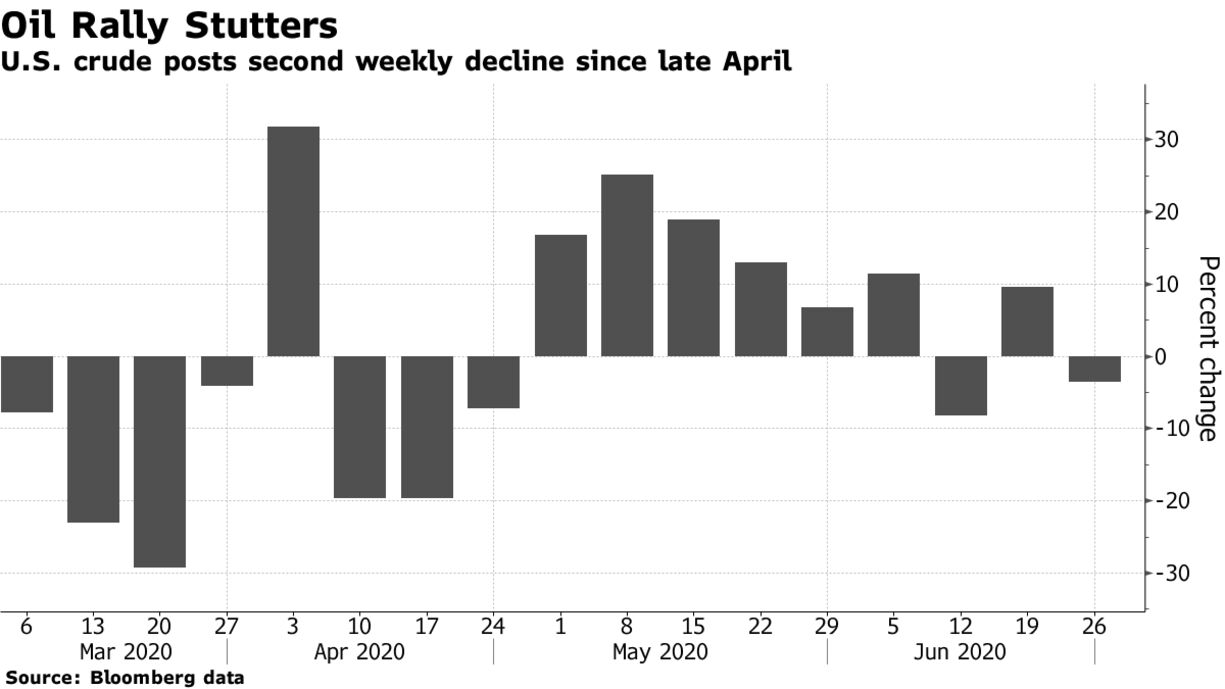

Oil posted its second weekly loss for the month, as a surge in U.S. coronavirus cases clouds the demand outlook and casts doubts on the market’s recovery.

“This week the market pushed through a 3 1/2 month high, and then all the sudden reporting about new cases seemed to break the back of the rally,” said Gene McGillian, vice president of research at Tradition Energy. “We have record amounts of oil and fuel in storage and still uncertainty about demand going forward.”

While massive OPEC+ output cuts and a pickup in demand have helped crude climb from its April low, price gains have slowed this month. Infections continue to soar in many parts of the world, consumption is still a long way off pre-virus levels and many refiners are struggling with low margins.

Crude stockpiles in the U.S. are at record highs, and there’s a risk that U.S. shale producers could start bringing back output. The number of rigs drilling for oil fell by 1 to 188, the lowest since June of 2009.

| PRICES: |

|---|

|

Still, the pessimism’s being tempered by huge cuts to Russia’s seaborne crude exports, a development that lifted oil earlier in the session. Shipments of the flagship Urals grade from its three main western ports are set to plunge by 40% next month, according to loading programs seen by Bloomberg. The steep reductions underscore the OPEC+ alliance’s commitment to eliminate the oil glut that built up earlier this year.