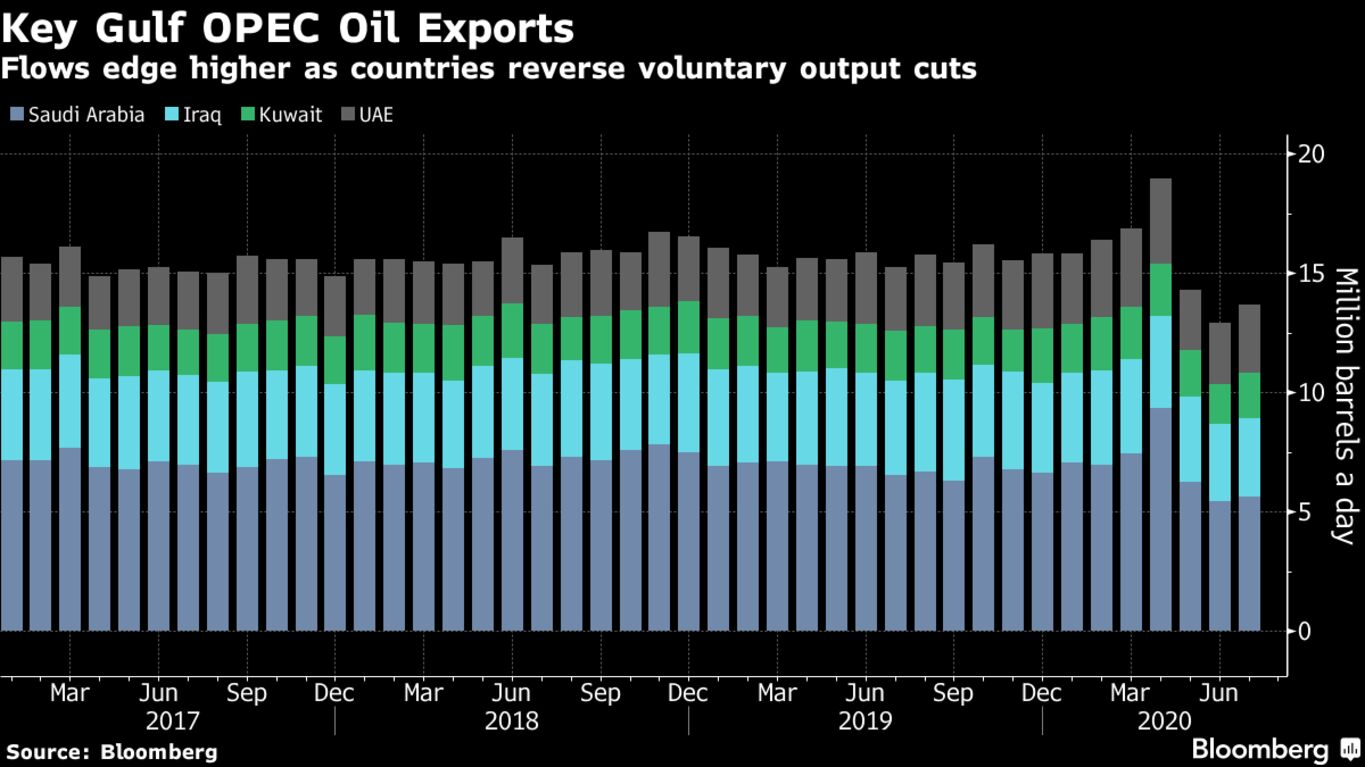

Oil exports from OPEC’s Middle East producers rose in July after Saudi Arabia and key Persian Gulf allies reversed the voluntary production cuts they had made the previous month. The figures excludes Iran. Kuwait and the United Arab Emirates led the gain in last month’s oil supplies to international markets, with Saudi Arabia increasing less quickly and Iraq barely changed. Saudi producers boosted shipments by 190,000 barrels a day, far less than its increase in production, possibly signaling domestic crude use has soared with summer temperatures.

The four nations boosted crude and condensate shipments last month by 758,000 barrels a day, or 6%, to a combined 13.68 million barrels a day, tanker-tracking data compiled by Bloomberg show. The increase reversed the previous month’s drop, as the region’s producers restored more than 1 million barrels a day of production that they removed from the market in June.

Flows from the four producers — which account for about 72% of production among members of the Organization of Petroleum Exporting Countries — rose to India and China. Shipments to South Korea slumped, possibly due to refiners opting for supply from the U.S. Gulf Coast.

Exports from Kuwait jumped in July, rising by 294,000 barrels a day, or 18%. Last month’s flows included a first shipment of crude from the Mina Saud terminal since the restart of the Wafra field in the Neutral Zone shared with Saudi Arabia. Production from the field halted in 2015 due to a dispute between the two countries.

Observed flows from Iran have been excluded, as tankers often disappear from tracking for weeks. In July, signals from eight tankers carrying an estimated 11 million barrels of Iranian crude or condensate appeared. The time and position at which the ships appeared suggest that two of them departed in June, with the other six leaving in July.

With nearly 16 million barrels of oil on ships from OPEC’s Middle East exporters yet to signal a final destination, estimates of flows to individual countries are subject to revision.