U.S. stocks dropped, capping their biggest weekly rout since March, after earnings from the largest tech companies disappointed investors concerned that a slowing economy will damp profit. The Nasdaq 100 declined about 2.6% after Apple Inc.’s iPhone sales and Twitter Inc.’s user growth both missed estimates, though Google parent Alphabet Inc. jumped after reporting a rebound in advertising. The S&P 500 Index dropped 5.6% over the past five days, the worst-ever loss in the week leading to a presidential election. Ten-year Treasury yields jumped to the highest since June.

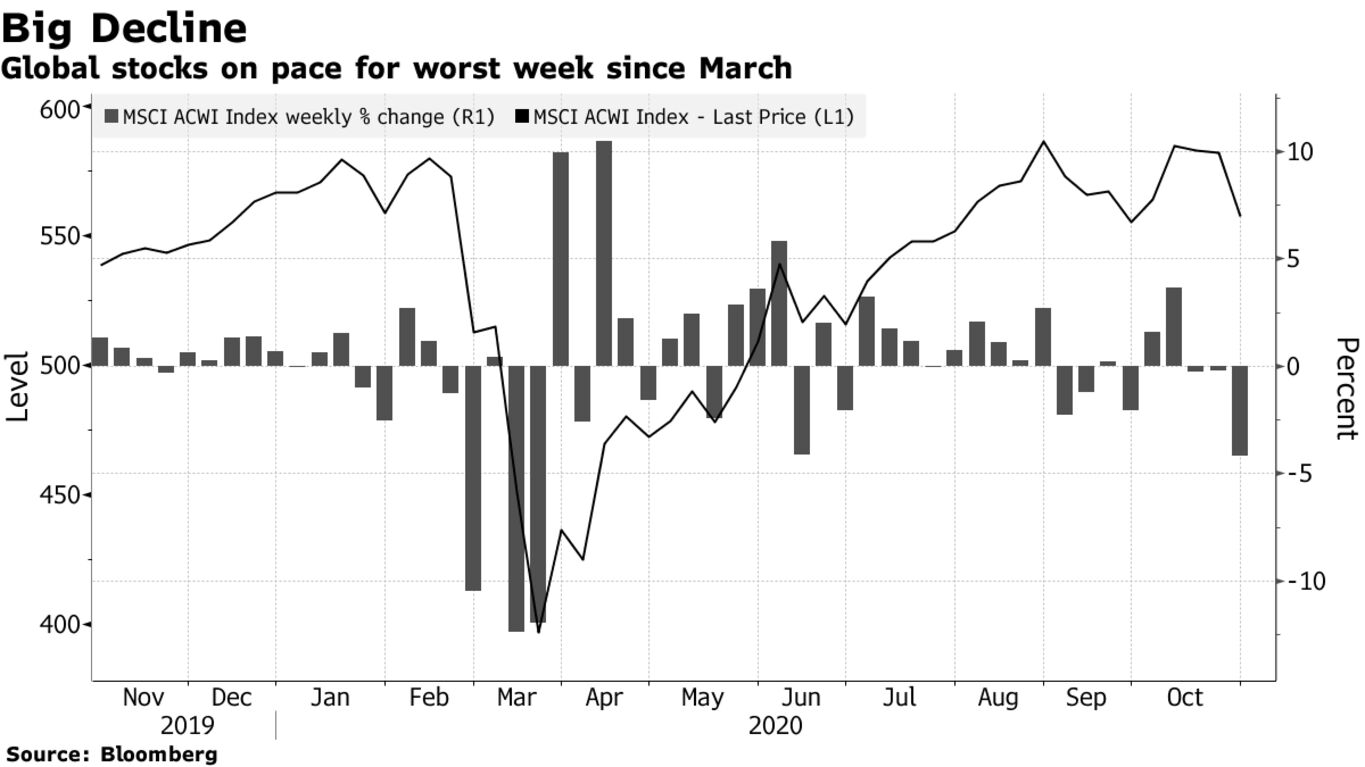

The tech slump, coming after an unprecedented run higher this year, is adding to volatility that’s likely to remain elevated heading into next week’s U.S. election. Global equities posted the worst weekly decline since March as lockdown measures in some countries and the lack of an agreement on U.S. stimulus dented sentiment. New U.S. coronavirus cases topped 89,000, setting a daily record.

In Europe, equities edged higher. Tech stocks also faltered as did Danish drug giant Novo Nordisk A/S, whose earnings disappointed analysts. Banks rose after Spain’s BBVA SA and the U.K.’s NatWest Group Plc reported improved pictures for soured loans.