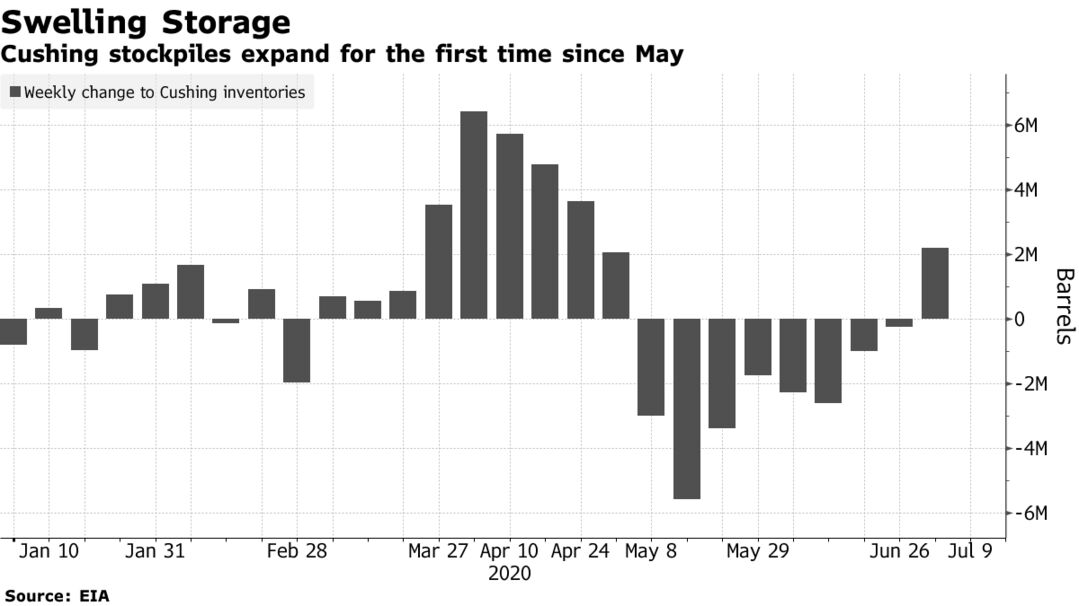

Oil traded below $41 a barrel in New York as coronavirus cases continued to surge across the world and U.S. crude stockpiles grew. Nationwide inventories rose last week, with supplies at the key storage hub of Cushing expanding for the first time since early May, according to government data. Meanwhile, California and Texas recorded some of their biggest daily increases in virus cases and deaths, Australia’s second-largest city went into lockdown and Iran reported its deadliest day yet.

Oil has rebounded from a plunge below zero in April as record output cuts from OPEC+ help rebalance the market. But some are predicting a long recovery from the pandemic, with Standard Chartered Plc estimating oil consumption next year at 2017 levels, meaning the virus would have destroyed the intervening years of growth. Though the global Brent benchmark has more than doubled from its lows, prices have struggled to make further gains.

It seems that finding further momentum to extend the rally is very difficult,” said Hans van Cleef, senior energy economist at ABN Amro. “The threat of more new lockdowns will continue to prevent oil prices to rally further.”

| PRICES |

|---|

|