Oil steadied near $47 a barrel in New York after coming under pressure from signs of increased U.S. supply and the resurgence of the pandemic. West Texas Intermediate futures recouped earlier losses, though remain about 4% down this week. The American Petroleum Institute said U.S. crude inventories rose by 2.7 million barrels last week, according to people familiar with the data. That would be the second weekly increase in three if confirmed by official figures due later on Wednesday.

“Jitters surrounding the new strain of the virus remain front and center,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. “The specter of fresh restrictions now hangs over Europe together with the prospect of a drawn-out recovery.” The threat to near-term demand from the virus mutation has rippled across crude markets.

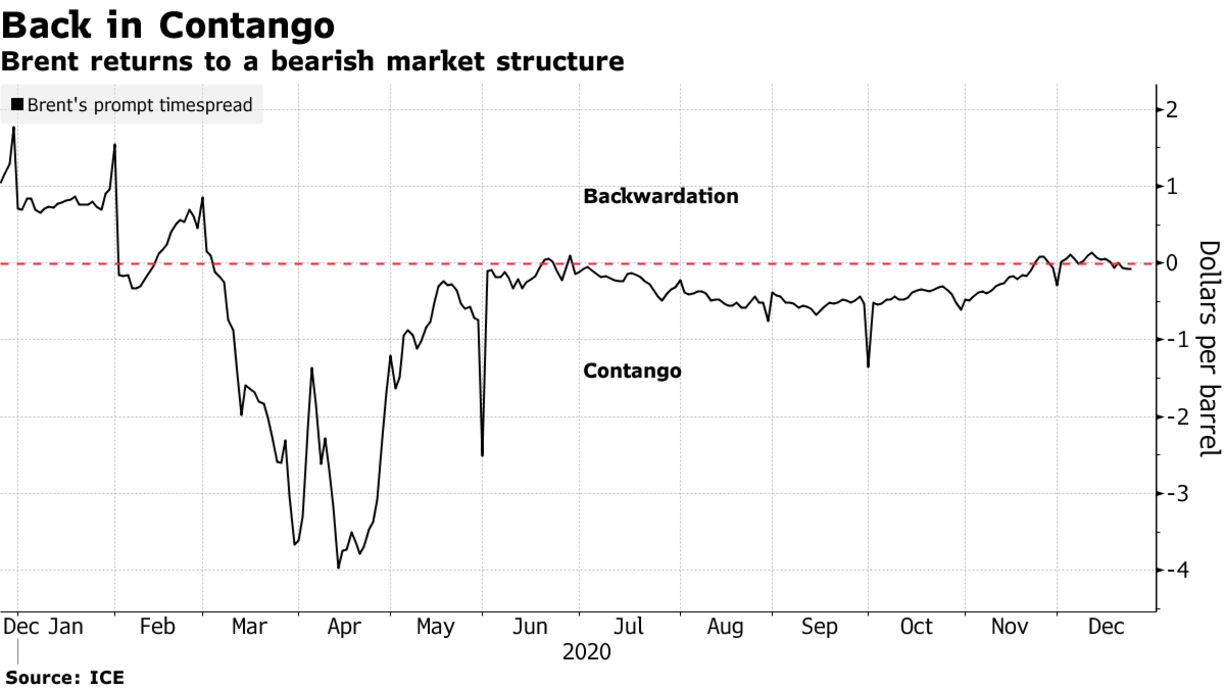

Brent’s prompt time-spread has moved back into contango, a bearish market structure where near-dated prices are cheaper than later-dated ones. Global demand for oil liquids won’t return to pre-virus levels until early or mid-2022, according to Gazprom Neft PJSC Chief Executive Officer Alexander Dyukov.

| PRICES |

|---|

|