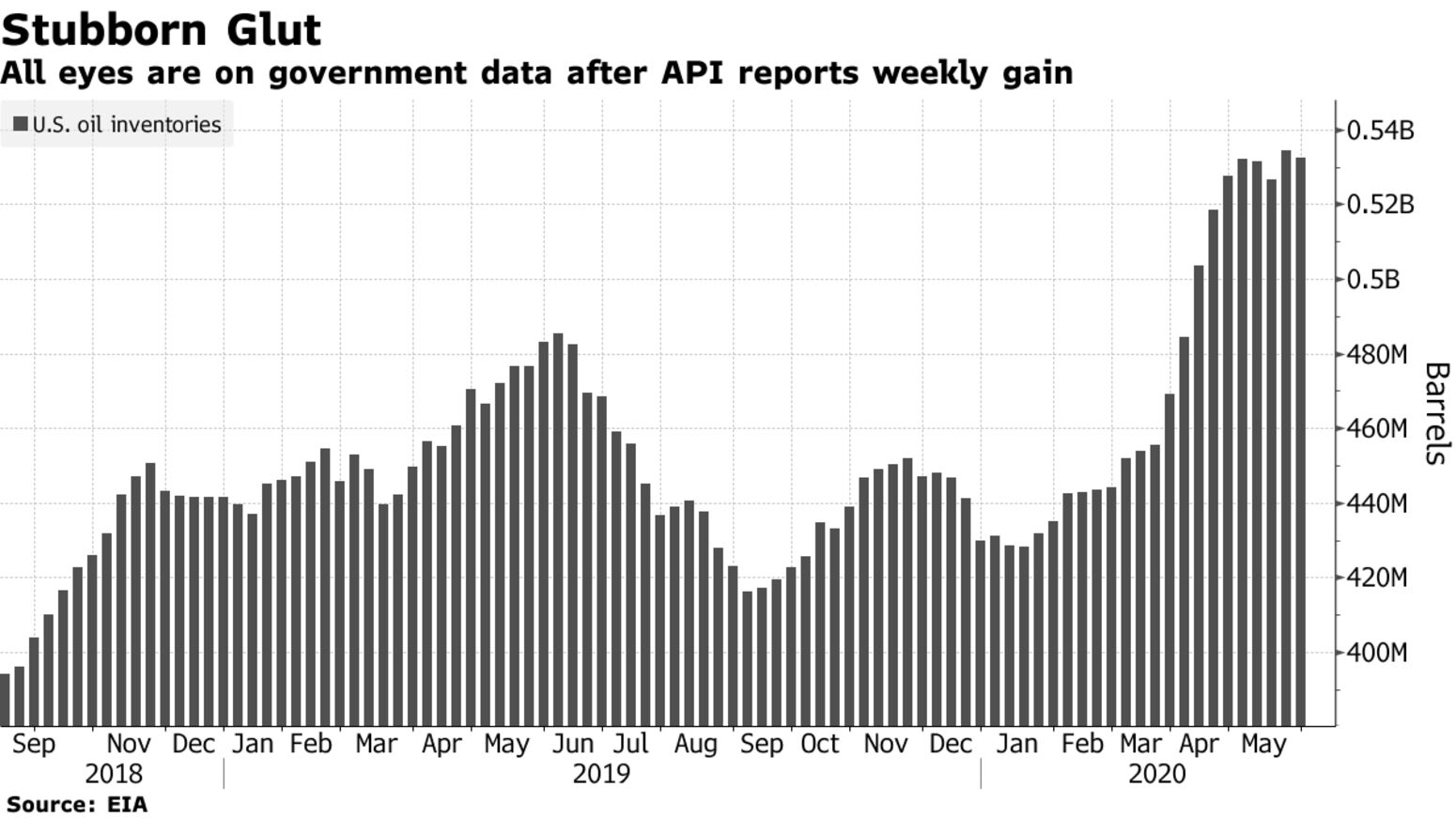

Oil retreated to near $38 a barrel after a U.S. industry report signaled a surprise jump in crude inventories, underscoring the market’s patchy road to rebalancing. Futures dropped 2.4% in New York. The American Petroleum Institute reported that stockpiles expanded by 8.42 million barrels last week, according to people familiar with the data. If confirmed by government figures later on Wednesday, it would be the largest build since the end of April. Inventories at a key European hub jumped to a two-year high last week, Genscape Inc. reported.

Oil’s recovery from the virus-driven demand crash and swollen stockpiles remains uneven. Consumption is showing signs of uptick in India, where Indian Oil Corp. is boosting processing at its refineries this month. Still, the OECD is forecasting a sharp contraction in the global economy this year, and one that could get worse if there’s a second wave of virus infections.