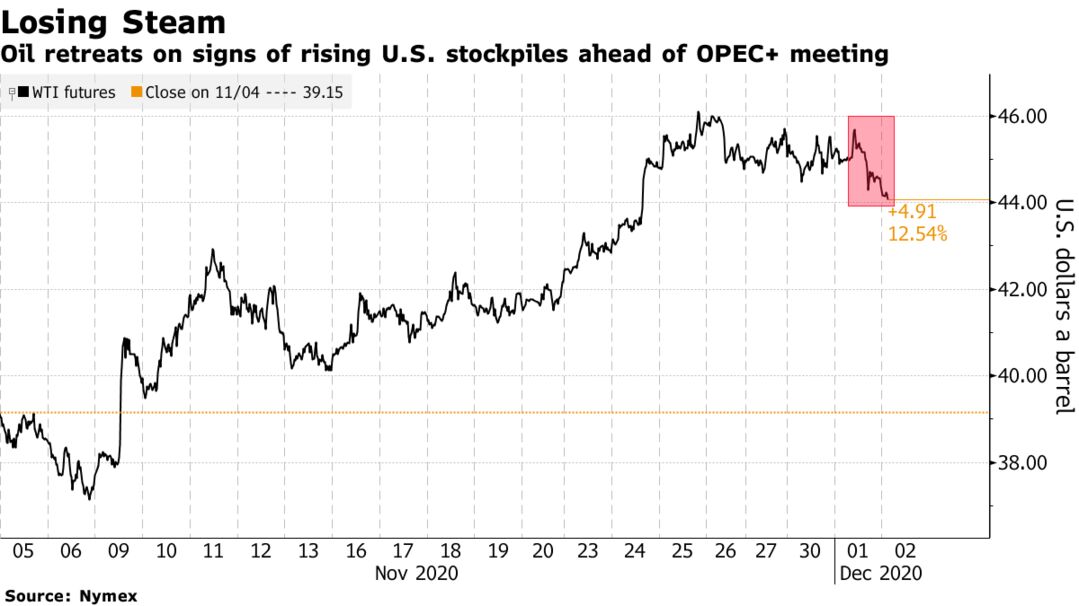

Oil slipped for a fourth day after an industry report pointed to a bigger-than-expected increase in U.S. crude stockpiles before a fractured OPEC+ gathers on Thursday to deliberate on its production policy. Futures slid 0.3% after falling 2.5% the past three days. The American Petroleum Institute reported crude inventories rose by 4.15 million barrels last week, according to people familiar. If confirmed by government data on Wednesday, it would be double the median estimate in a Bloomberg survey.

Oil capped its biggest monthly gain since May last month on Covid-19 vaccine breakthroughs, but the rally is being threatened by uncertainty surrounding OPEC+ output cuts after cracks emerged in the alliance. While most market watchers expected curbs to be extended for three months, tensions between allies Saudi Arabia and the United Arab Emirates are complicating talks.

| PRICES |

|---|

|