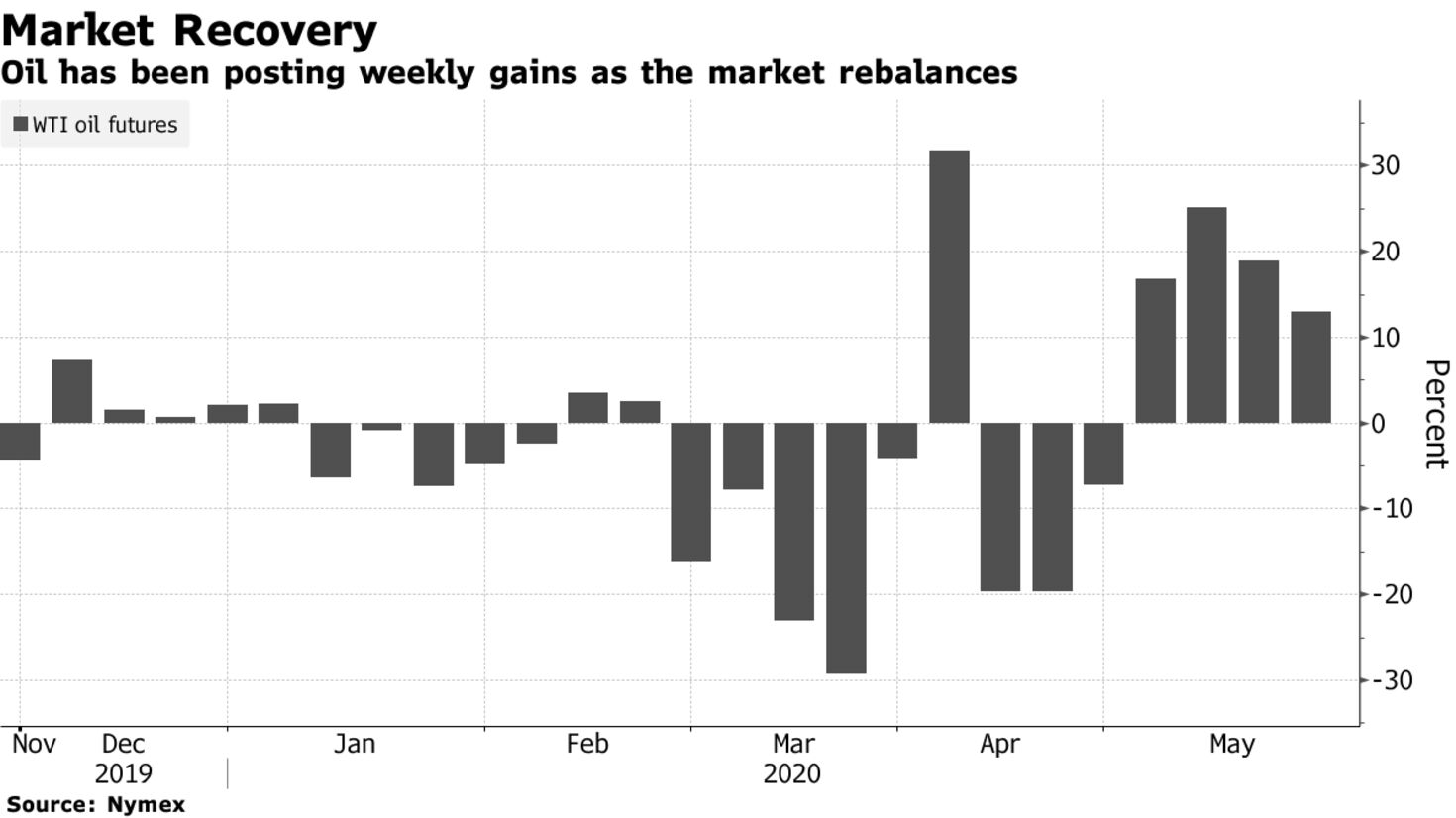

Oil’s recovery from its historic crash last month is barreling ahead, with some OPEC producers displaying signs of confidence that the market is stabilizing. Nigeria and Algeria — both members of the Organization of Petroleum Exporting Countries — have lifted the official selling prices for their supply, a sign that they believe customers are willing to pay more for their barrels. That would offer some respite after demand was crushed by the fallout from the coronavirus outbreak.

“The global market is starting to tighten a bit,” said John Kilduff, partner at Again Capital LLC. “You’ve got constrained supplies in the face of a bit of a rebound at least in demand that is a recipe for these higher prices.”

Output cuts have started to chip away at a massive oversupply. U.S. oil output will reach a low point of about 10.7 million barrels a day in June, which would be the lowest in two years, according to Rystad Energy.

Still, the fragile nature of the recovery was on display over the Memorial Day weekend in the U.S., when gasoline demand dropped an estimated 25-35% from a year earlier. It slid 1.34% from Thursday to Monday of the holiday weekend compared to the week prior, according to Patrick DeHaan, an analyst at GasBuddy.

Russia, a key member of the OPEC+ alliance that has pledged record production cuts, expects the market to balance in June or July. The country wants to start easing oil output cuts from July, in line with the terms of the deal with other producers struck in April, according to people familiar with its position.