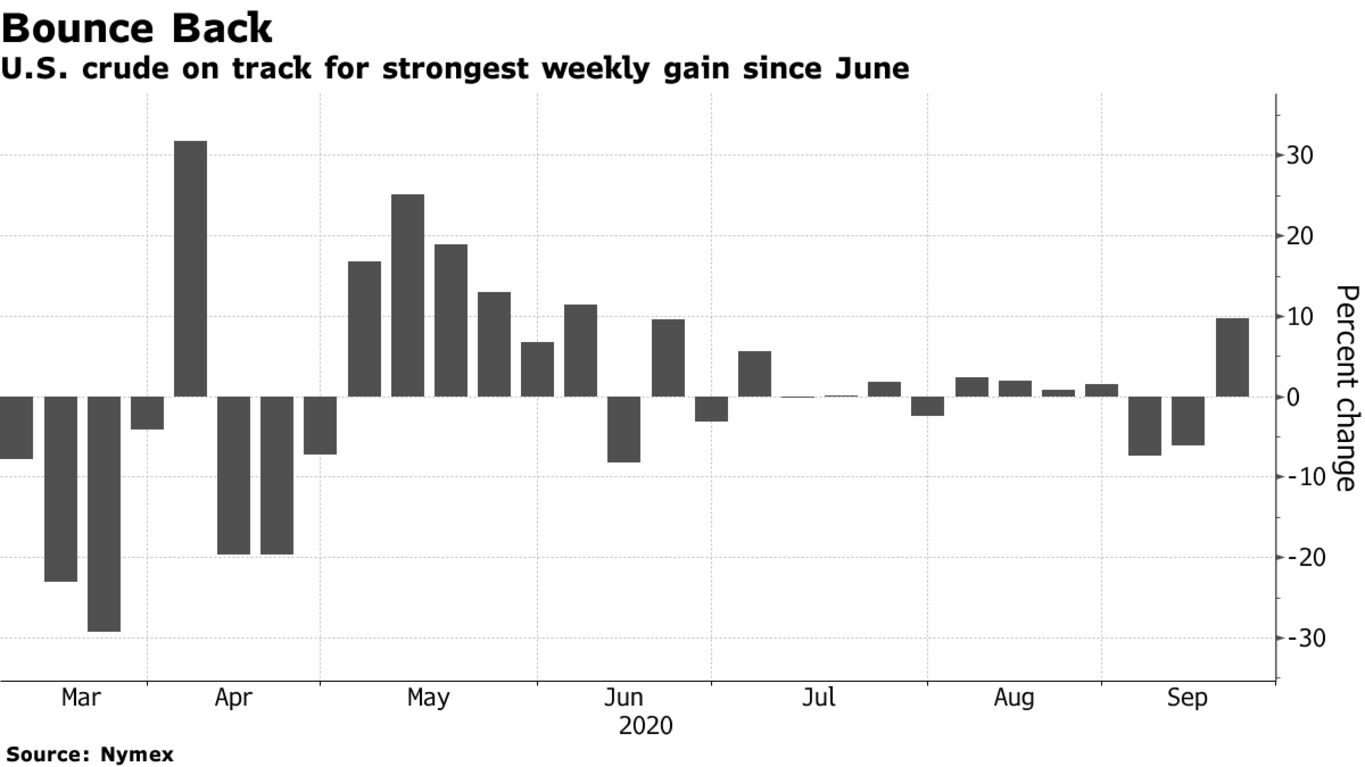

Oil is poised for its biggest weekly advance since early June with Saudi Arabia ratcheting up the pressure on OPEC+ members to adhere to the group’s production cuts amid signs demand is faltering. Futures in New York are up almost 11% this week, despite bearish calls on the outlook from industry heavyweights such as BP Plc and Trafigura Group to the International Energy Administration. Saudi Arabia showed its determination to protect the recovery at an OPEC+ committee meeting on Thursday, lambasting members that have cheated on production quotas.

Oil has clawed its way back to $41 a barrel this week, buoyed by a weaker dollar and a surprise decline in U.S. crude inventories. The market is still contending with an uneven recovery in consumption, with OPEC+ seeing a risk to demand from a second wave of the outbreak, urging members to be proactive and ready to take further action.

Saudi Energy Minister Prince Abdulaziz bin Salman opened the meeting with a forceful condemnation of members that try and get away with pumping too much crude. This week, the IEA said the United Arab Emirates almost entirely disregarded its commitment to quotas last month, while tanker tracking data shows Iraq is exporting more crude so far in September than it shipped in August, a sign it’s falling behind in its compliance efforts.