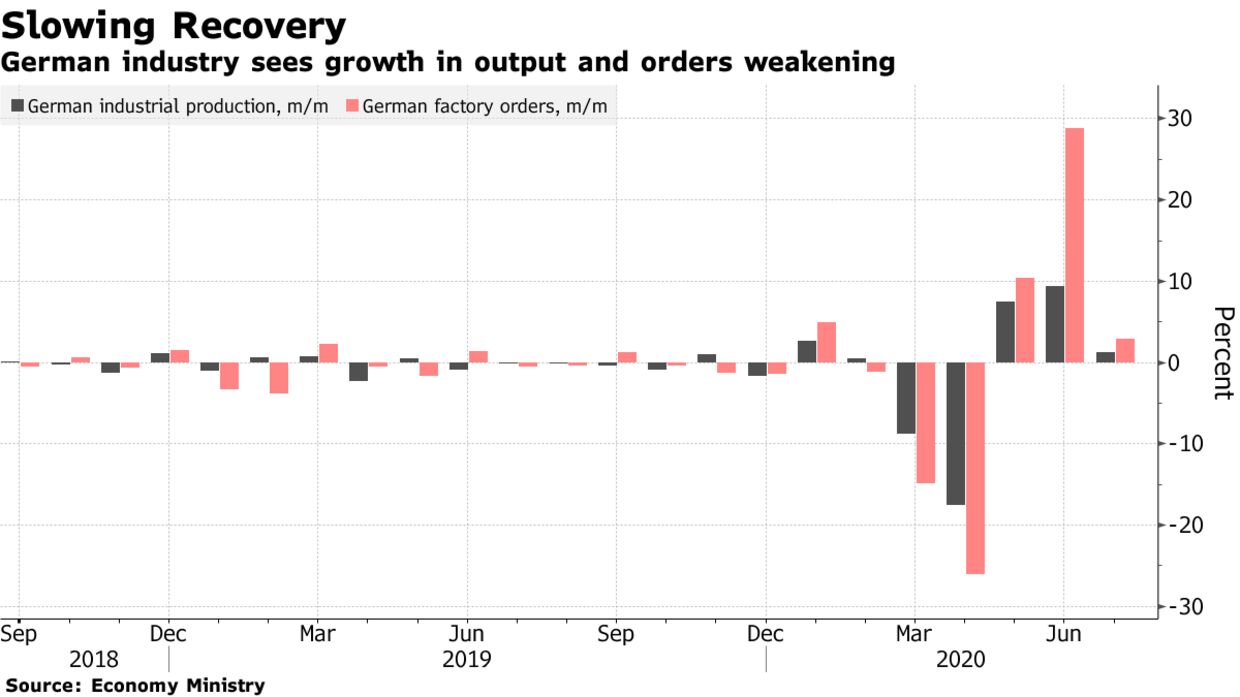

German manufacturers ramped up production for the third straight month, though the pace of growth slowed considerably in July. Industrial output rose 1.2%, less than forecast by economists. The increase was led by carmakers while machinery retreated. Investment-goods production still increased 2.1%.

The Economy Ministry said Germany’s industry is back at nearly 90% of pre-crisis levels, and predicts that improved sentiment and declining short-time work will continue to drive the recovery, although it will take some time. A separate report on Friday showed factory demand slowed.

Germany’s economy is trying to claw back the ground it lost during months of lockdowns that left factories shattered and many workers furloughed, if not unemployed. While the economy has seen a sharp rebound over the summer, Bundesbank President Jens Weidmann has sought to temper optimism, arguing last week that the recovery will be long and bumpy.

What Bloomberg’s Economists Say

“Germany industry’s position in global value chains means a full recovery won’t come until the rest of the world recovers too. Covid cases are rising in parts of Europe and the U.S. and emerging markets are experiencing a protracted downturn.”

— Jamie Rush. Read the GERMANY REACT

Some recent indicators suggest momentum has also started to flag in some parts of the euro area amid resurgent infections and concerns about potential restrictions. A number of governments have imposed new travel curbs and ordered citizens to wear masks. The uncertain outlook is set to feature prominently in discussions when European Central Bank officials meet this week. Most economists predict the Governing Council will keep policy unchanged on Thursday, although they expect another increase in asset purchases before the end of the year.