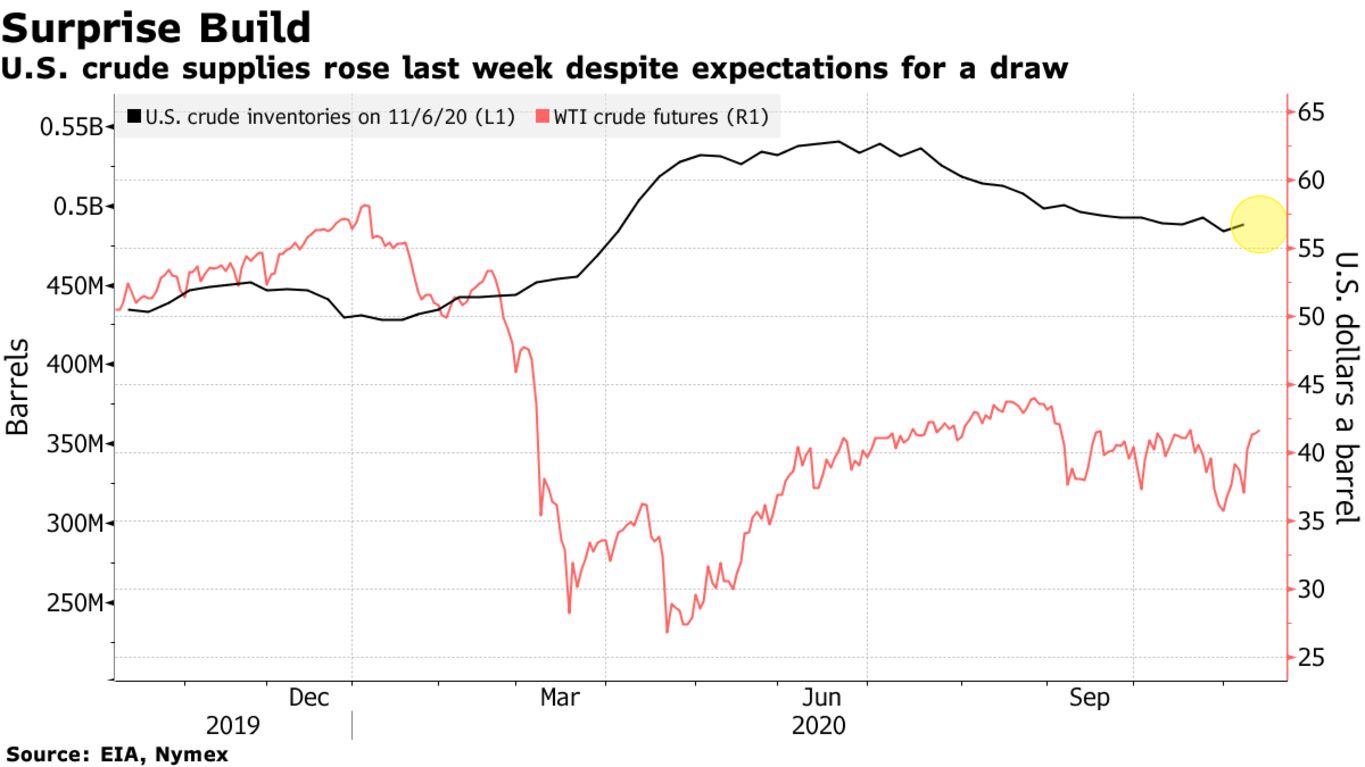

Oil dropped after an unexpected increase in U.S. stockpiles and a Federal Reserve warning that a vaccine may not be enough to get the economy back on track. Futures in New York fell 0.8% after Federal Reserve Chair Jerome Powell’s remarks, erasing gains of as much as 1.8% in a volatile session. America’s crude inventories increased by 4.28 million barrels last week, the government said Thursday, while most analysts surveyed by Bloomberg expected a decline. Slowing refining activity also didn’t bode well for oil demand.

The International Energy Agency cut its forecast for global oil demand earlier, saying the coronavirus vaccine breakthrough won’t quickly revive markets. The constantly evolving state of demand recovery taking place at varying speeds around the world adds to the challenges facing OPEC+ when it meets at the end of the month to decide on its output strategy.

While renewed lockdowns in Europe have coincided with weakening road travel, particularly in France and the U.K., it’s a mixed demand picture globally. India — whose consumption dwarfs both countries — posted its first annual increase since February and a return in Chinese buying interest is helping spur an oil buying frenzy.

“OPEC seems to be hinting that not only will they ease back the cuts, but they may even increase them,” said Gary Cunningham, director of account management and research at Tradition Energy. “Vaccine or not, OPEC’s not really counting on oil demand to recover here in the next six months.”

| PRICES |

|---|

|