Every day, traders in London congregate at 4 p.m. to buy and sell North Sea oil for half an hour. The window, as it’s known in the industry, is where competition between the most powerful players in the market sets the price of Brent crude. Two months ago, every trader wanted to sell cargoes and none were keen to buy. Now the window has transformed into a bull market, where bids outnumber offers 10 to one and prices are surging. “The physical market is strong,” said Ben Luckock, co-head of oil trading at Trafigura Group.

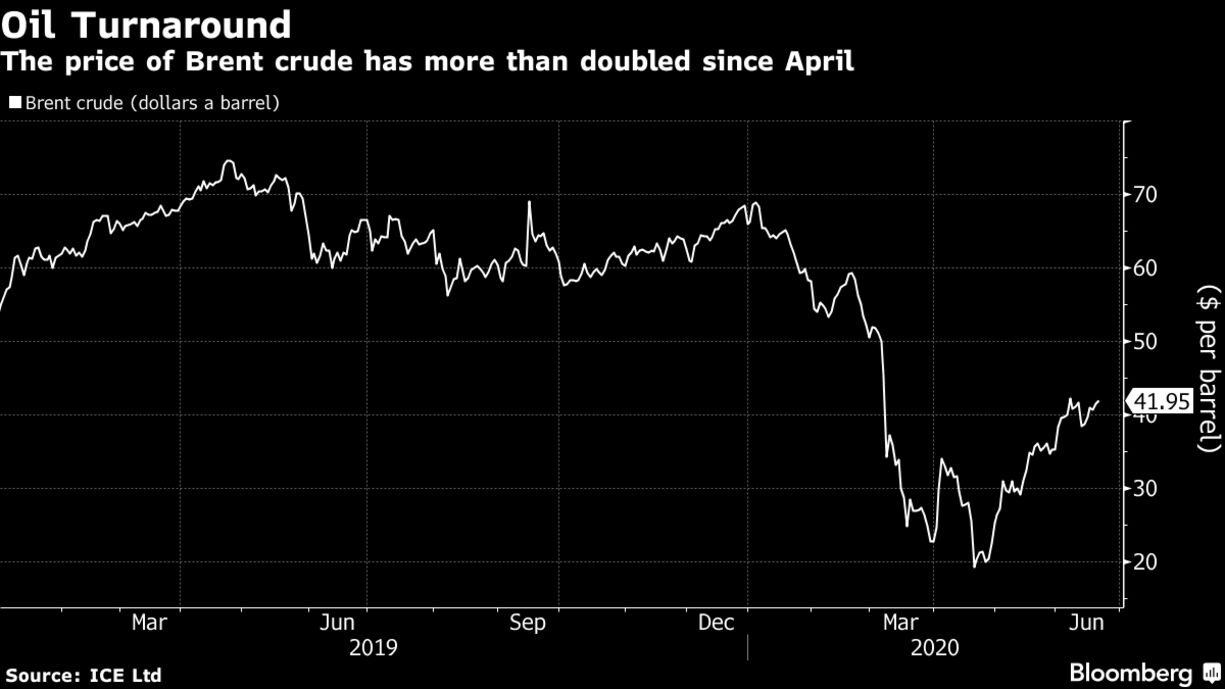

The turnaround reflects the most torrid period in the history of oil.

First, the coronavirus outbreak obliterated demand in China and shattered the oil alliance between Moscow and Riyadh. Next, the global epidemic and destructive Saudi-Russia price war pushed the market to the brink of disaster. The collapse brought the rivals back together for the biggest production cut on record, just as the pandemic ebbed.

Mirror Image

The renewed strength of the “physical market” for crude — where actual barrels change hands between producers, refiners and traders — is driving a surge in the much larger Wall Street world of oil contracts traded on exchanges in London and New York.

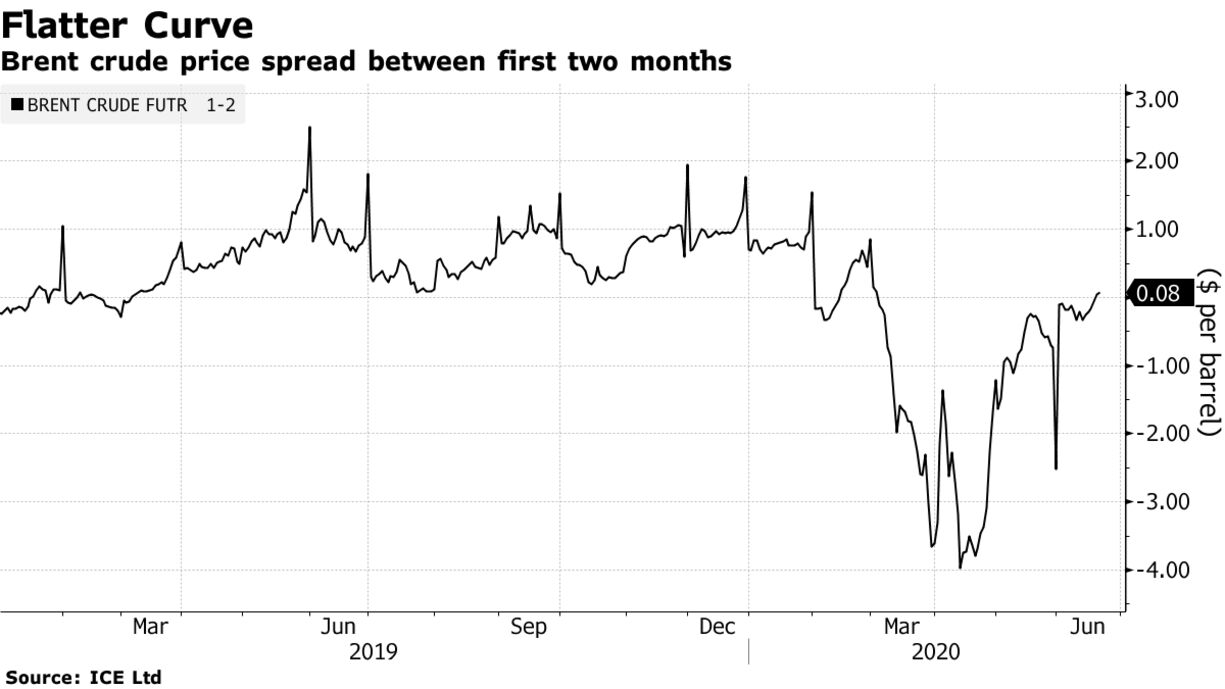

Beyond the symbolism of that number for the American market, the oil price curve for Brent — the range of futures contracts covering the coming months — shows the international market has transformed too. It flipped last week into so-called backwardation, with crude for immediate delivery trading at a premium to forward contracts. That shape is a telling sign that refiners that saw demand for their products disappear during the lockdown, are now willing to pay top dollar to secure supplies for their facilities.