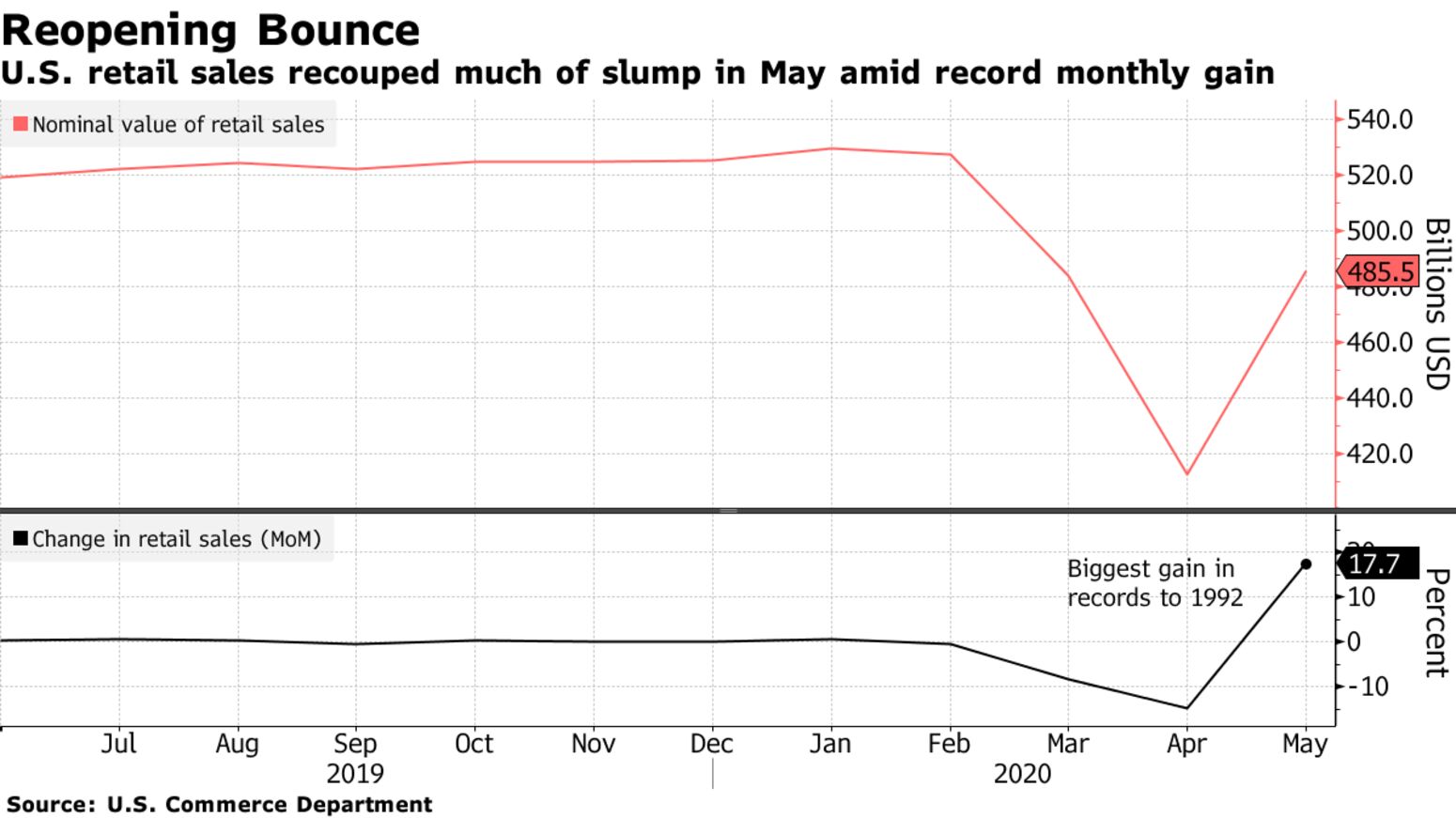

A record jump in U.S. retail sales offered some hope the world’s largest economy is emerging quickly from a deep recession, while demand is lagging behind an improvement in euro-area capacity. Here are some of the charts that appeared on Bloomberg this week, offering insight into the latest developments in the global economy:

U.S.

American consumers are getting their groove back as a record surge in May retail sales offered some hope of a quicker recovery from the pandemic-induced recession. The 17.7% advance from the prior month, to $485 billion in receipts, was the biggest gain in data going back to 1992, following unprecedented declines in the prior two months.

Permanently Gone

U.S. job losses due to a reallocation shock won’t be quickly recouped

Source: Bloomberg Economics

About 30% of the increase in total U.S. unemployment from February to May can be explained by a reallocation shock, and so risks being long-lasting, according to Bloomberg Economics.

