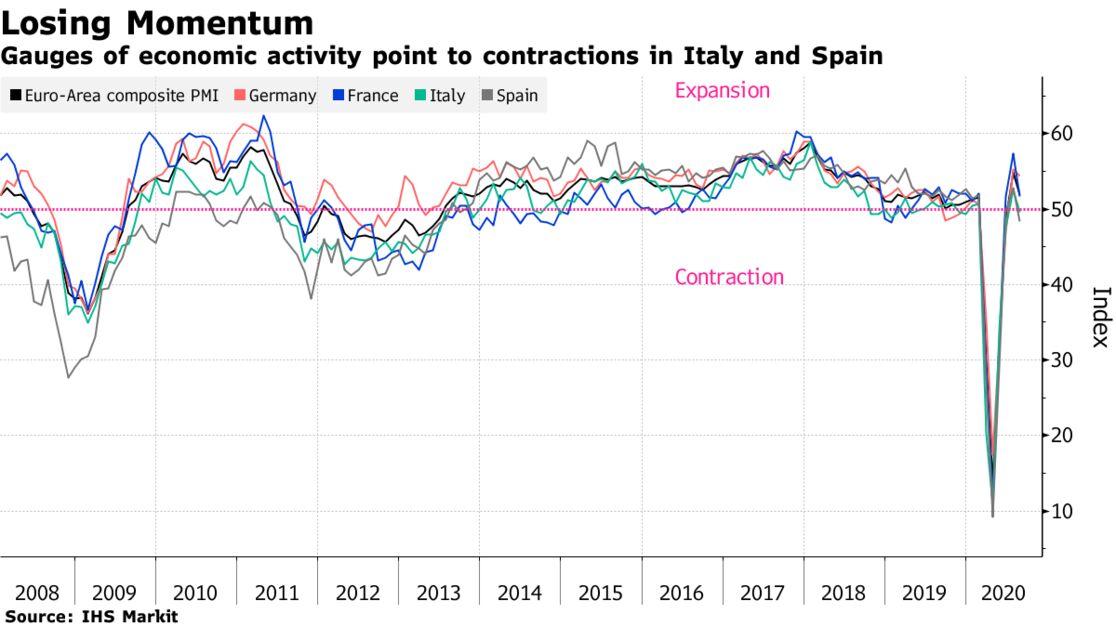

The euro area’s recovery ran out of steam midway through the third quarter, with gauges of activity pointing to contractions in Italy and Spain. While manufacturing output rose markedly in August, the larger services sector saw only marginal growth, according to an IHS Markit report. Orders increased at a slower pace, job cuts continued and confidence about the outlook eased.

“The rebound has lost almost all momentum,” said Chris Williamson, an economist IHS Markit. “The autumn is likely to still see the economy rebound strongly from the collapse witnessed in the spring,” but “the survey highlights how policymakers will need to remain focused firmly on sustaining the recovery.” Coming in a week that saw the euro-area inflation rate drop below zero for the first time in four years, the PMI weakness is another worrying sign for the European Central Bank. Policymakers meet next week, though it’s not clear if they’ll boost stimulus again just yet.

What Bloomberg’s Economists Say…

“Signs have emerged that the euro area’s recovery has slowed, virus cases are on the rise and inflation has decelerated sharply. The Governing Council may indicate next week that downside risks have intensified, signaling monetary policy could be loosened further before the end of the year.”

–David Powell. Read the full ECB PREVIEW

Governments are also trying to help the recovery along with more stimulus spending. France this week unveiled details of a 100 billion-euro stimulus plan, and German Chancellor Angela Merkel’s parliamentary caucus backed plans allowing for further extraordinary deficit spending next year.