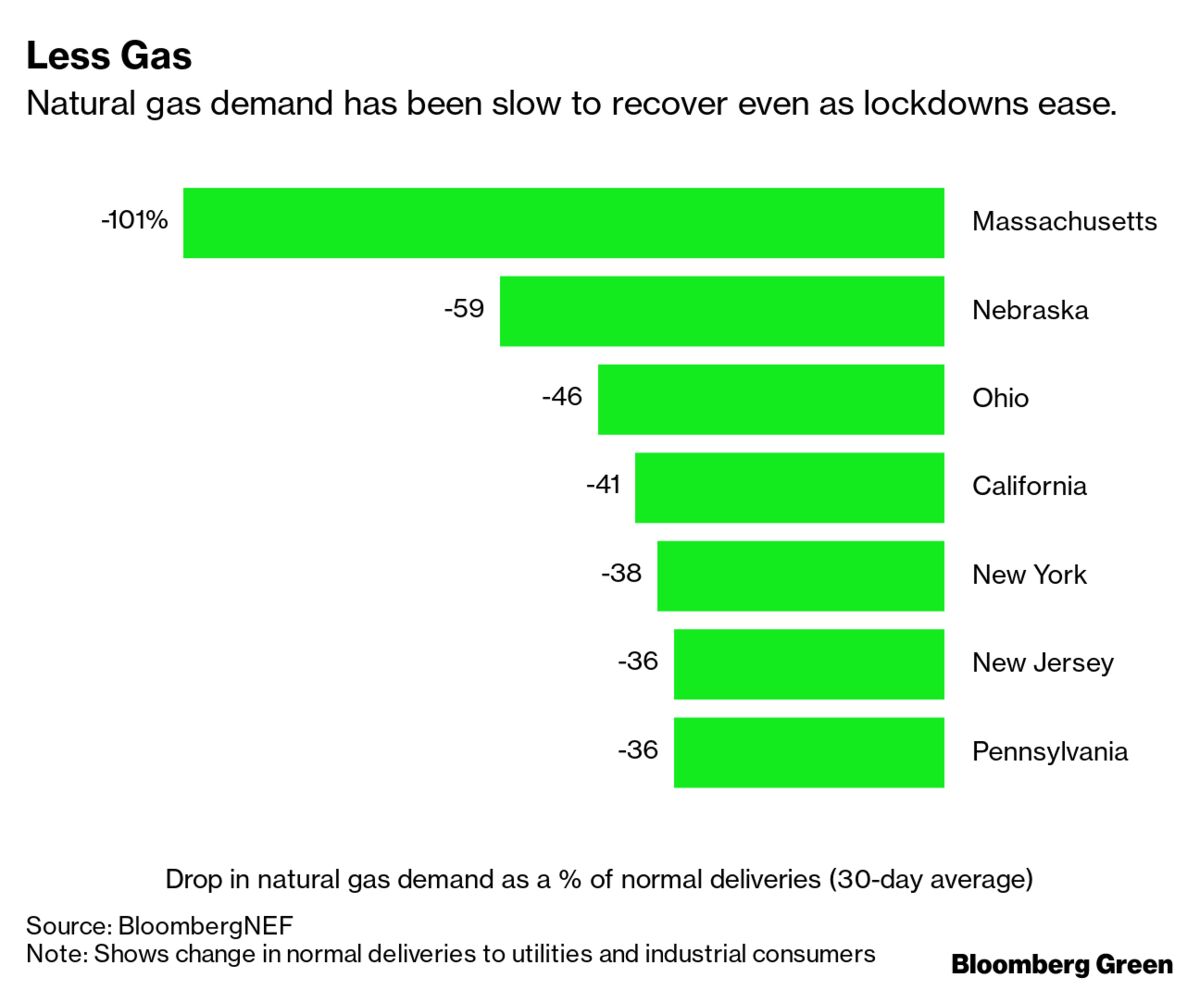

It was a tough week for the North American fossil fuel industry. Over just a few days, the Atlantic Coast natural gas pipeline was canceled by developers, the Dakota Access oil pipeline was shut down by a federal judge and the Trump administration lost its Supreme Court bid to resuscitate the Keystone XL oil pipeline (though the justices did make it easier to build other pipelines). These three strikes, though potentially reversible, nevertheless illustrate another reason why pipelines are pretty risky investments right now—especially those that carry natural gas. Already, the pandemic-induced drop in demand, its dangerous role in global warming and questions about whether it truly is a competitive transitional fuel have many wondering whether gas is headed the way of coal.

“The alarming rate at which pipelines are leaking planet-warming methane is already catching the eye of regulators,” said John Hoeppner, head of U.S. stewardship and sustainable investments at Legal & General Investment Management America. As the energy transition to renewables accelerates, these issues could continue to raise costs for gas pipeline operators, especially if the industry can’t control emissions, he said.