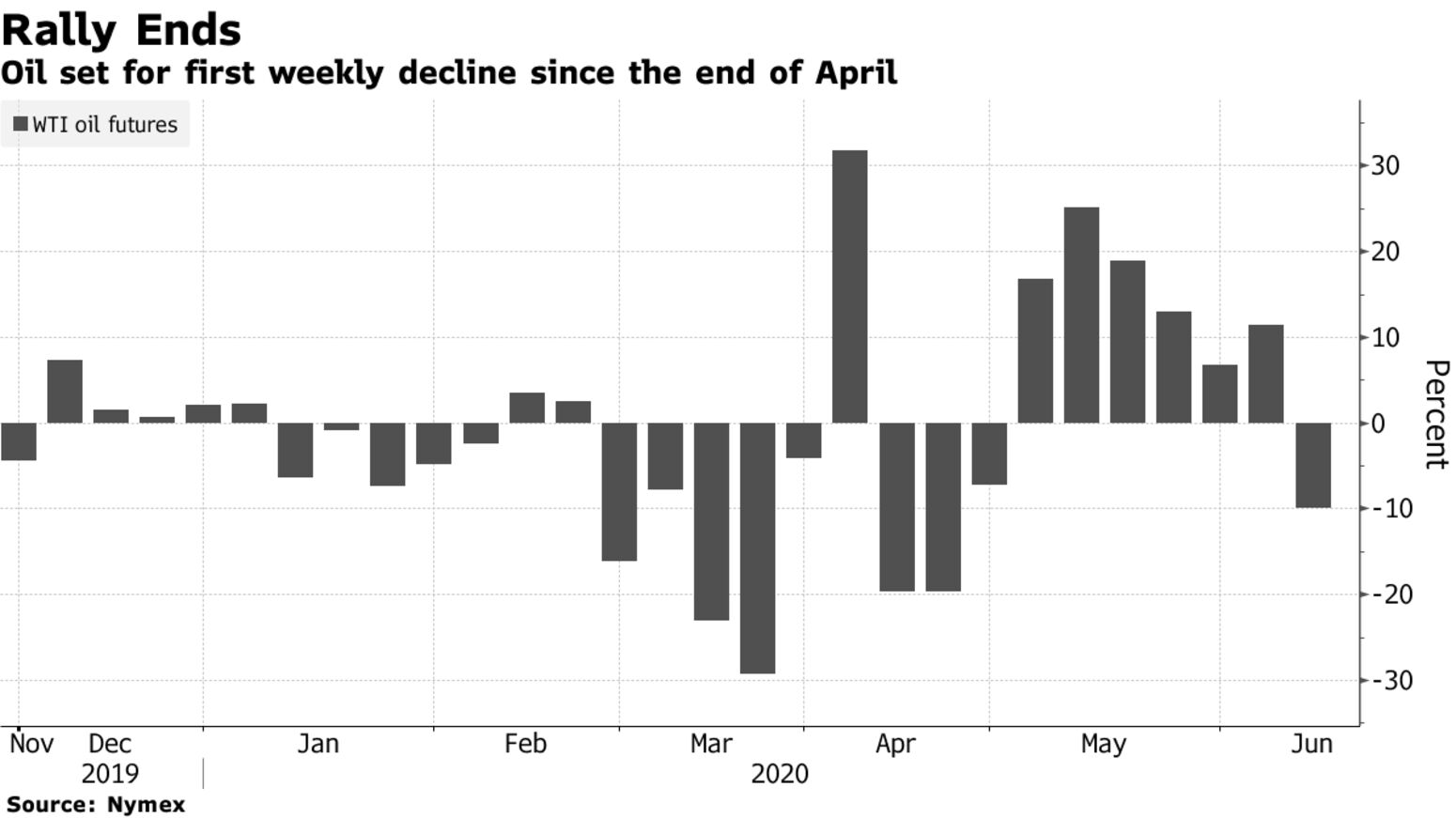

Oil is heading for the first weekly loss since late April in New York on fears a second wave of U.S. infections could derail a fragile recovery. The market has shrugged off a pledge by OPEC+ to extend record output cuts, with sentiment souring this week after the Federal Reserve warned of prolonged damage to the economy by the pandemic and U.S. inventories reached record highs. Crude pared earlier declines to trade above $36 on Friday.

Oil slumped 8.2% on Thursday, the sharpestt decline since prices fell below zero in April. Any recovery is expected to be uneven, with Barclays Plc predicting the market has already seen the fastest improvement in demand and steepest drop in supply, and Goldman Sachs Group Inc. turning bearish due to poor returns from refining.

While Treasury Secretary Steven Mnuchin said the U.S. shouldn’t shut down the economy again even if there is another jump in coronavirus cases, more than 2 million Americans have now been infected. Localized surges have raised concerns among experts even as the nation’s overall case count early this week rose just under 1%, the smallest increase since March.

“The past 24 hours have highlighted the perils of underestimating the economic fallout of the Covid-19 pandemic and the threat of fresh lockdowns,” said PVM Oil Associates analyst Stephen Brennock. “This isn’t the first and won’t be the last time that markets are guilty of complacency.”

| PRICES |

|---|

|

Optimism at the start of the week over the agreement by the Organization of Petroleum Exporting Countries and its allies to extend curbs by a month quickly diminished after Saudi Arabia said it would cease extra voluntary cuts at the end of June. The deal even secured commitments from laggards such as Iraq and Nigeria after they were called out for their non-compliance.