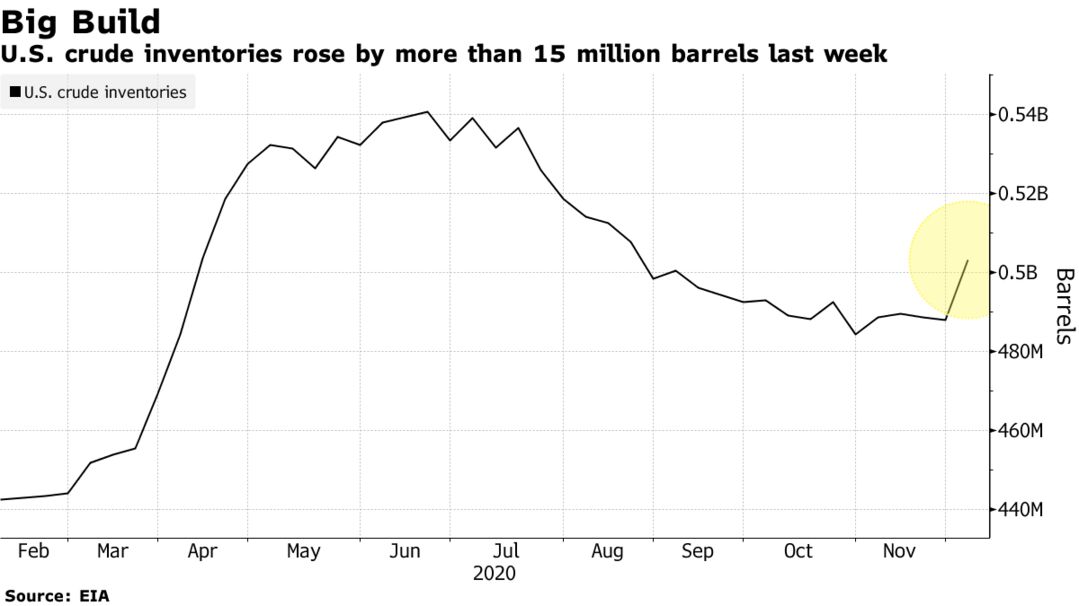

Oil rose toward $46 a barrel after shrugging off a massive increase in U.S. crude stockpiles on optimism that vaccine rollouts will lead to a swift improvement in global energy demand next year. The Energy Information Administration reported a 15.2 million barrel jump in American oil inventories, the second-biggest on record. While prices dropped on the data, they retraced most of their losses with some support from a falling dollar to close down just 0.2% on Wednesday. A militant attack on the Khabbaz field in Iraq had aided crude earlier in the session.

Oil rose Thursday even as Asian stocks tracked Wall Street lower on the lack of U.S. stimulus. Canada became the latest country to approve a Covid-19 vaccine and Chicago said it will offer vaccines free of charge to all adult residents next year. Asian physical demand, meanwhile, looked set to remain strong for another month amid early buying by Chinese and Indian refiners.

Oil has fallen this week, but remains near a nine-month high, as the market holds out for vaccine deployments to spur the next leg of the demand recovery. While concerns about near-term consumption are still weighing on sentiment as governments reimpose restrictions, the oil futures curve is signaling investors are fairly comfortable about the outlook for next year.

The market is in a “fairly buoyant mood” as investors focus on the longer-term outlook due to vaccine rollouts, said Daniel Hynes, a senior commodity strategist at Australia & New Zealand Banking Group Ltd. in Sydney. “Risk appetite is improving and certainly commodity markets are caught up in that.”

| PRICES |

|---|

|