The nuclear industry has been stalled for years now, struggling to compete with cheaper forms of power and viewed as suspect ever since the accidents at Fukushima, Chernobyl and Three Mile Island. Only two reactors are being built in the U.S., in Georgia, and they are years behind schedule and weighed down by cost overruns and political opposition. But now there’s a race to take nuclear power in a radically different direction in a bid to revive the industry. Companies around the world, including NuScale Power LLC in the U.S., China National Nuclear Corp. and Russia’s Rosatom, are developing a new generation of reactors, with some designs that will be more than 90% smaller than the hulking facilities that have dominated the industry for decades. One model can even fit into a single-family house.

“At least for now, and for the foreseeable future it’s difficult to see a renewables-only energy system,” said Chris Colbert, chief strategy officer at Portland, Oregon-based NuScale.

Advocates say small modular reactors, or SMRs as they’re generally called, can be built at factories, delivered by truck or train, and then assembled on-site, saving time and money. Utilities can install just one or bundle several together, expanding the potential market by including countries that don’t need a big conventional nuclear plant. Some designs will also provide industrial heat as well as electricity—one potential use is in remote villages in far northern latitudes that need both. China National Nuclear was the first to pass an International Atomic Energy Agency safety review for an SMR design. It began building a demonstration version of its 125-megawatt Nimble Dragon plant in 2019. And in Russia, Rosatom last year introduced the world’s first operational SMR, on a ship that can be sent all over the world. Companies in South Korea, Canada and the U.K. are also developing similar designs.

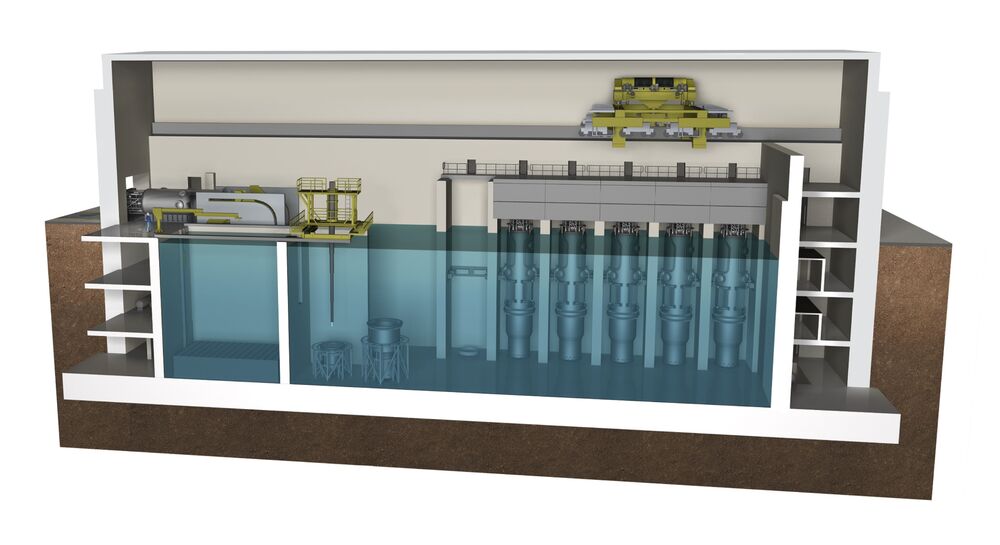

In the U.S., NuScale is working on a 60-megawatt reactor design, enough to power 48,000 U.S. homes, and its design just won approval from the Nuclear Regulatory Commission this month. The cylindrical power generator would be about 65 feet tall and 9 feet in diameter. That’s tiny compared to big, conventional reactors that typically have about 1,000 megawatts of capacity. And it’s less expensive. A single power plant with 12 NuScale reactor-modules linked together would cost about $3 billion, compared to some major projects that have exceeded $20 billion for conventional nuclear plants. NuScale’s first commercial plant would go into service in Idaho in 2029 if all goes as planned.

NuScale’s design is based on the pressurized water reactors that are widely used now in conventional nuclear plants, so the technology is familiar to regulators and developers. Other developers are trying different technologies. Oklo Inc., based in Sunnyvale, California, is working on a so-called fast reactor that could use nuclear waste from existing power plants as fuel, and is cooled with a liquid alkaline metal instead of water. And billionaire Bill Gates is backing TerraPower LLC, which is working on another type of fast reactor that uses liquid sodium as a coolant.

“There’s a race, sort of like at the dawn of nuclear energy,” said Ted Jones, senior director for national security and international programs at the Nuclear Energy Institute, the industry’s trade association. The small plants are also safer, the developers say. The key risk from a nuclear plant is that radiation could leak, but since smaller reactors have less nuclear material at their cores, there’s less potential risk. NuScale says its designs could be installed in below-ground water pools, which would minimize the risk of failure because they wouldn’t need pumps to circulate water for cooling.

But along with a smaller size, these new designs may also have smaller and weaker systems to control a potential radiation leak, said Edwin Lyman, director of nuclear power safety at the Union of Concerned Scientists. That’s worrisome because there’s also been a push to build SMRs closer to population centers, he said.