Resurgent coronavirus infections are putting a chill on U.S. job creation, manufacturing in China is gaining pace and the final stages of Brexit negotiations are complicating the U.K.’s recovery prospects. Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

U.S.

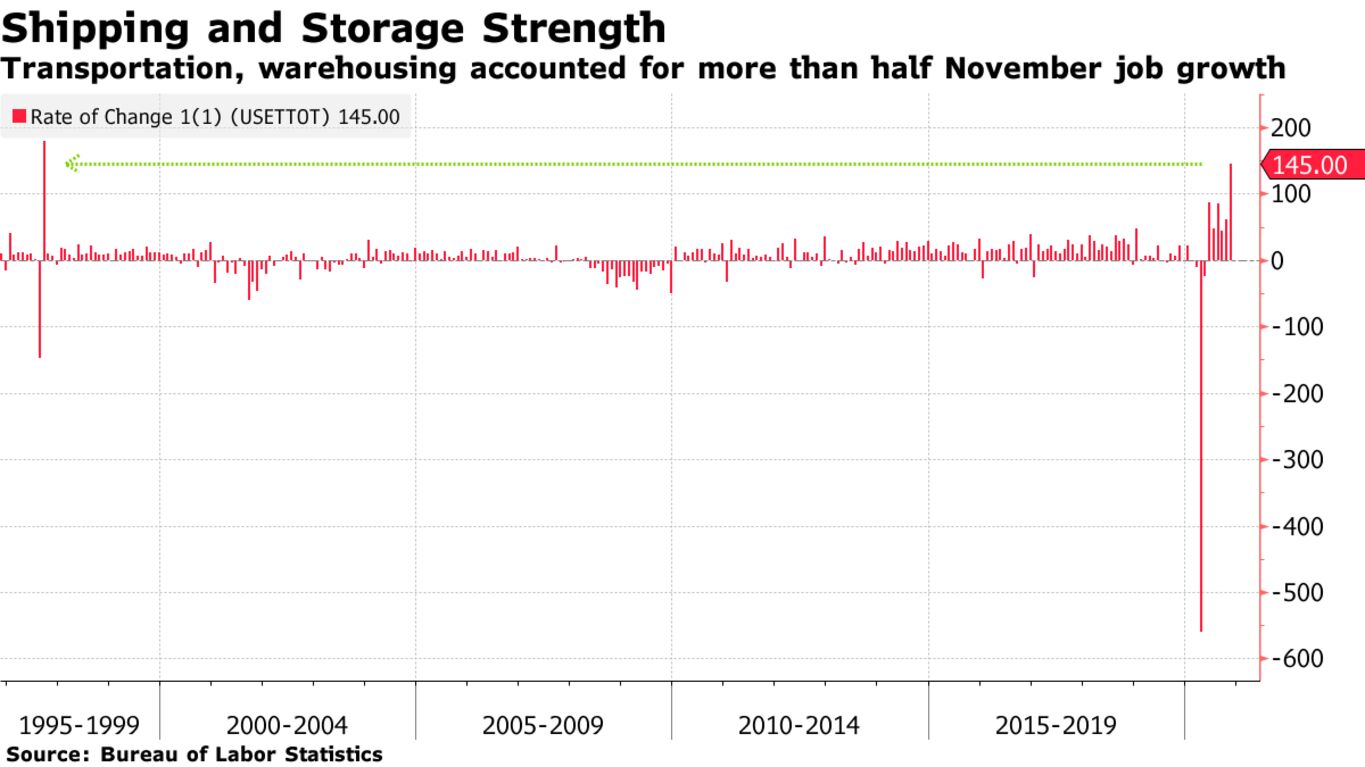

Surging payroll growth in the transportation and warehousing sector — the most since 1997 — accounted for more than half of total U.S. job gains in November, according to the government’s monthly employment report that proved disappointing. Total payrolls rose by 245,000 during the month, well short of estimates, and hiring was concentrated in fewer industries as the pandemic continued to disrupt.

Fiscal Rescue

Pandemic spending left U.S. with biggest budget deficit since World War II

Source: Congressional Budget Office, Sept. 2020

President-elect Joe Biden announced his economic team that will be charged with keeping the recovery on track, while balancing the need for more fiscal stimulus and a rapidly expanding budget shortfall.

Europe

Economic Blow

WTO trading terms would add to the scarring already inflicted by the virus

Source: Bloomberg Economics

Note: 2019 = 100

With the U.K. economy suffering more from the coronavirus than most advanced nations, the stakes couldn’t be higher as Brexit trade negotiations enter their endgame.