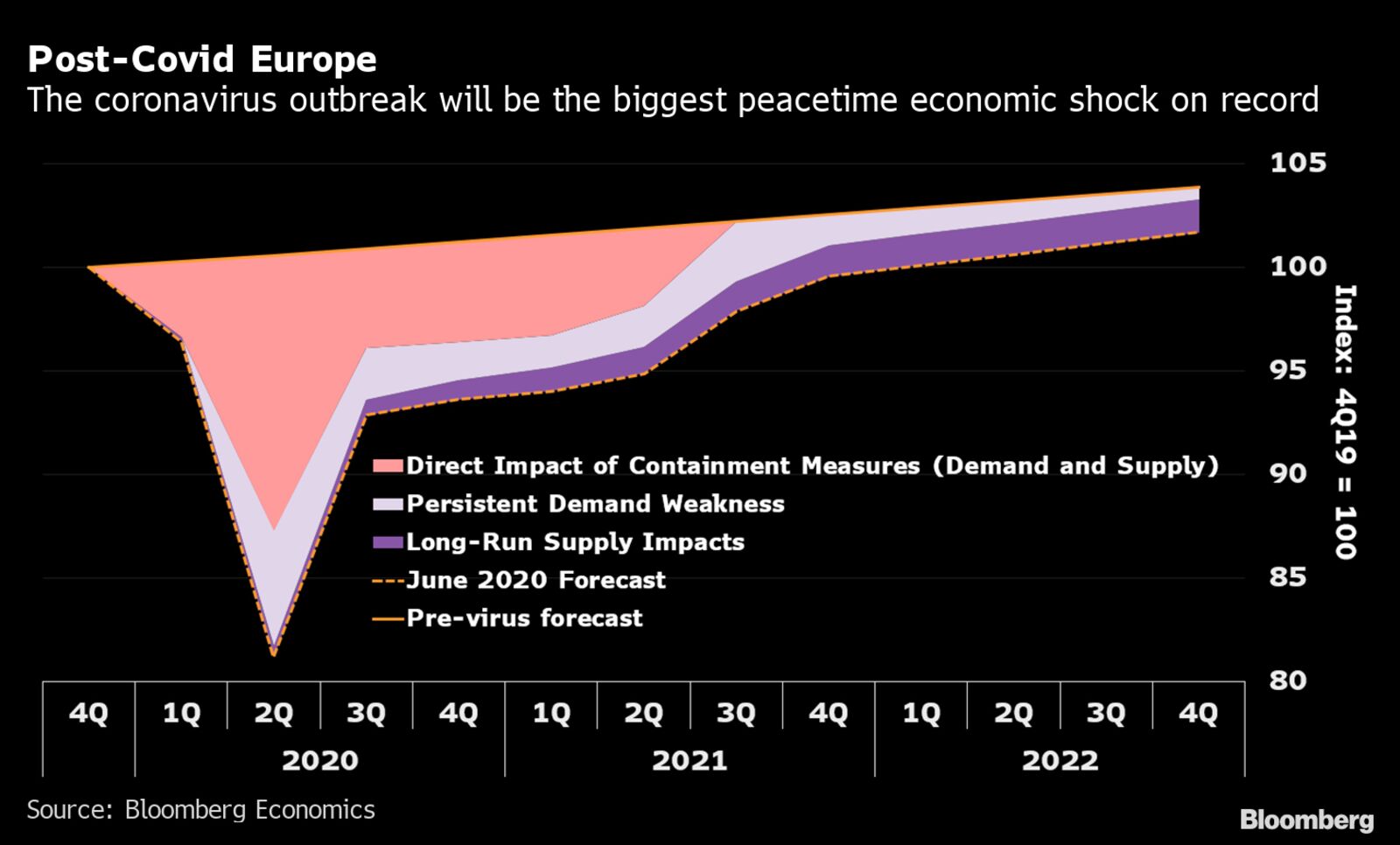

Europe

The bulk of the coronavirus hit to the euro area economy reflects the simultaneous fall in demand and supply as lockdowns took effect. As restrictions continue to be lifted, capacity is rising, but demand is not moving up in lockstep, according to Bloomberg Economics.

Where Poverty, Brexit and Covid Collide

North England areas with high levels of deprivation and covid-19 cases

Sources: The English Indices of Deprivation 2019: Ministry of Housing, Communities & Local Government; Electoral Commission; Public Health England

The Brexit-supporting regions that propelled Prime Minister Boris Johnson into power are now being disproportionately hit by coronavirus and will bear the brunt of the economic fallout.

Asia

Dependence on U.S. Falling

Exports to U.S. down 18% from peak, but total shipments only down 3%

Source: China’s General Administration of Customs, Bloomberg calculations

Investment and trade have underpinned the U.S.-China relationship, though reciprocal tariffs introduced in 2018 reduced the strength of the bond. While progress in trade negotiations in late 2019 helped reduce tensions, the pandemic has posed a challenge for China to live up to purchase commitments it made in the deal signed in January.

Tourism Off Trail

Economists wonder if visitors will fall below 5 million in 2020

Source: Japan National Tourism Organization

Note: 2020 figure in orange is a threshold flagged by SMBC Nikko

Fewer than 5 million tourists could end up visiting Japan in 2020 as the government’s goal of welcoming 40 million visitors meets the reality of the coronavirus pandemic.