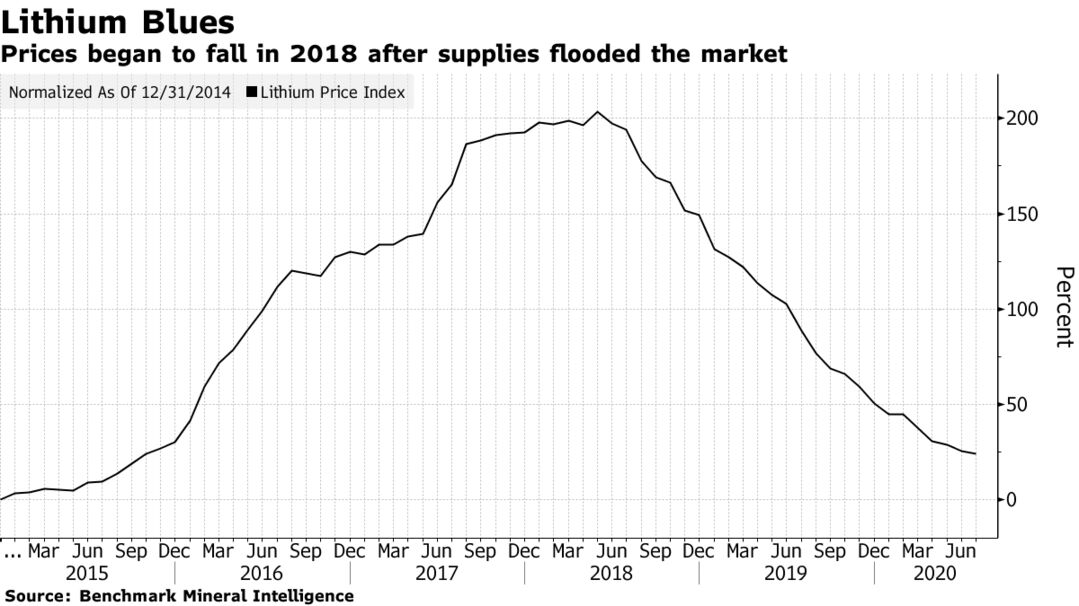

European consumers are getting hefty incentives to buy electric cars, mining projects are getting delayed and some auto plants are reopening. All of that will pull lithium out of the doldrums. That’s the view of Albemarle Corp., the world’s largest producer of the battery metal. Despite mining delays as well as restarts of some auto plants following coronavirus lockdowns, prices for the metal used in electric-vehicle batteries remain at multiyear lows. But the head of Albemarle’s lithium business says hefty incentives for consumers to buy EVs in Europe, as well as changes to encourage carmakers to build greener cars globally will help lithium demand.

Europe outpaces other regions in pushing green policy in response to Covid-19, according to BloombergNEF analyst Victoria Cuming. “Its states have approved $43 billion to renewables, electric vehicles and other lower-carbon technologies, plus $18 billion to carbon-intensive sectors but with climate-related strings attached,” Cuming said in a July report.

Charlotte, North Carolina-based Albemarle said this week it’s temporarily idling select lithium battery-grade production due to weaker demand and higher inventory in the supply chain. It also expects third-quarter earnings at its lithium unit to be weighed down by weaker auto demand. So when will lithium-demand growth return?

“Pretty quickly,” Albemarle Chief Executive Officer Kent Masters said in the same interview. “It’s probably going to be somewhere around late 2021.”