Chevron Corp. overtook Exxon Mobil Corp. as the largest oil company in America by market value, the first time the Texas-based giant has been dethroned since it began as Standard Oil more than a century ago. The reordering of the oil giants says more about Exxon than Chevron.

The company has been struggling to generate enough cash to pay for capital expenditures, leaving it reliant on debt and putting pressure on its $15 billion-a-year dividend. It pursued a series of expensive projects that promised growth after years of stagnating production. Those became a drag on its cash flow when the pandemic hit. Chevron has meanwhile fared relatively well, having emerged with the strongest balance sheet among its Big Oil peers.

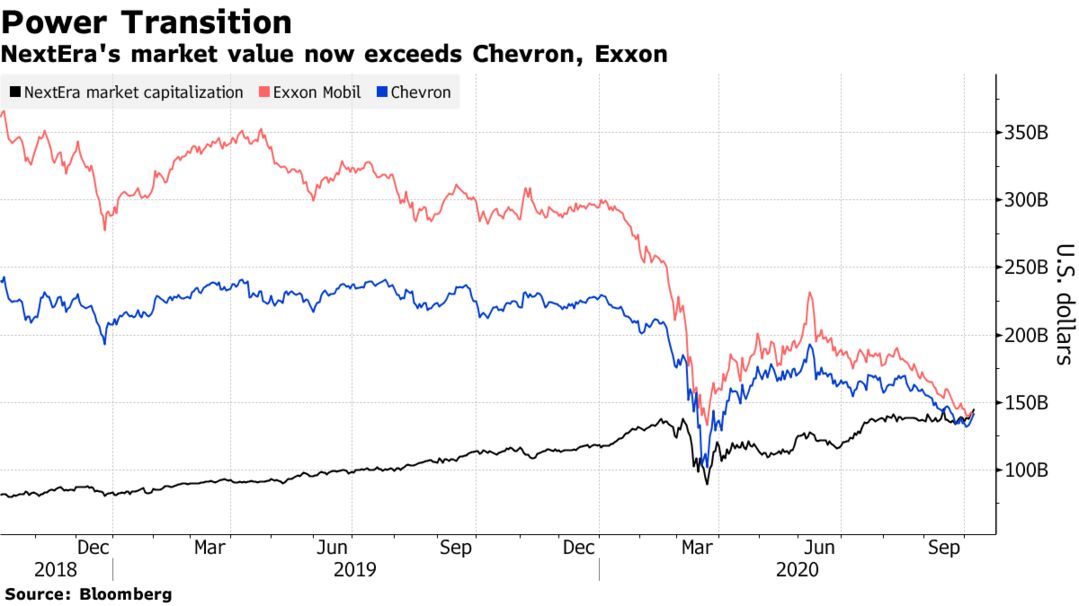

Even so, both Exxon and Chevron are receding into the rear-view mirror of NextEra Energy Inc. The world’s biggest producer of wind and solar power has now surpassed the oil majors, leading a spectacular rally in power stocks as much of the world shuns fossil fuels to fight climate change.

NextEra ended Wednesday with a market capitalization of $145.5 billion, topping Exxon’s $141.6 billion. Last month, the power giant eclipsed Chevron, now valued at $142 billion. Exxon’s shares have tumbled more than 50% this year, and its second-quarter loss was its worst of the modern era. In August, it was ejected from the Dow Jones Industrial Average.

READ: Exxon’s Humbling Fall From Oil Juggernaut to Mediocre Company

NextEra has emerged as the world’s most valuable utility, largely by betting big on renewables, especially wind. Its shares have surged more than 20% this year and it’s expanding aggressively, with plans to grow its renewables portfolio to 30 gigawatts, enough to power 22.5 million homes.