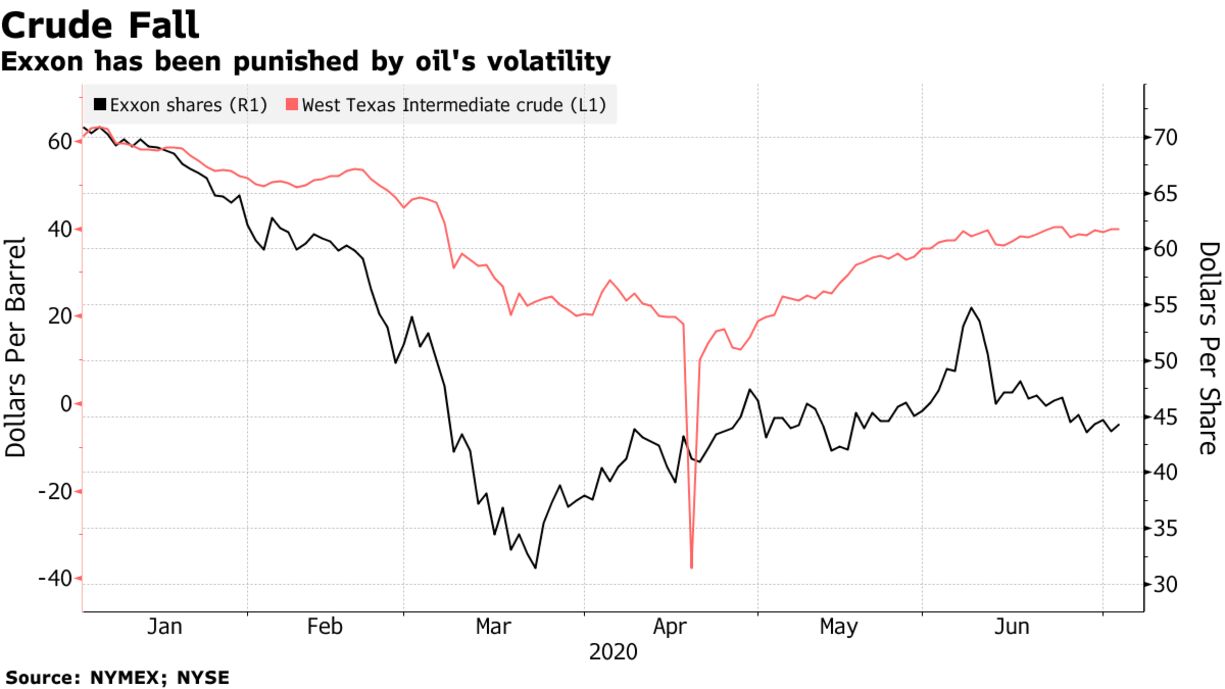

Exxon Mobil Corp. incurred an unprecedented second straight quarterly loss as almost every facet of the oil giant’s business slumped amid Covid-19 lockdowns that stunted economic activity. The explorer’s oil and natural gas unit took a hit of as much as $3.1 billion as prices for those commodities slumped, according to a regulatory filing on Thursday. Margins in Exxon’s refining business contracted by almost $1 billion while the chemical unit teetered on the edge of a loss.

“Given the current environment, XOM will likely need to continue defending its long-term view of energy growth that underpins its counter-cyclical capex program that could ramp back up next year,” Cowen analysts including Jason Gabelman wrote in a note to clients. Major oil and gas producers from Norway to the U.S. saw profit plunge in the opening three months of the year. Exxon reported its first quarterly loss in modern history during the January-to-March period, and that was only the result of the initial spread of the coronavirus.