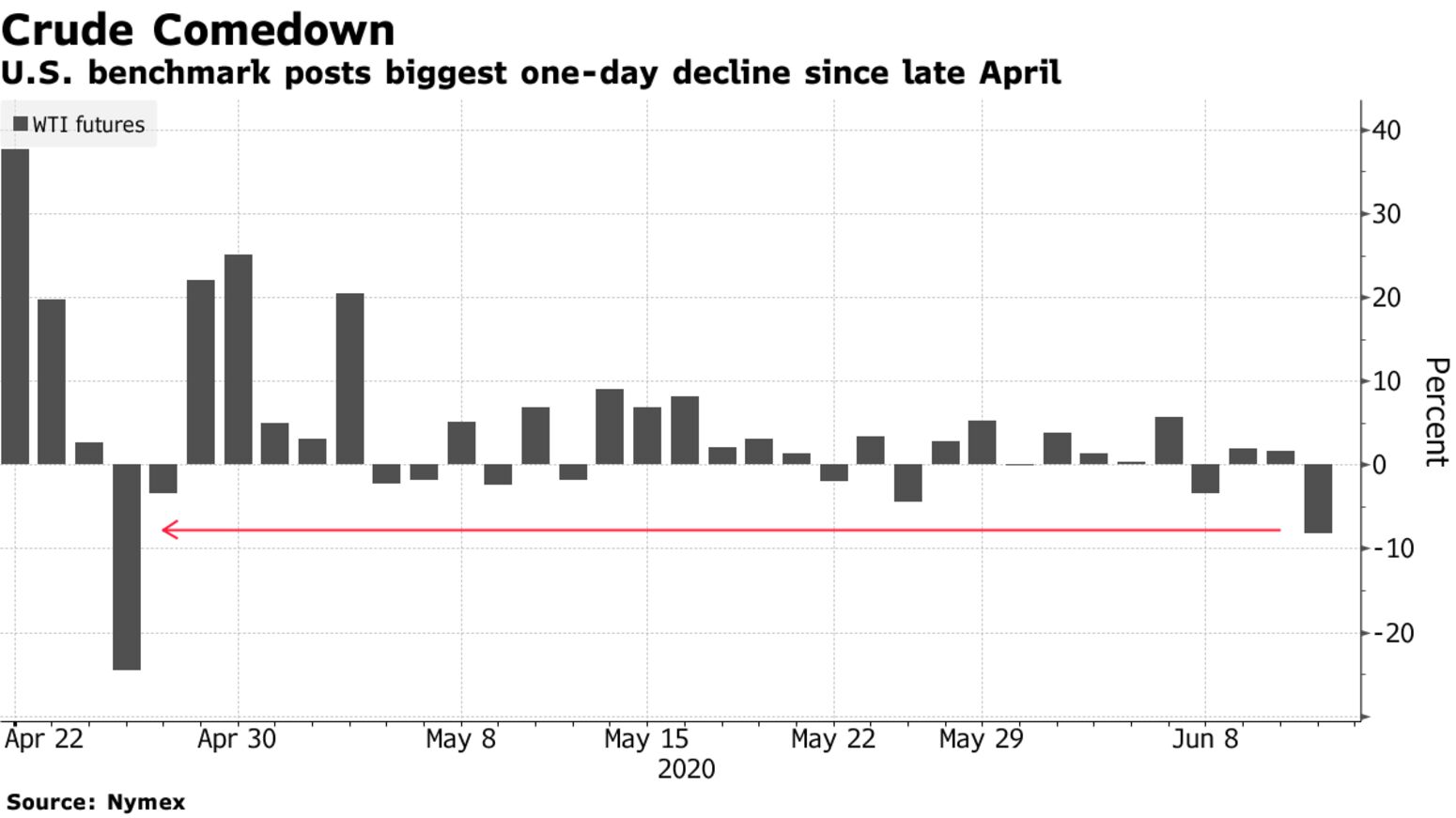

Oil fell the most since late April as economic uneasiness iced U.S. stock markets, threatening to spoil crude’s recovery from a historic drop below zero. The market is grappling with record high U.S. oil inventories and an uneven demand rebound as signs mount that a second wave of the pandemic could be taking hold in some states. U.S. jobless claims remained high, underscoring longer-term macroeconomic challenges a day after the Federal Reserve provided a grim outlook for the economy. Oil’s recovery has been driven by production cuts and the easing of pandemic-related lockdowns.

On the supply side, higher prices have pushed some producers to turn on the taps. U.S. crude stockpiles rose last week to 538.1 million barrels, according to the Energy Information Administration. That’s the highest level in data compiled by Bloomberg since 1982. “The surprisingly bearish stats, particularly on crude, the relatively dour comments by the Fed yesterday and fears of a resurgence of the coronavirus have all added to the price weakness today,” said Thomas Finlon, of Houston-based GF International.

| PRICES |

|---|

|

Investors have been bullish in recent weeks with bets on rising WTI prices jumping to the highest level in 22 months during the week ended June 2. Data for the week ended June 9 will be released Friday. Yet crude’s inability to sustain prices over $40 a barrel is leaving many companies across the industry in dire straits.