Bank of England officials hold their final scheduled policy decision of a tumultuous year still unsure whether the U.K. will get a Brexit trade deal, and knowing there’s little they can do to soothe the economic pain if it doesn’t. Economists expect monetary policy settings to remain as they are on Thursday, while acknowledging that could change if no-deal becomes a reality before then. The BOE last boosted stimulus, to counter the prolonged coronavirus crisis, just six weeks ago.

“Whatever they do is going to make no difference,” said George Buckley, chief U.K. economist at Nomura International Plc. “It’s not really something that monetary policy can target. The only thing they can try to do is mitigate the impact on financial markets.”

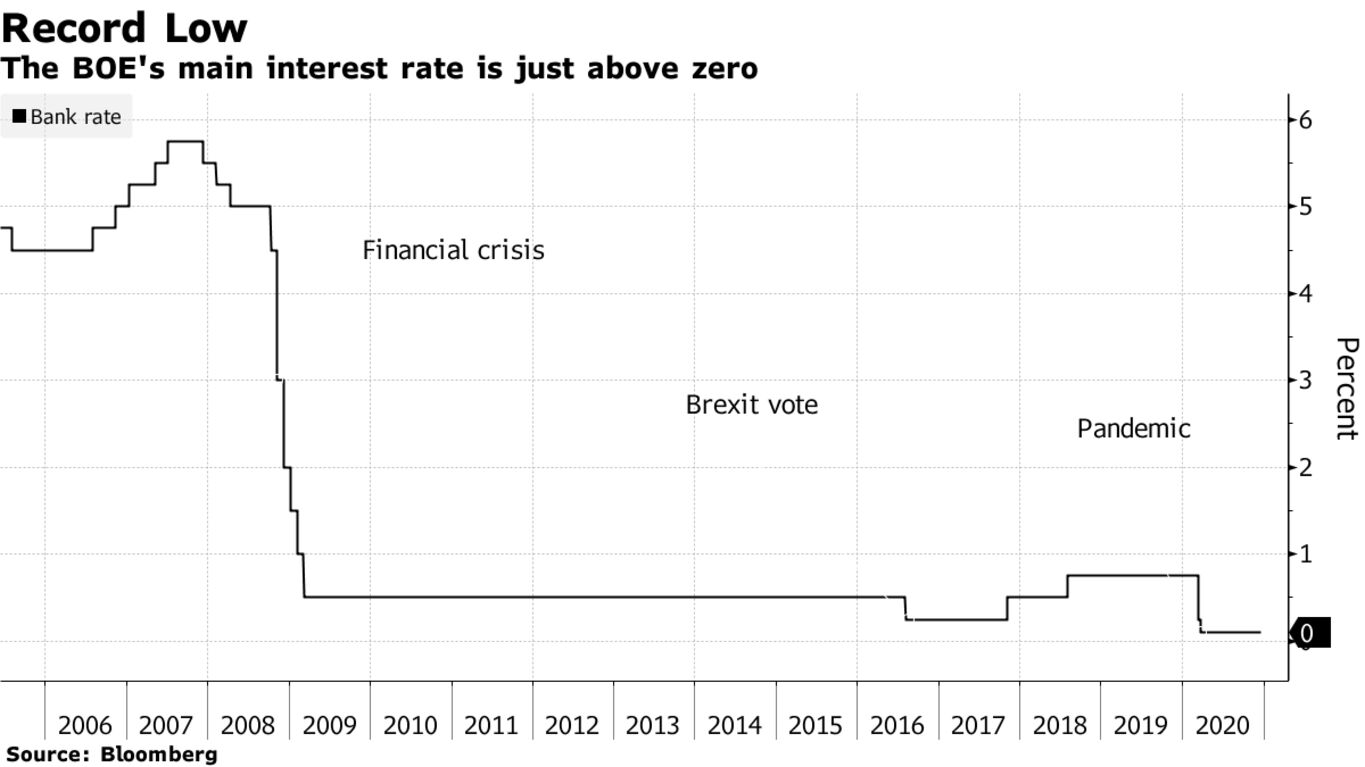

Like central banks elsewhere, the BOE is currently focused on keeping funding costs for the heavily indebted government, companies and households as low as possible during the pandemic. The benchmark interest rate is at a record-low 0.1%, and the bond-buying program has doubled this year to 895 billion pounds ($1.2 trillion).

Brexit is an added risk. Britain’s crunch talks with the European Union are in their final days after multiple missed deadlines. Failure to strike a free-trade agreement would mean the immediate introduction of tariffs and customs checks on goods when the transition period ends on Dec. 31.

Stockpiling ahead of year-end is already causing disruption at ports like Dover and Felixstowe. A survey of chief financial officers by the BOE last month found just 6% of firms were fully prepared.

Bloomberg Economics estimates that the near-term shock of no-deal may total 1.5% of U.K. gross domestic product in 2021, and says if talks collapse before Thursday then the bank will respond.

What Bloomberg Economics Says…

“If it’s clear both sides are heading for a no-deal outcome, policy makers will probably announce a faster pace of asset purchases. The central bank would also be likely to signal more stimulus ahead once the contours of the Brexit shock are known.”

Dan Hanson. To read the full report, click here.

Should a Brexit decision come after Thursday, the BOE has proved its willingness to act outside of its meeting schedule, with two emergency decisions in response to the Covid-19 crisis this year.

Ramping up the pace of quantitative easing is seen as a likely first option. Policy makers say they have plenty of headroom, and can accelerate buying quickly if needed.

A report Wednesday showed the inflation rate stood at just 0.3% in November, driven lower by clothing and food prices as the nation endured a new lockdown. That further adds to the case for expansionary policy.