Oil dropped in London and New York following warnings over global energy demand and the state of the U.S. economy. Crude fell along with other risky assets after Federal Reserve officials said more fiscal stimulus is critical to sustain the U.S. recovery. In Europe, the head of commodity trader Mercuria Energy Group said global oil markets won’t be able to absorb OPEC+ production increases as demand is weaker than expected.

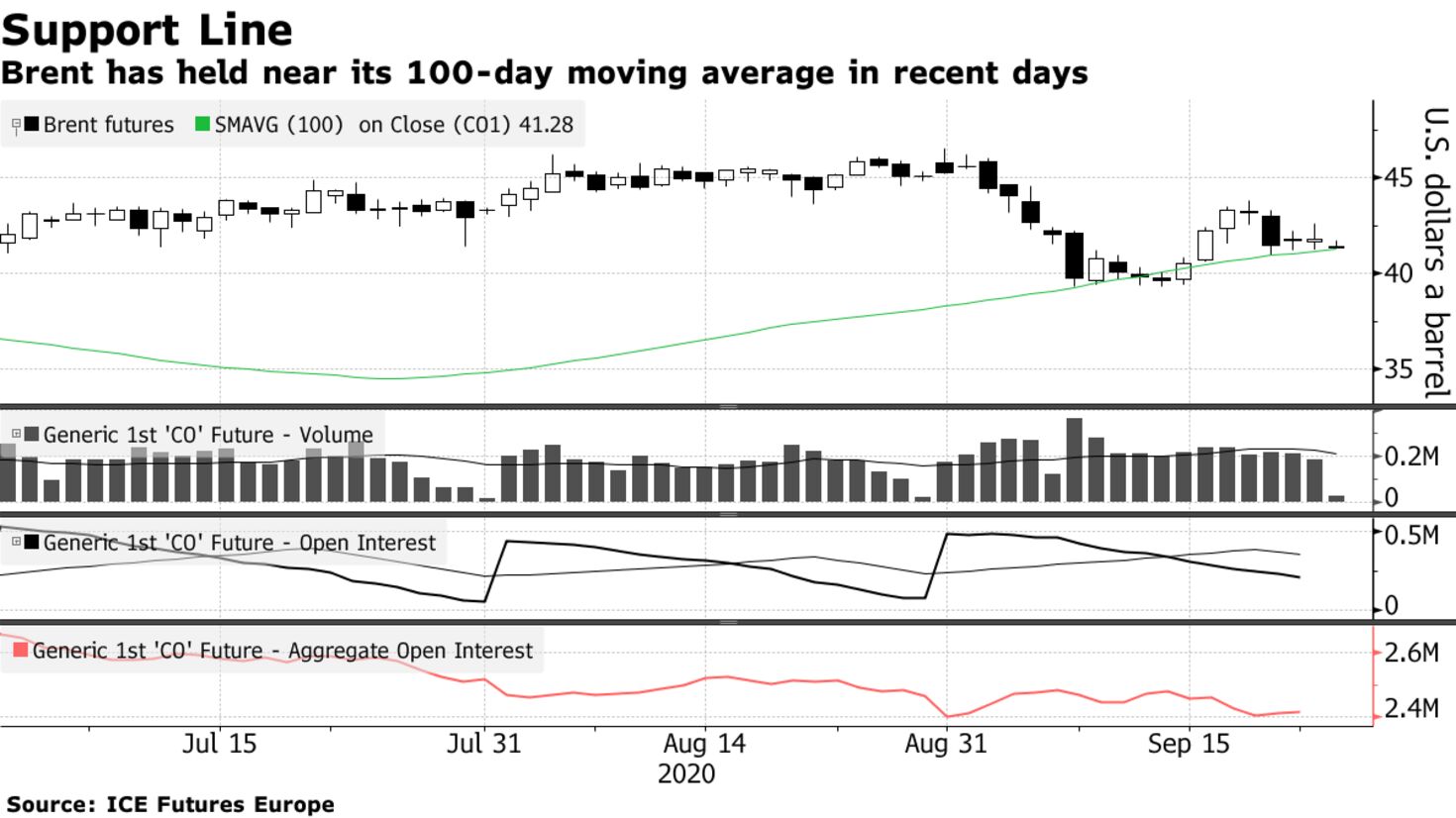

Oil has lurched lower this month amid signs a resurgence in the coronavirus could lead to more lockdown measures, though the global Brent benchmark has bounced around near its 100-day moving average in recent days. The OPEC+ alliance, meanwhile, is slowly tapering its production cuts and Libya is unleashing fresh supply as its civil war abates.

Crude declined Thursday even after U.S. crude and fuel stockpiles shrank, according to weekly data from the Energy Information Administration. “Downside risks remain much bigger than the upside,” said Hans van Cleef, senior energy economist at ABN Amro Bank. There are “worries regarding new lockdowns now Covid-19 emerges again; worries that OPEC+ might want to increase production anyhow; worries that inventories may be built up even further.”

| PRICES |

|---|

|