Several Asian refiners struggling with weakening demand will ask Saudi Arabia for less crude next month after the kingdom cut official selling prices by a smaller amount than the processors had been hoping for. At least three buyers are planning to request less oil from Saudi Aramco for September, according to company officials with knowledge of their crude procurement. Three others expressed disappointment at the size of the cut — the first reduction in four months — but will seek normal volumes, said the people who asked not to be identified as the information is private.

Asian demand has taken a hit of late as the coronavirus staged a comeback in countries including India, and as flooding in China led to top refiner Sinopec scaling back some crude processing. Chinese oil imports fell in July from a record in June as tankers clustered off ports waiting to unload cargoes of cheaper oil purchased earlier in the year.

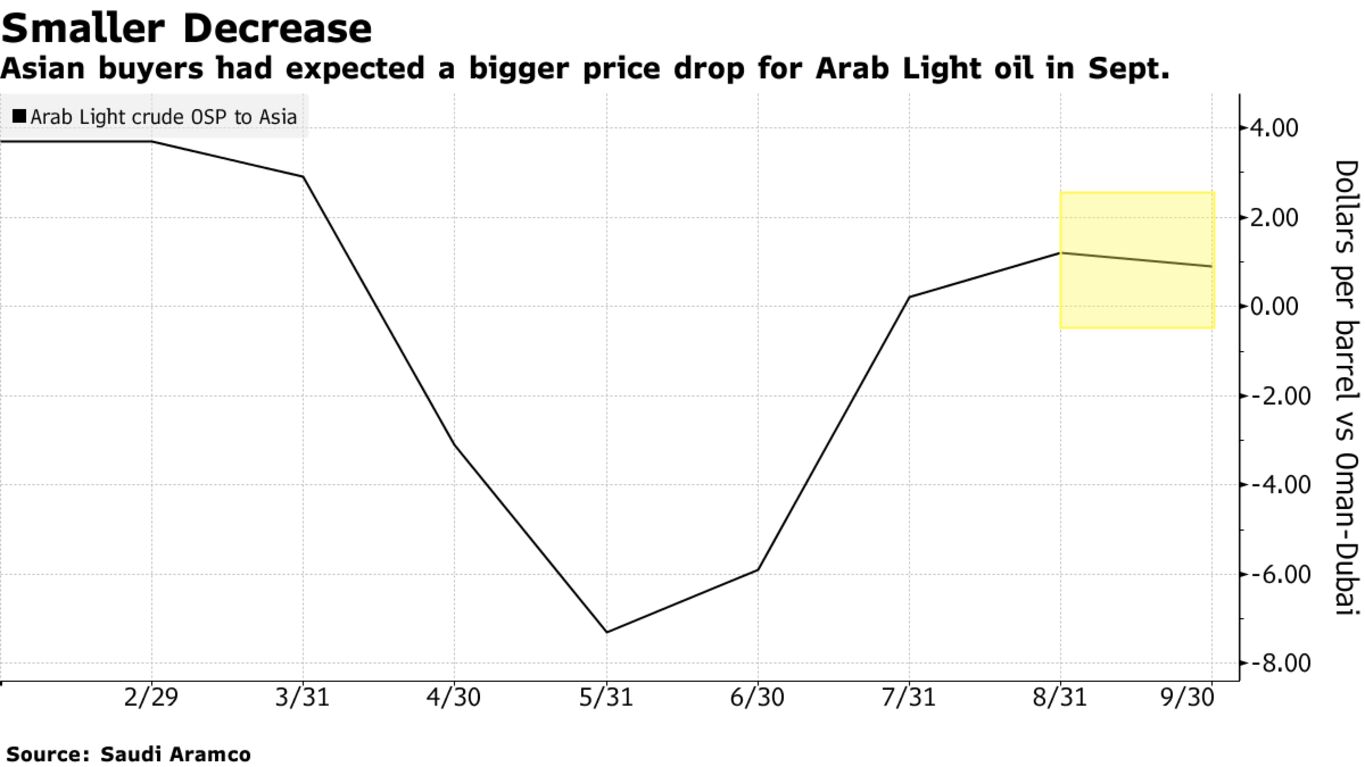

Saudi Aramco cut the price of its flagship Arab Light by 30 cents a barrel to 90 cents over the Oman-Dubai benchmark, compared with an expected 48-cent decline in a Bloomberg survey. Nominations for September volumes are due Friday. Aramco didn’t immediately respond to an email seeking comment.

“We were expecting the Saudis to cut prices by more than $1 and what they announced didn’t meet our expectations,” said R. Ramachandran, director of refineries at India’s Bharat Petroleum Corp. “We aren’t processing at higher volumes, so we are not worried. Whichever crude that becomes suitable for us, we will take it — even substituting with smaller quantities wherever we can.”