Oil kept falling after just its second weekly drop since April as coronavirus infections and fatalities surpassed grim milestones in a reminder the outbreak is far from under control in many parts of the world. Futures in New York fell below $38 a barrel after losing 3.2% last week. Deaths from the pandemic topped half a million, cases rose past 10 million and a United Nations agency reported the most infections for a single day. A surge in cases across the southern and western U.S. is causing states including Texas to reinstate measures to halt its spread, threatening the outlook for oil demand.

After rebounding rapidly from its plunge below zero in April on supply cuts and recovering demand, crude has fallen in two of the last three weeks. Oil stockpiles in the U.S. are at record highs, worldwide consumption is still a long way off pre-virus levels and many refiners are struggling with low margins. There’s also evidence American production is starting to come back, while Norway is pumping flat out from its new field.

“Oil may have eached its peak in the short run and prices are likely to consolidate over the next few weeks,” said Howie Lee, an economist at Oversea-Chinese Banking Corp. in Singapore. Prices have risen enough to encourage the return of marginal producers in the U.S., he said.

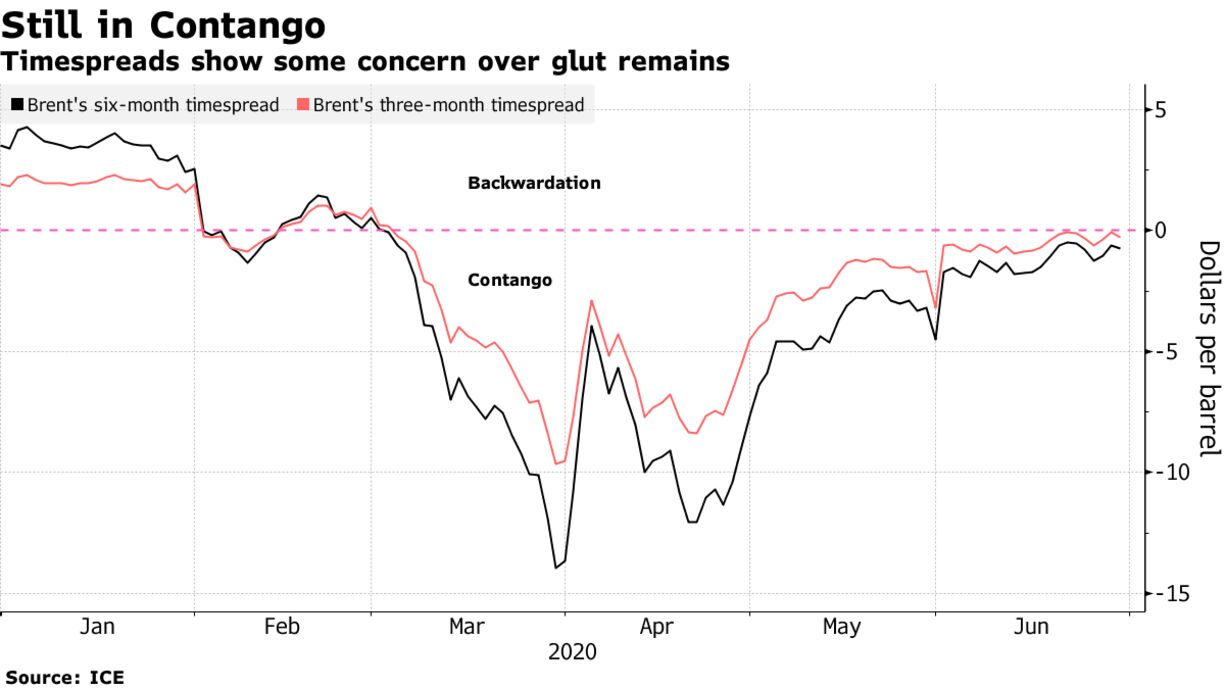

The global benchmark crude’s six-month time spread was 93 cents in contango, where later-dated contracts are more expensive than near-dated ones, from 62 cents in contango Friday. The market structure indicates there is still some concern about over-supply.

View full article at www.bloomberg.com