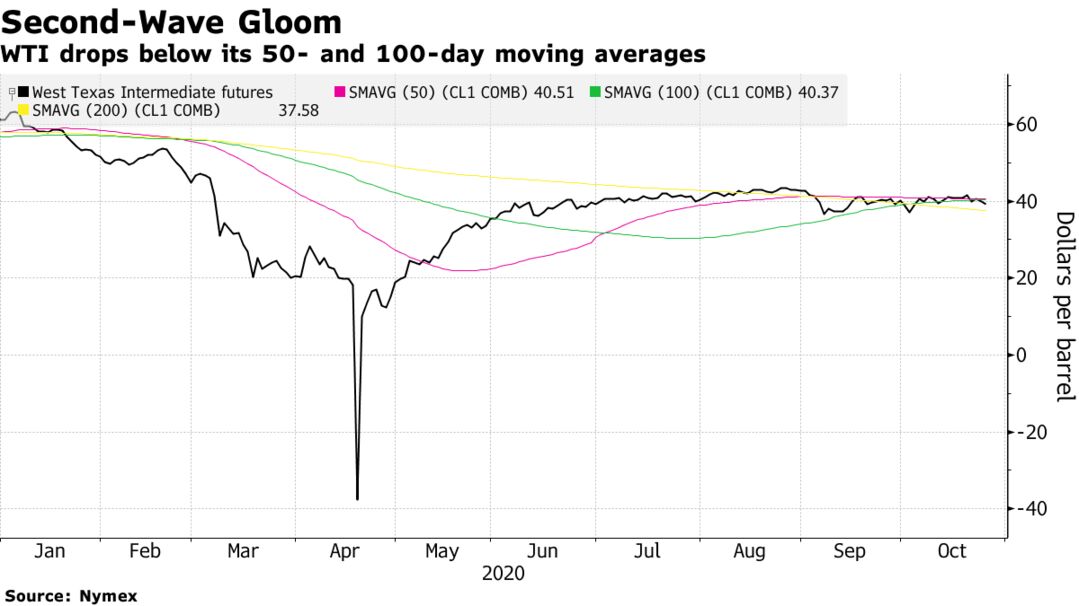

Oil extended its slide to a second day on a toxic cocktail of surging coronavirus cases in the U.S. and Europe, dwindling prospects for pre-election stimulus in Washington and a steady resumption of supply from Libya. Futures in New York fell almost 3% to drop below $39 a barrel. The U.S. reported record infections for a second straight day, while Italy approved a partial lockdown and Spain announced a national curfew. Democrats and Republicans accused each other of “moving the goalposts” in interviews on CNN as hopes for a deal before next week’s election appeared to be in tatters.

A little more than six months after Covid-19 sent oil prices into a tailspin, a second wave is threatening to take another bite out of energy demand. There are several reasons why a repeat of April’s bloodbath is unlikely, however. Flagging consumption isn’t coinciding with a price war, governments may be less likely to impose major lockdowns and demand in Asia is holding up.

“Demand issues tied to resurgent virus cases have taken the market’s attention for the past few weeks,” said Daniel Hynes, a senior commodity strategist at Australia & New Zealand Banking Group Ltd. “The supply side issues have now certainly started to gain a little bit more prominence with Libya suggesting that their supplies will rise significantly over the next couple of months. That presents a new headwind for OPEC.”

| PRICES |

|---|

|