China is about to show the world that its economy is pulling further out of the chasm created by the coronavirus, setting it apart from other nations struggling to avoid renewed lockdowns. Gross domestic product for the third quarter — due Monday — is forecast to come in at a 5.5% expansion from a year earlier, recovering all of the lost ground from the historic contraction in the first three months of the year.

Global trade has been an unexpectedly strong driver for the world’s second-largest economy, and even still-cautious domestic consumers are becoming more confident. That returning optimism is based on the nation’s success in keeping the virus practically at bay despite an occasional cluster emerging.

“Right now, China has basically put Covid-19 under control,” People’s Bank of China Governor Yi Gang said on Sunday in a webinar organized by the Group of 30. “In general, the Chinese economy remains resilient with great potential. Continued recovery is anticipated which will benefit the global economy.”

What Bloomberg’s Economists Say..

“Improving consumer sentiment and consumption likely also boosted private demand. Leading indicators indicate demand is coming back at a faster pace than production at this stage of the recovery.”

–Chang Shu, chief Asia economist. For the full note click here

Elsewhere, at least nine central banks from Russia to Mozambique deliver interest-rate decisions, while European activity indicators could signal growth is petering out.

U.S. and Canada

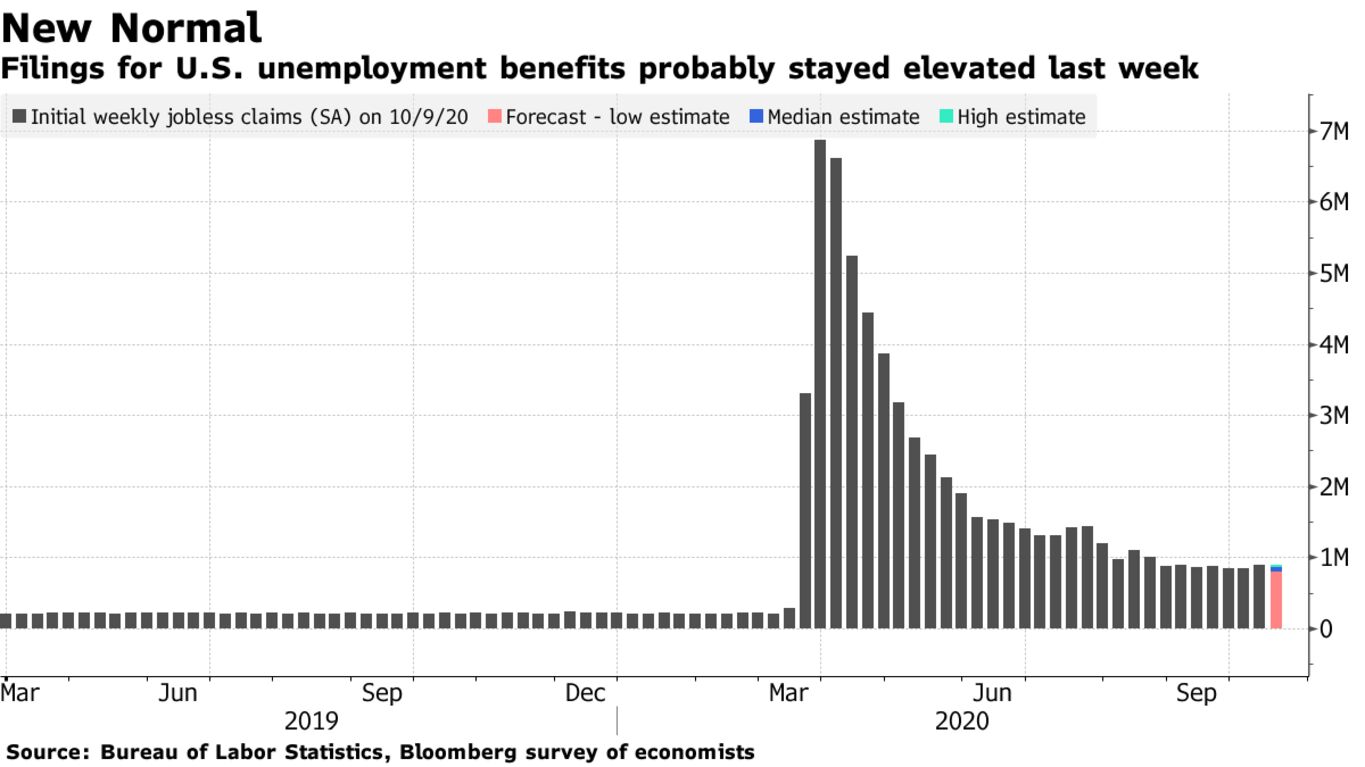

In the U.S., figures on residential construction starts, previously owned home sales and weekly unemployment benefit applications are the highlights of a relatively quiet week for economic data. In addition, the Federal Reserve will issue its Beige Book — a collection of economic and business activity assessments within each of the central bank’s 12 regions.

In Canada, investors will be watching for Monday’s release of the central bank’s business outlook survey as well as inflation data on Wednesday. Those reports will set up the Oct. 28 rate decision.

Europe, Middle East, Africa

This week will offer more evidence of the euro area’s fading recovery, with flash PMIs forecast to weaken again in October. Those numbers will follow another flurry of European Central Bank speakers, giving investors final hints into their thinking before a quiet period sets in ahead of the ECB rate decision on Oct. 29.

In the U.K., inflation is set to rebound after the expiry of the government’s Eat Out to Help Out restaurant support program. Markets will also be closely watching Bank of England speeches for clues on a potential stimulus top-up early in November.

Hungary’s central bank holds its monthly and weekly rate decisions within the space of two days, with investors hoping for clarity about whether the two will move in tandem or diverge. Ukraine, meanwhile, will announce its key policy rate amid rising uncertainty over its independence, cooperation with the International Monetary Fund and a virus spike.