Out of Reach

First-time buyers are now paying almost $600,000 to live in London

Source: Nationwide Building Society

As with economies everywhere, the U.K. has suffered a deep slump because of the virus. But the housing market, juiced in part by a sales-tax cut, is in a mini-boom, with demand and prices surging. That’s proving an issue for prospective first-time buyers, especially in London.

Too Much Negativity

Consumer prices are now falling across much of the euro zone

Source: Eurostat

Note: Data for November, except Austria (October)

Falling consumer prices can be found across the euro area, but in some quarters it’s the fear of steep and entrenched declines — a deflationary trap that drags wages and ultimately brings the whole economy down — that has people worried most.

Asia

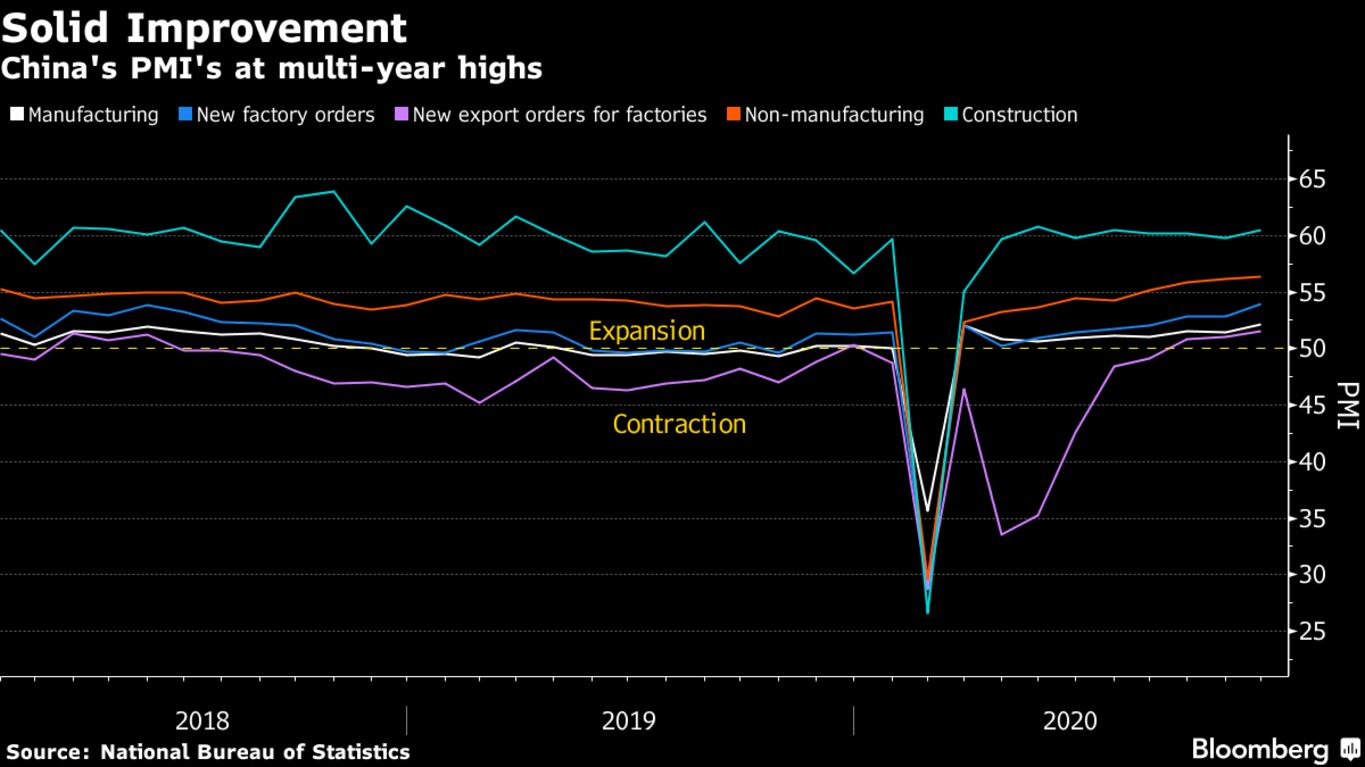

An official gauge of activity in China’s manufacturing sector rose faster that expected, suggesting the economy’s recovery is gathering pace.

London Calling

Nearly 60,000 BNO passports for Hong Kong residents were approved in October

Source: U.K. government

The U.K. is granting the most special travel documents to Hong Kong residents since the 1997 handover, bolstering predictions of a mass exodus as China tightens its grip over the former British colony.