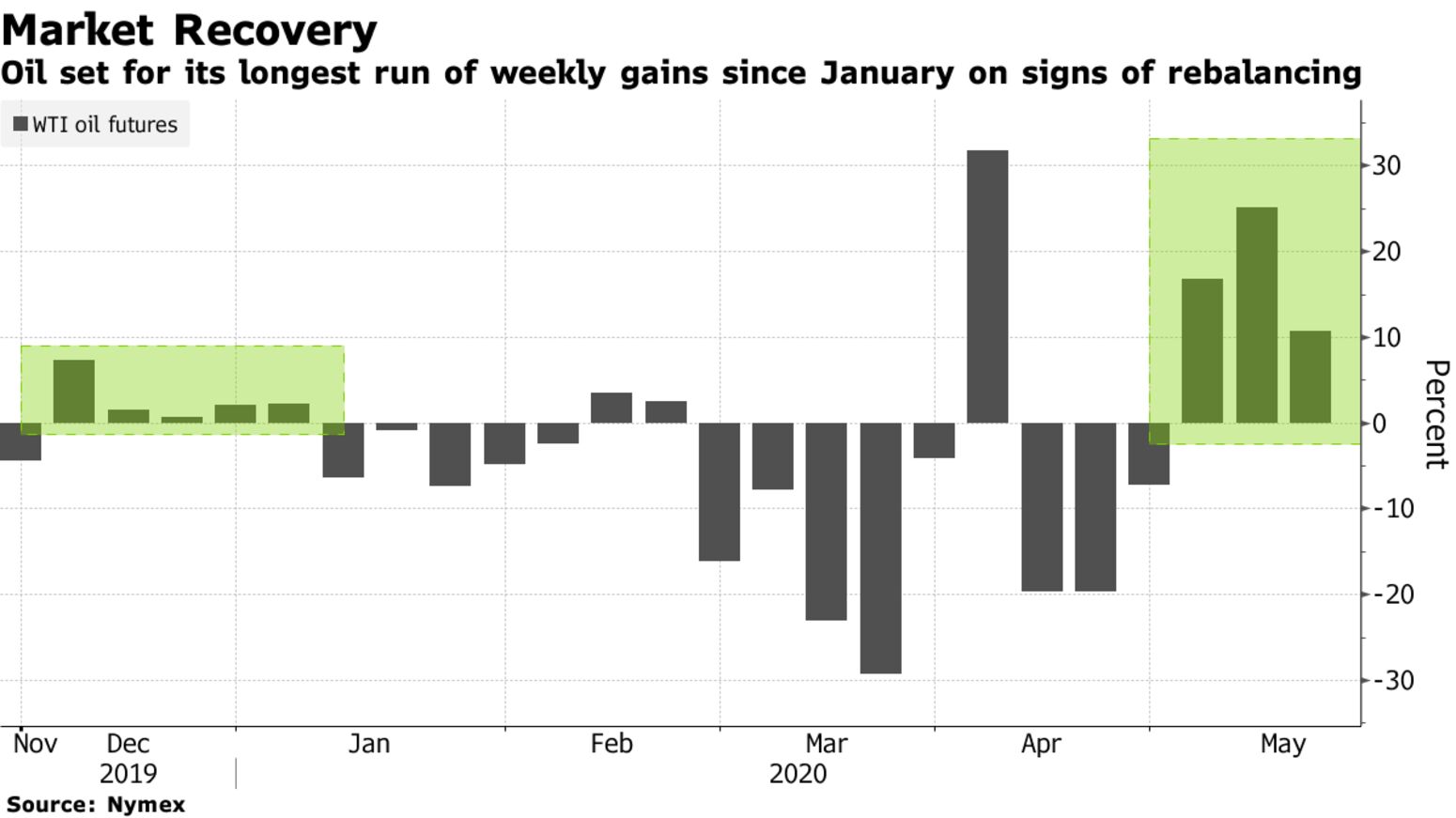

Oil is heading for a third weekly gain on signs the market is slowly rebalancing as major producers slash supply and consumption recovers after a historic collapse in demand due to the coronavirus. Futures in New York are up about 13% this week and traded near a six-week high on Friday around $28 a barrel. China’s industrial output increased in April for the first time since the outbreak, signaling economic recovery aided by government stimulus efforts. Meanwhile, Saudi Arabia has slashed supply to its customers in the U.S., Europe and Asia as OPEC and its allies reduce production sharply.

Oil is down more than 50% this year after a rout that pushed prices below zero and the road back to pre-virus levels of demand looks long and uncertain. Still, bright sports have emerged this week, with BP Plc seeing oil demand surging back and the International Energy Agency saying the market’s outlook has improved. OPEC+ has cut daily exports by almost 6 million barrels during the first 14 days of this month, according to Petro-Logistics, buoying the global Brent benchmark above $30.