Oil fell toward $47 a barrel after dropping the most since early November on Monday as a faster-spreading strain of the coronavirus discovered in the U.K. raised the risk of more lockdowns and less global travel. Futures in New York for February delivery are down more than 4% so far this week. Many countries have suspended travel with the U.K., where more than 16 million people are now required to stay at home. A resurgence of the virus gathered pace in Asia, with Taiwan recording its first locally transmitted infection since April and a cluster of cases swelling in Sydney. A stronger dollar also reduced the appeal of oil that’s priced in the currency.

The Covid-19 mutation is stoking concerns that more parts of the world may face renewed restrictions on movement, curbing a recovery in global energy demand. On the supply side, Russia said it intends to support a further increase in OPEC+ production in February at the group’s meeting next month.

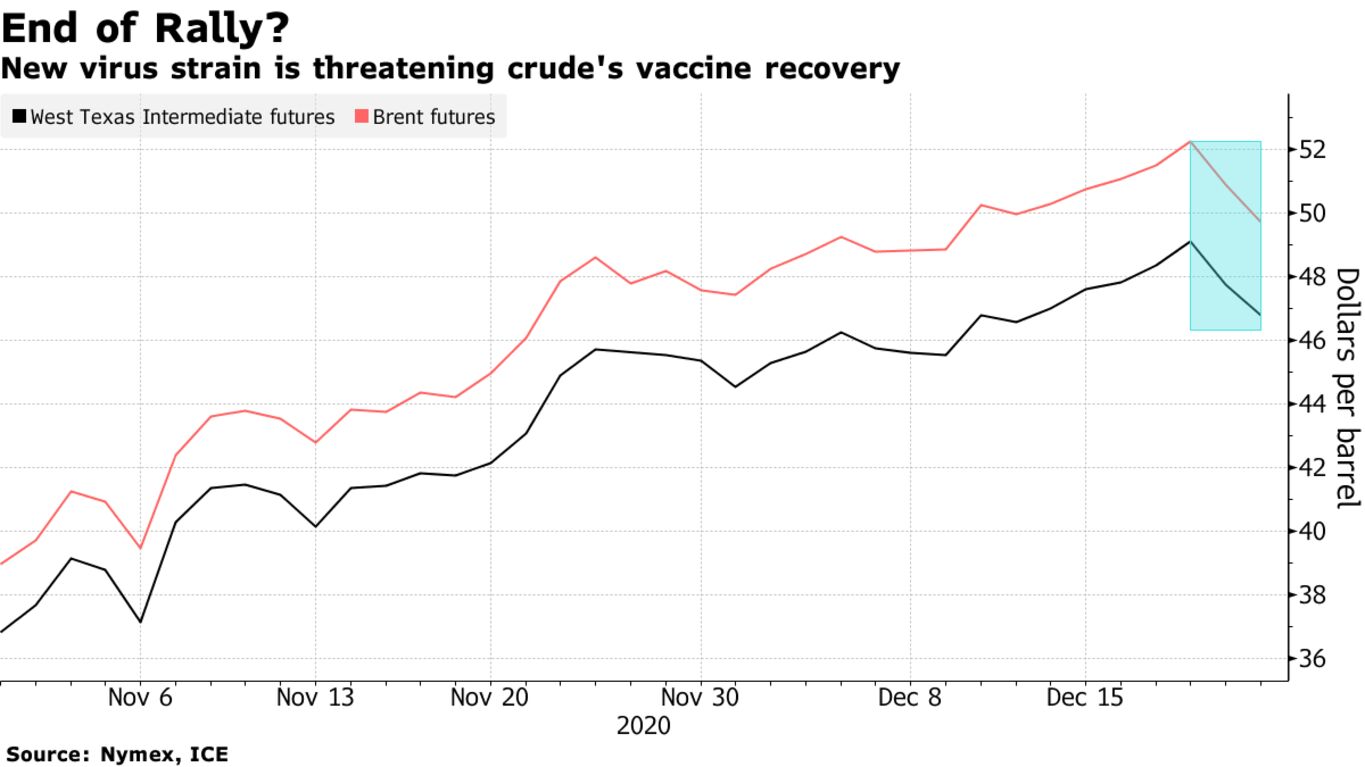

Crude has surged more than 30% since the end of October, in part due to a series of vaccine breakthroughs, but the likelihood of additional stay-at-home measures is now threatening the rally and also weakening oil’s forward curve. Brent’s prompt timespread has moved back into contango, a bearish market structure where near-term prices are cheaper than later-dated ones.

| PRICES |

|---|

|